The new strategy of Novartis-in-chief Vas Narasimhan is part of the acquisition of new therapies. Annually 5 per cent of the market capitalisation, i.e. currently about 11 billion dollars are to be paid. This is significantly higher than the approximately 9 billion dollars for their own research.

Behind the big shopping tour, a modified orientation of the group is: Narasimhan wants to focus Novartis from its broad positioning even more on highly innovative therapies. New technology platforms such as gene therapy, in which the in-house research had missed the connection, be purchased. Thus, Novartis is currently more Investor research group.

Novartis is not alone

Also a competitor, Roche uses acquisitions to missed therapy paths to connect. So, the group wants to buy the US gene therapy company Spark for 4.8 billion dollars. In the case of Novartis Acquisitions are currently in focus: Two new therapies with a sales potential of over a billion dollars has bought Novartis so.

The cancer Central Lutathera the French company AAA belonging to the boy blockbusters of the group. And Zolgensma against genetically-muscle wasting-related – this is likely to be a best-seller. But with him, the group was a bad surprise. "Ironically, in Zolgensma, Narasimhans first big purchase as a CEO, are problems with the integrity of the data can do appeared," says Sanjeet Mangat of Aberdeen Standard Investments. The acquisition of the US company Avexis for $ 8.7 billion last year, was the big Coup of the new corporate bosses.

Human error is the reason

The gene therapy Zolgensma is medically as well as financially a success. She saves the lives of babies and young children and is likely to bring to the group, as the most expensive therapy in the world at a price of $ 2.1 million, soon a billion.

But as the toxic data from the study of therapy against muscle wasting Zolgensma for the Reputation of Novartis prove. Because there was data manipulation in the case of impact tests with mice, as this summer it became known. For Enquiries in this regard, Novartis discovered that Avexis had not passed data to the complications in Tests on primates for an extended application to the U.S. FDA.

In this case, this was not a cover-up attempt, but according to Novartis simply to human error in some process steps of Avexis. After then being reported to the FDA last week, stopped a part of the ongoing Experiments on small children.

"Of Novartis is not likely that the group would cover up. But in the case of newly acquired enterprises can be a risk," says Vontobel Analyst Stefan Schneider. The acquisition strategy in the pharmaceutical industry, three fundamental risks: financial, legal, and medical. These three General uncertainties are known. New a reputational risk for Novartis in addition.

Good relationship with FDA

The repeated irregularities can have a considerable impact at Avexis. Because working with the FDA could be more complicated. With your it want to forfeit is not a pharmaceutical company, it decides on studies and Launches on the largest and most lucrative pharmaceutical market in the world.

Since Novartis had for a long time a good relationship with the FDA, it should not be completely destroyed, says Mangat. The group has responded according to its own information instantly, and the FDA is assured that the global quality organization will take at Avexis now a management strategy and a strengthening of the culture of Quality in the Hand, like a Novartis spokesman said.

"The acquisition strategy has helped Novartis to exciting therapy areas, but now it is questionable whether it is Narasimhan manage the trust in the company again," says Mangat.

Created: 07.11.2019, 12:17 PM

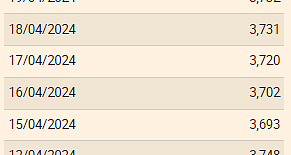

The Euribor today remains at 3.734%

The Euribor today remains at 3.734% Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations What is Akila, the mission in which the Charles de Gaulle is participating under NATO command?

