The coal industry, it is increasingly difficult to insure their production and transport capacities. Mainly European insurance bubble to retreat from the coal, which is regarded as the largest single cause of man-made climate change. Now, this practice starts to spread to other regions to expand, as shown by the recent Report of the global campaign network Unfriend Coal is. In the spring of 2019 two insurers in the United States and in Australia, guidelines have been introduced with the aim of their involvement in the coal sector to limit.

"We see the insurance companies a momentum away from the carbon, as I have as a long-time campaign Manager have never experienced," says Peter Bosshard, the author of the Unfriend Coal Reports. To limit the risk coverage of the coal companies and their infrastructure, or to refuse, in whole, become a worldwide Trend.

"That makes it all the more difficult for those insurers engaged in this business," says Bosshard. "They are coming under growing pressure to justify, in the Public as well as specifically for their own employees."

Far from being the best away

your withdrawal from the business with the coal industry the most progress of the two Swiss companies Swiss Re and Zurich have driven. They show the new ranking of the "cleanest" insurance of Unfriend Coal, the places one and two. In Switzerland also strongly represented Axa and Allianz, then the third, respectively, in seventh place.

The top ranking thanks to Swiss Re and Zurich to the fact that you represent not only new, but also no existing equipment for the mining of coal. Furthermore, no policies that make both companies more from for new projects for the extraction of Oil from tar sand, which is considered to be particularly environmentally and climate harmful; and the Zurich intends to insure in this area and no existing infrastructure. Not less important: Both Swiss insurers refuse to take on risk coverage for carbon groups in total, the same applies, at least for a certain amount of tar Sands corporations.

The rank-three to ten of the listed insurance companies have committed to a coal phase-out policy, but less rigorously and comprehensively as Swiss Re and Zurich. This is especially clear in the distinction between new and existing plants to coal: In the case of new projects, the insurers waving almost in unison, for the existing of the existing insurance protection applies.

reached Yet, even Swiss Re as an industry leader with respect to insurance of coal kaktivitäten only four out of a maximum of ten possible points. Bosshard justified this with the "high standards", and the other with a "lack of transparency": In the response to the catalogue with a total of 80 questions, a lot of had not been "in the Rough".

Lloyd's market have opted out of

According to the Report, 17 major insurers and reinsurers until today insurers to insure new coal projects. In the previous year, there were 7. Their market share in reinsurance, fragmented adds up to a good 46 per cent, in the much stronger primary insurance, the drop-out come to just under 10 percent. In Parallel, at least 35 insurance companies with assets have holdings of over 10 billion dollars of its debt and equity investments in the coal industry is scaled back.

In Europe is the London-based Lloyd’s market still is the only significant actor of the life insurance policies for coal mines and offers exploiters. In the United States, however, a number of large corporations runs this business and continue in full, including AIG and Warren Buffett's Berkshire Hathaway. The same applies, according to the Unfriend Coal for the vast majority of insurers in Asia.

Japanese industry representatives argued, as it says in the Report that a shift away from coal is difficult, as long as the government in Tokyo encourages the Expansion of this sector. The boss hard the examples of Axis Capital and Chubb in the United States, or QBE in Australia: they have decided to retreat, although local governments continue to rely on coal as a Central energy carrier. In the past, the Allianz and Hannover Re were converted: they insure as well as no new coal projects, while in Germany for years, brown coal is extracted.

Oil and Gas

boss hard get off is expected by the insurance companies but even more far-reaching measures. "You can refrain from extensive data on climate change and claims history, what will happen to the industry and to us," says the campaign Manager. "So you have to bring in a much stronger and more vocal, such as trade associations, or as shareholders of the company."

"The Zurich and Swiss Res must refuse next to the Expansion of the Oil and gas industry." Peter Bosshard, Unfriend Coal Report

Also, it could allow the insurer, so the boss hard, not with the phase-out of coal at that. With an estimated 0.3 percent on the global property and liability business, the coal - related premium volume is without this, is negligible. In the Oil and gas industry far more for the insurance on the game.

"It passes by no way around it," says Bosshard, "the Zurich and Swiss Res must refuse next to the Expansion of the Oil and gas industry." Of an immediate, comprehensive stop the insurance activities in this sector, the representative of Unfriend Coal but the front hand is nothing, because there is still providers a comprehensive Alternative to fossil energy.

Created: 03.12.2019, 06:28 PM

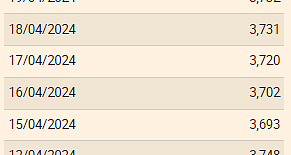

The Euribor today remains at 3.734%

The Euribor today remains at 3.734% Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations What is Akila, the mission in which the Charles de Gaulle is participating under NATO command?

