As the Central Secretary of the Commercial Association (KV), Switzerland H. S. had a good wage. He could, therefore, afford to even retire early. At the age of 60 years, he retired in 2006 from the professional. A few months earlier, the widower had met a new partner with whom he had moved in soon after. He reported the cohabitation in accordance with the regulations of the pension Fund, to ensure that his partner get a survivor's pension, if he should before you die.

In the summer of 2016 H. S. received a Letter from the KV-pension Foundation. It said that it will reduce due to financial reasons at the beginning of 2017 the pension conversion rate. As H. S. had already bought an annuity, he was not affected by this Change. The entry into force of the new regulations of the pension Fund was looking at, but a few months later, he noted that the conditions for life partner pensions were tightened.

According to the old regulations, life partner, got a pension if the partnership had lasted for at the death of the insured Person for at least five years. In the new regulations state that a community must already have at the time of Retirement of the insured Person for at least five years to complete.

H. S. and his partner meet the conditions for a partner's pension after the old regulations, since they were already together for more than ten years. They had not learned but was only a few months before H. S.’ Retirement know, what was sufficient according to the new rules. Thus, the partner of H. S. would be left with nothing.

is not allowed Retroactively

That a pension Fund changes the rules for performance claims, is permissible, provided that the statutory Minimum is guaranteed to continue. This is the case here, because pensions for cohabiting partners are not required by law. the pension funds may not, however, detract from, acquired rights to benefits. In other words: Current pensions is not. The partner of H. S. has not acquired the right to a survivor's performance, because the H. S. is still alive. You must expect, therefore, that the conditions for a survivor's pension change. Is crucial in your case, only the regulations in the time of the death of H. S. in force.

pension funds are obliged to inform the Insured about any Changes to your claims.

Now, pension funds are obliged to inform the Insured, if you change your rules. It is not enough that you point out only on innovations and the Insured then the regulations sifting through to find out what is in the future thing. "As soon as you makes Changes that have an impact on the performance claims, it must demonstrate to the pension Fund in a personal Avis the Insured's clear what it's about," says Raffaella Biaggi, a specialist lawyer for insurance law in Basel.

Also, the Information should be done at an early stage, if possible, as soon as it was clear that there would be Changes, adds Biaggi. The Insured should have the opportunity to respond in a timely manner and to take any measures to secure claims.

cash to. pay

the retired H. S. alleges that the pension plan of the Commercial Association, to have its information obligation has been violated In fact, not a word is in the Letter the Fund in the summer of 2016 about the new features starting in 2017, informed, that the conditions for a partner's pension change.

the representatives of The Fund say, a piece of Information would have put H. S. on anything, because he would already be able to do anything. The resist the H. S. speaks: "Would have informed the Fund in Writing obligation pursuant to, then I would have my life-partner in front of my 70. Birthday, getting married and securing." As the innovation came into force, was H. S. already 70 years old. A marriage at this age would guarantee his partner is only the minimum statutory widow's pension.

Apart from the lack of Information it finds. h. p. pushing, that the Pension Fund has changed the terms and conditions for the partner's pension from one day to the other for all Insured persons. It would have been possible without further ADO, the new rules only after a transitional period to apply.

Since the former KV-Secretary has to know that his partner should go to his death empty, he tries to take the Pension Fund of the KV in the duty. He relies on the protection of confidence: Because the Board have failed to cash in with its action against good Faith, should you apply the old conditions, and his partner, a pension to pay.

Responsible silence

To support H. S. has contracted a lawyer, the other side did the same. In H. S. emphasized that he wanted to possible to achieve during the lifetime of an amicable agreement. Such is not, however, even after over two years of correspondence in point of view.

but What those who are responsible for the Change in the regulations of the KV to have the pension Fund and the present case is triggered? Bruno Schmid, President of the KV Luzern and at the time Vice-President of the Board of Trustees of the KV-pension Fund, does not want to speak publicly. He emphasized, however, that the pension Fund Foundation is, as before, to a call ready.

Created: 03.11.2019, 17:52 PM

Torrential rains in Dubai: “The event is so intense that we cannot find analogues in our databases”

Torrential rains in Dubai: “The event is so intense that we cannot find analogues in our databases” Rishi Sunak wants a tobacco-free UK

Rishi Sunak wants a tobacco-free UK In Africa, the number of millionaires will boom over the next ten years

In Africa, the number of millionaires will boom over the next ten years Iran's attack on Israel: these false, misleading images spreading on social networks

Iran's attack on Israel: these false, misleading images spreading on social networks New generation mosquito nets prove much more effective against malaria

New generation mosquito nets prove much more effective against malaria Covid-19: everything you need to know about the new vaccination campaign which is starting

Covid-19: everything you need to know about the new vaccination campaign which is starting The best laptops of the moment boast artificial intelligence

The best laptops of the moment boast artificial intelligence Amazon invests 700 million in robotizing its warehouses in Europe

Amazon invests 700 million in robotizing its warehouses in Europe Switch or signaling breakdown, operating incident or catenaries... Do you speak the language of RATP and SNCF?

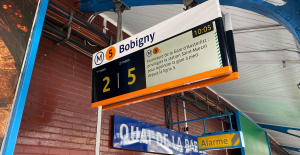

Switch or signaling breakdown, operating incident or catenaries... Do you speak the language of RATP and SNCF? Transport in Île-de-France: operators are pulling out all the stops on passenger information before the Olympics

Transport in Île-de-France: operators are pulling out all the stops on passenger information before the Olympics Radio audiences: France Inter remains firmly in the lead, Europe 1 continues its rise

Radio audiences: France Inter remains firmly in the lead, Europe 1 continues its rise Russian cyberattacks pose a global “threat”, Google warns

Russian cyberattacks pose a global “threat”, Google warns A new Lennon-McCartney duo, more than 50 years after the Beatles split

A new Lennon-McCartney duo, more than 50 years after the Beatles split The Curse vs Immaculée: two thrillers but only one plot

The Curse vs Immaculée: two thrillers but only one plot Mathieu Kassovitz adapts The Beast is Dead!, the comic book about the Second World War and the Occupation by Calvo

Mathieu Kassovitz adapts The Beast is Dead!, the comic book about the Second World War and the Occupation by Calvo Goldorak 'has never lived so much as now'

Goldorak 'has never lived so much as now' Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy During the night of the economy, the right points out the budgetary flaws of the macronie

During the night of the economy, the right points out the budgetary flaws of the macronie Europeans: Glucksmann denounces “Emmanuel Macron’s failure” in the face of Bardella’s success

Europeans: Glucksmann denounces “Emmanuel Macron’s failure” in the face of Bardella’s success These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Champions League: semi-final schedule revealed

Champions League: semi-final schedule revealed Serie A: AS Roma extends Daniele De Rossi

Serie A: AS Roma extends Daniele De Rossi Ligue 1: hard blow for Monaco with Golovin’s premature end to the season

Ligue 1: hard blow for Monaco with Golovin’s premature end to the season Paris 2024 Olympics: two French people deprived of the Olympic Games because of a calculation error by the international federation?

Paris 2024 Olympics: two French people deprived of the Olympic Games because of a calculation error by the international federation?