Erik Åsbrink avoid to mention the word real estate taxes in his article. But if there is to be any tax reform with reduced marginal tax rates and at the same time, income inequality goes this is hardly to achieve without clarity in the debate.

By the tax reform of 1991 replaced the previous standard taxation of villas and holiday homes with property taxes. The tax amounted to 1.5 per cent from 1993. This was supplemented with a rule that no tax would be paid during the first five years after completion, and only half tax in the following years. This rule was expanded from the year 2013 to the full tax exemption during the first 15 years after completion. The property tax was transformed from the year 2008 to a ”municipal property” and the tax rate is now a maximum of 0.75% of the cadastral value.

introduced from 2008 on a system with the regressive taxation of owned single-family homes. In most of the municipalities in Sweden is the tax on average in the vicinity of 0.75% of the cadastral value. In the municipalities of Danderyd and Lidingö is the average tax rate in the vicinity of 0.1 percent of the cadastral value.

During the period 1968-1980, we had a system for the taxation of capital gains on the sale of owned houses where the cost was counted up with the rate of inflation (consumer price index). This meant that the profit corresponded to the supplementation of purchasing power for the seller that accumulated during the holding period.

At the tax reform in 1991, there was a transition to be deleted from the appreciation in the nominal kronor in the calculation of the taxable profit. When in this way the inflation was not taken into account, there could be no question of lock-in effects. That remedy was introduced a ceiling for the tax levy. This system was not long-lived. Instead, the reduced tax rate for holding gains radically. Furthermore, introduced deferment with the removal of the tax on the capital gain upon acquisition of new owned housing. The total accumulated uppskovsbeloppet currently amounts to about 300 billion sek.

on the capital gains or the deferral of taxation on the sale of owned housing is that it improves mobility. But in an article entitled ”the Myth of the immobile housing market,” the journal Ekonomistas (2017-11-15) by Daniel Waldenström reported that Sweden in 2011 with 23 per cent escalation in the last two years, finished 3rd among 26 OECD countries when it came to having a maximum of relocation.

In the investigation that preceded the tax reform in 1991, advocated that the taxation of condominiums – the most favoured tenure status – would be the same as for home owners. This has still not been followed up with action.

I agree with Erik Åsbrink that a removal of the värnskatten should be balanced by other measures, which makes the overall fördelningsprofilen will be acceptable. But there is no evidence to suggest that the four parties who have entered into the ”januariavtalet” is prepared to take the necessary measures in housing taxation.

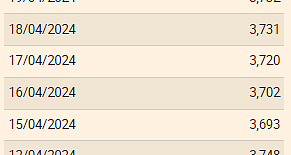

The Euribor today remains at 3.734%

The Euribor today remains at 3.734% Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations What is Akila, the mission in which the Charles de Gaulle is participating under NATO command?

What is Akila, the mission in which the Charles de Gaulle is participating under NATO command? What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic MEPs validate reform of EU budgetary rules

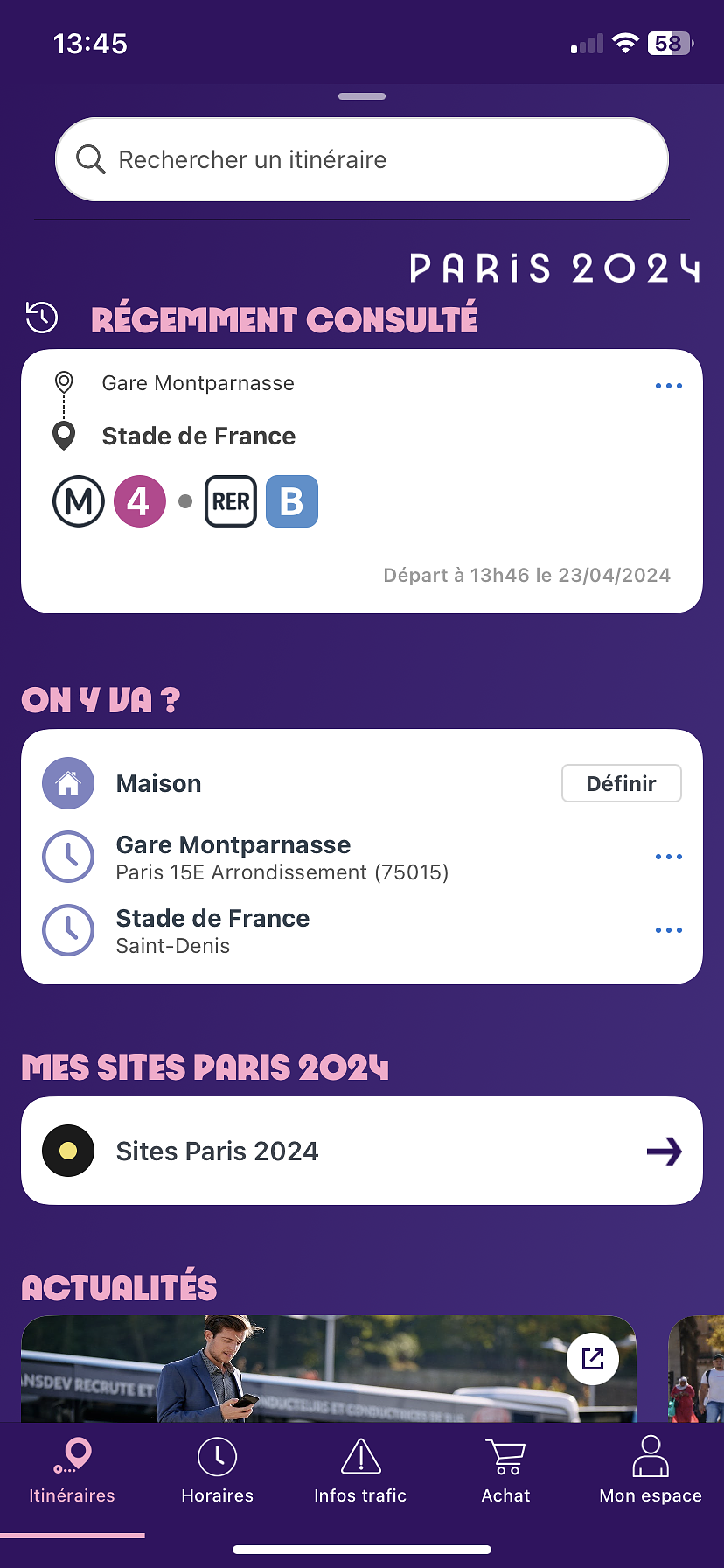

MEPs validate reform of EU budgetary rules “Public Transport Paris 2024”, the application for Olympic Games spectators, is available

“Public Transport Paris 2024”, the application for Olympic Games spectators, is available Spotify goes green in the first quarter and sees its number of paying subscribers increase

Spotify goes green in the first quarter and sees its number of paying subscribers increase Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund

Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer

Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame

Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame Three months before the Olympic Games, festivals and concert halls fear paying the price

Three months before the Olympic Games, festivals and concert halls fear paying the price With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics

With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Serie A: Bologna surprises AS Rome in the race for the C1

Serie A: Bologna surprises AS Rome in the race for the C1 Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues?

Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues? Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby

Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season

Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season