What is Akila, the mission in which the Charles de Gaulle is participating under NATO command? What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic MEPs validate reform of EU budgetary rules

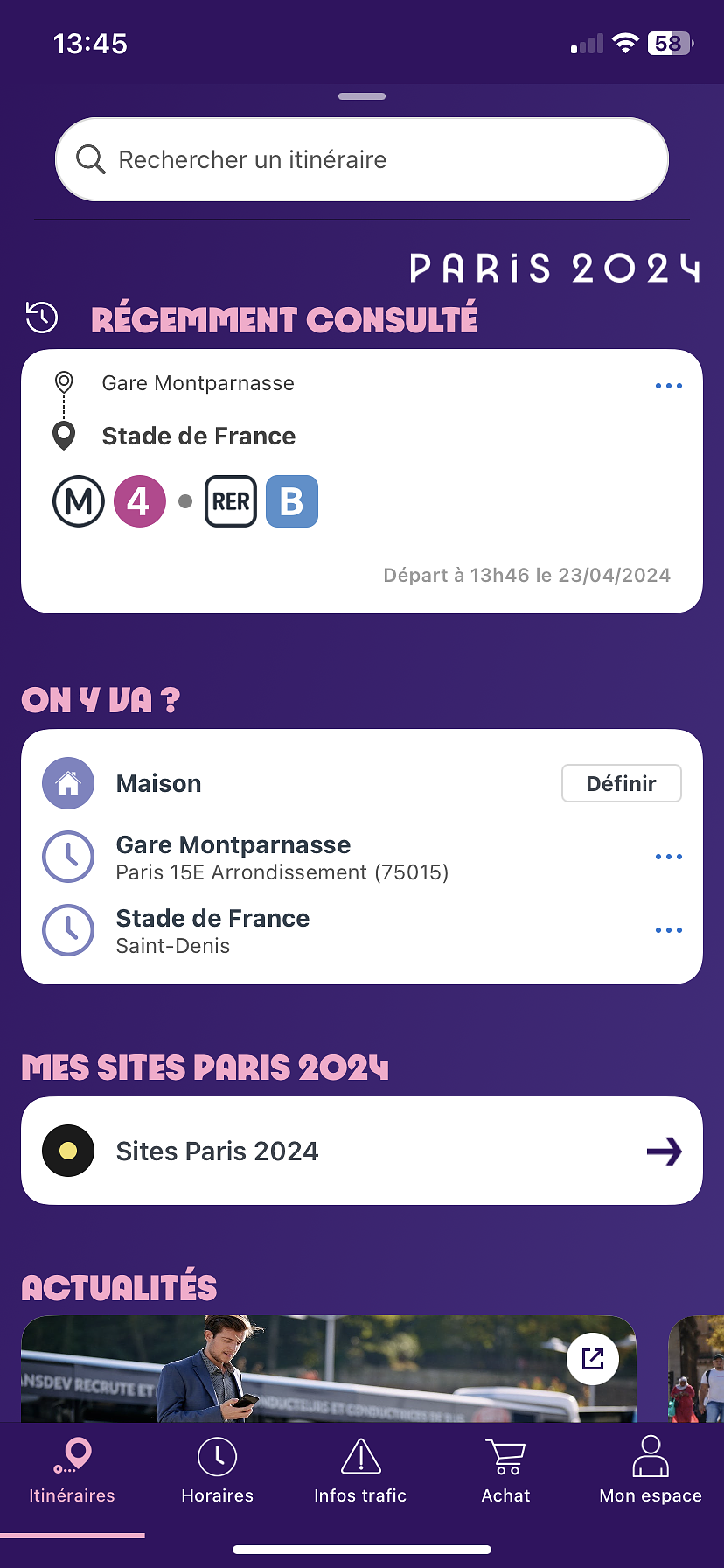

MEPs validate reform of EU budgetary rules “Public Transport Paris 2024”, the application for Olympic Games spectators, is available

“Public Transport Paris 2024”, the application for Olympic Games spectators, is available Spotify goes green in the first quarter and sees its number of paying subscribers increase

Spotify goes green in the first quarter and sees its number of paying subscribers increase Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund

Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer

Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame

Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame Three months before the Olympic Games, festivals and concert halls fear paying the price

Three months before the Olympic Games, festivals and concert halls fear paying the price With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics

With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Serie A: Bologna surprises AS Rome in the race for the C1

Serie A: Bologna surprises AS Rome in the race for the C1 Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues?

Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues? Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby

Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season

Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season