The views of all stakeholders in the Oil business is currently focused on Saudi Arabia. How will the Kingdom after the US government's decision to ban Iran, in fact, from the Oil market? The Saudis will jump into the breach, meaning that their Oil production to increase and a supply shortage after the Iranian supply failure? This is one of the most-discussed question of Ölhändlern and analysts.

"The answer has a significant impact on how Oil prices will behave in the near term," says David Suchet, spokesman for the petroleum Association. "If Saudi Arabia and the United Arab Emirates, compensate for actually, the volumes of Iran, speaks nothing for a further increase in the price of Oil." A price forecast is not liked make Seek, however, to be much currently in limbo. Because apart from the failure of Iran, the spokesman for the local Öllobby to consider, "could it Supply to unplanned interruptions in Libya and Nigeria due to civil unrest".

jump for Oil

In the past weeks has increased the price of gasoline in Switzerland, according to Suchet, already "a few cents", and in comparison to the beginning of the year, it was at some gas price increases of more than 10 cents. This happened against the Background of significantly verteuerter oil prices: North sea Brent crude recorded since the beginning of this year, a price rise of 38 per cent.

image to enlarge

in just the last six days, until yesterday, Tuesday, the Brent prices have risen by 4 percent to 74.60 dollars per barrel. It's possible that motorists will still have to face higher fuel bills. According to a rule of thumb, it takes about two weeks to price changes on the oil markets hit the domestic petrol pumps.

the reason for the recent price jump is the decision of the United States, from Monday to tighten the last November imposed Ölsanktionen against Iran again. At the time Washington was granted for eight countries of temporary exemptions to purchase Iranian Oil. With these exceptions, now on 2. May be an end – while the players in the market mainly with a repeated extension of the special permits had expected.

China care about the welfare of

The complete exclusion from the Market of the Islamic Republic means, theoretically, that the Supply of oil shrinks to about 1 Million barrels per day. Open is now, as some of the affected eight countries in view of its expiration, the exception will be permits to react. China, which covered about half of the exported Iranian Oil, had on Monday announced that it will not respect the unilaterally by the United States in sanctions imposed.

Significant criticism of the actions of the US government, Turkey said earlier this week, and its President, Recep Tayyip Erdogan had declared last year that his country will Iran ignore the Oil embargo. From the Turkish economy, however, other tones are heard, There you would prefer not to Iranian Oil, in order not to fall again into an economic conflict with the United States.

From the environment of the Indian Prime Minister Narendra modi, it was said, according to media reports, you will bow to the more stringent US sanctions well-being and looking for other oil suppliers. What concerns the rest of "exception countries" – Greece, Italy, Taiwan, Japan and South Korea, and therefore all of US-allies, so you are likely to the Iran-join the Boycott, if you have not already done it.

The Saudis tricked

thus, to assume that the US government can build a Front against the Mullah-Regime from may, a largely closed the Boycott, so you have to get now even Saudi Arabia. For the world's largest oil Exporter, there is a need in the composite with the United Arab Emirates, no huge effort, the production capacity to the extent of the expected Iranian cases of non-delivery.

image to enlarge

The Saudis had burned in the last year, but already the fingers as they expanded at the request of the USA, their Oil production to about 1 Million barrels per day, before Washington's sanctions announced on Iran. Since no one had reckoned with the said exemptions for Iranian Ölabnehmer, was suddenly too much of the black Gold on the market. In consequence, drove the price of Oil between early November and end of December 2018 by nearly a third in depth.

However, even if Saudi Arabia is once again in the USA clamp, to Price fluctuations to cushion the Oil market, remains a risk: Should the Iran-its threat and the Strait of Hormuz military lockdown, there would be Tanker with Saudi Oil, no more.

(editing Tamedia)

Created: 23.04.2019, 22:48 PM

His body naturally produces alcohol, he is acquitted after a drunk driving conviction

His body naturally produces alcohol, he is acquitted after a drunk driving conviction Who is David Pecker, the first key witness in Donald Trump's trial?

Who is David Pecker, the first key witness in Donald Trump's trial? What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain?

What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain? The shadow of Chinese espionage hangs over Westminster

The shadow of Chinese espionage hangs over Westminster Colorectal cancer: what to watch out for in those under 50

Colorectal cancer: what to watch out for in those under 50 H5N1 virus: traces detected in pasteurized milk in the United States

H5N1 virus: traces detected in pasteurized milk in the United States What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France The right deplores a “dismal agreement” on the end of careers at the SNCF

The right deplores a “dismal agreement” on the end of careers at the SNCF The United States pushes TikTok towards the exit

The United States pushes TikTok towards the exit Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille

Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille This is what your pay slip could look like tomorrow according to Bruno Le Maire

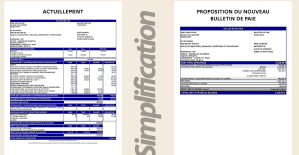

This is what your pay slip could look like tomorrow according to Bruno Le Maire Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week

Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival

The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival Strasbourg inaugurates a year of celebrations and debates as World Book Capital

Strasbourg inaugurates a year of celebrations and debates as World Book Capital Kendji Girac is “out of the woods” after his gunshot wound to the chest

Kendji Girac is “out of the woods” after his gunshot wound to the chest Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated

NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated Real Madrid: what position will Mbappé play? The answer is known

Real Madrid: what position will Mbappé play? The answer is known Cycling: Quintana will appear at the Giro

Cycling: Quintana will appear at the Giro Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card

Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card