last week, the Riksbank raised the rate increase from minus 0.50 to minus 0.25 per cent. When governor Stefan Ingves announced interest rate decision, he added that we probably can expect more increases in 2019.

until the state-owned bank SBAB raised interest rates on their mortgages with variable interest rates and with fixed-rate periods one and two years. Now Swedbank, with more than 4 million retail customers in the same track.

– That the Riksbank raised the repo rate before the end of the year we waited for us. This decline has been preceded by increased market interest rates during the autumn, which, in turn, led to increased borrowing costs for us, so we have simply adapted to the market situation, " says Gabriel Francke Rodau.

the Bank's increase of 0.20 percentage points for both tremånadersräntan and ettårsräntan. For those who instead want to tie their loans in two years time if interest rates are raised by 0.15 percentage points. The customers who already have a mortgage loan at Swedbank can wait for normal increases of as much on the ränteändringsdagen.

– Depending on when ränteändringsdagen expires, will your mortgage be adjusted after the increase, in other words, it happens not with the customers ' mortgage loans until then, says Gabriel Francke Rodau.

do ränthöjningar, he says, is up to them to comment on. According to the TT even choosing Länsförsäkringar to raise interest rates on mortgages with fixed rate periods of three months, one year and two years.

"Because market interest rates have risen over a period of time, one can imagine that even our competitors will raise their interest rates, which the three major players have done already," he adds.

the Other banks choose to wait before raising interest rates. At SEB, affected the decision, among other things, how the competition act.

"this type of decision, we will wait with until further notice, among other things, develop the decision of how our competitors are acting," says Laurence Westerlund, press officer at the SEB.

it is currently not possible to make any rate increases. By retaining his lowest interest rate for variable-rate loans mean the bank that they offer something that challenges the competition.

In november lowered the Nordea few of his long, bound mortgage rates as a response to the Riksbank's expected interest rate hike. Currently, there are no plans for rate increases.

For a person with a loan of 3 million means an increase of 0.20% 6.000 sek higher årsräntekostnad. After ränteavdraget on the 30% land cost on 4.200 sek. Swedbank recommends customers to review their ability to spread out their loans.

– The current interest rate environment is a good opportunity to spread the risks by various fixed rate periods. We and our customers must assume today's economy and interest rates, to reduce the risks can be a good idea when interest rates look set to continue upwards, " says Gabriel Francke Rodau.

Read more: How to negotiate you best mortgage rate.

His body naturally produces alcohol, he is acquitted after a drunk driving conviction

His body naturally produces alcohol, he is acquitted after a drunk driving conviction Who is David Pecker, the first key witness in Donald Trump's trial?

Who is David Pecker, the first key witness in Donald Trump's trial? What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain?

What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain? The shadow of Chinese espionage hangs over Westminster

The shadow of Chinese espionage hangs over Westminster Colorectal cancer: what to watch out for in those under 50

Colorectal cancer: what to watch out for in those under 50 H5N1 virus: traces detected in pasteurized milk in the United States

H5N1 virus: traces detected in pasteurized milk in the United States What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France The right deplores a “dismal agreement” on the end of careers at the SNCF

The right deplores a “dismal agreement” on the end of careers at the SNCF The United States pushes TikTok towards the exit

The United States pushes TikTok towards the exit Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille

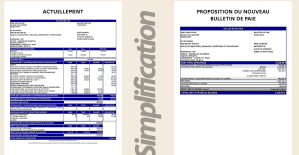

Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille This is what your pay slip could look like tomorrow according to Bruno Le Maire

This is what your pay slip could look like tomorrow according to Bruno Le Maire Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week

Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival

The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival Strasbourg inaugurates a year of celebrations and debates as World Book Capital

Strasbourg inaugurates a year of celebrations and debates as World Book Capital Kendji Girac is “out of the woods” after his gunshot wound to the chest

Kendji Girac is “out of the woods” after his gunshot wound to the chest Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated

NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated Real Madrid: what position will Mbappé play? The answer is known

Real Madrid: what position will Mbappé play? The answer is known Cycling: Quintana will appear at the Giro

Cycling: Quintana will appear at the Giro Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card

Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card