What is Akila, the mission in which the Charles de Gaulle is participating under NATO command? What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic MEPs validate reform of EU budgetary rules

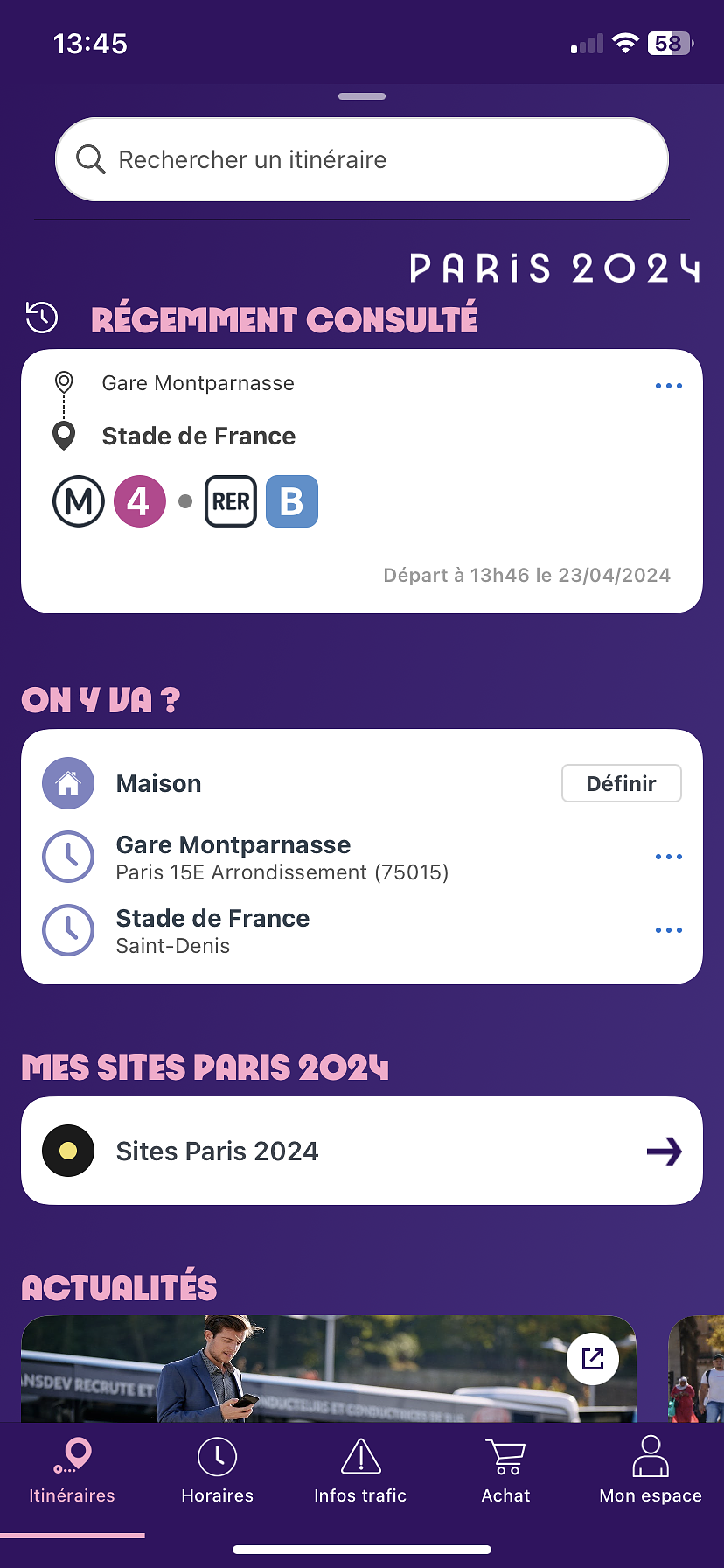

MEPs validate reform of EU budgetary rules “Public Transport Paris 2024”, the application for Olympic Games spectators, is available

“Public Transport Paris 2024”, the application for Olympic Games spectators, is available Spotify goes green in the first quarter and sees its number of paying subscribers increase

Spotify goes green in the first quarter and sees its number of paying subscribers increase Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund

Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer

Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame

Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame Three months before the Olympic Games, festivals and concert halls fear paying the price

Three months before the Olympic Games, festivals and concert halls fear paying the price With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics

With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Serie A: Bologna surprises AS Rome in the race for the C1

Serie A: Bologna surprises AS Rome in the race for the C1 Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues?

Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues? Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby

Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season

Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season