The VAT administration sent out the first invoices for the media tax, which replaced since the beginning of the year the previous device-dependent Radio - and TV fee. Not only individuals, but also companies levy are liable for when you have a turnover of more than 500'000 Swiss francs.

the work communities of companies for a major contract are subject to VAT, it comes to a double - or even triple-taxation. Such operations for a project are in the planning - and building industry.

The company receive a bill for the revenue of the Association, and then for the same sales to the actual company. The company belongs to a Holding company, showing the sales again, he will be taxed a third Time.

In the debate to anyone

noticed, "There are engineering companies that expect more than twenty bills, because they are involved in more than twenty communities," said Mario Marti, Executive Director of the Association of consulting companies engineer.

Marti expects that there are Hundreds of working groups, whose turnover is higher than half a Million francs and for which, therefore, revenue will be double taxed. The procurement legal work encourages communities.

"a Lot of builders do not want to negotiate with twenty companies with separate contracts, but for all the projects offer," says Marti. In the debate on the new law on Radio and television this noticed to anyone. You will be in Parliament to make representations to, to change that.

Over one thousand communities affected

similarly, there are many in the construction industry. Also, Gian-Luca Lardi, President of the master builders Association estimates that there are "several Thousand" work communities of companies that are subject to VAT and, therefore, a statement for the Media control. "Even if the law may be clear, I am not convinced that such multiple taxation was, in the sense of the legislature," says Lardi.

According to the Swiss Federal tax administration have 1193 work communities will receive an invoice. A total of 1.2 million Swiss francs were taken into account.

can be placed While in the case of the VAT already paid tax deduction, this is not the case of the media tax. The tax administration emphasizes on inquiry, that all walk with the right things.

"Shameless Abkassiererei"

This is the opinion of the trade Association is not at all. It was never the intention of the legislator to tax the sales of two - or even three times. "The trades Association is against this shameless Abkassiererei with all the power to the military," said its President and national councillor Jean-Francois Rime (SVP, FR). Rimes road construction company itself is part of a consortium that has received in the Valais, a large order, and, therefore, he paid the tax twice.

"Actually, I will pay even three times, because as a private person, I get a bill," says Rime. Also the Association of contributions such as the income of the trade Association would be double taxed, once as revenues in the company, a second Time at the Association.

The double - and triple-taxation of entrepreneurs and their firms to show that the media is costly and error-prone, and not well thought out, says the Zurich SVP national councillor Gregor Rutz. He therefore calls for the deletion of the submission of the company from the law: "So we avoid the double taxation and all the red tape." Since each employee as a private person, paying the tax, it is incomprehensible why a company would be taxed a second and, if you participate in a joint venture, a third Time.

The initiative was endorsed last November by the competent Commission of the national Council. He is in the States Committee pending. You agreed to the proposal, will be prepared a revision of the law. (Editorial Tamedia)

Created: 18.02.2019, 16:53 PM

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations What is Akila, the mission in which the Charles de Gaulle is participating under NATO command?

What is Akila, the mission in which the Charles de Gaulle is participating under NATO command? Lawyer, banker, teacher: who are the 12 members of the jury in Donald Trump's trial?

Lawyer, banker, teacher: who are the 12 members of the jury in Donald Trump's trial? What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic Orthodox bishop stabbed in Sydney: Elon Musk opposes Australian injunction to remove videos on X

Orthodox bishop stabbed in Sydney: Elon Musk opposes Australian injunction to remove videos on X One in three facial sunscreens does not protect enough, warns L'Ufc-Que Choisir

One in three facial sunscreens does not protect enough, warns L'Ufc-Que Choisir What will become of the 81 employees of Systovi, a French manufacturer of solar panels victim of “Chinese dumping”?

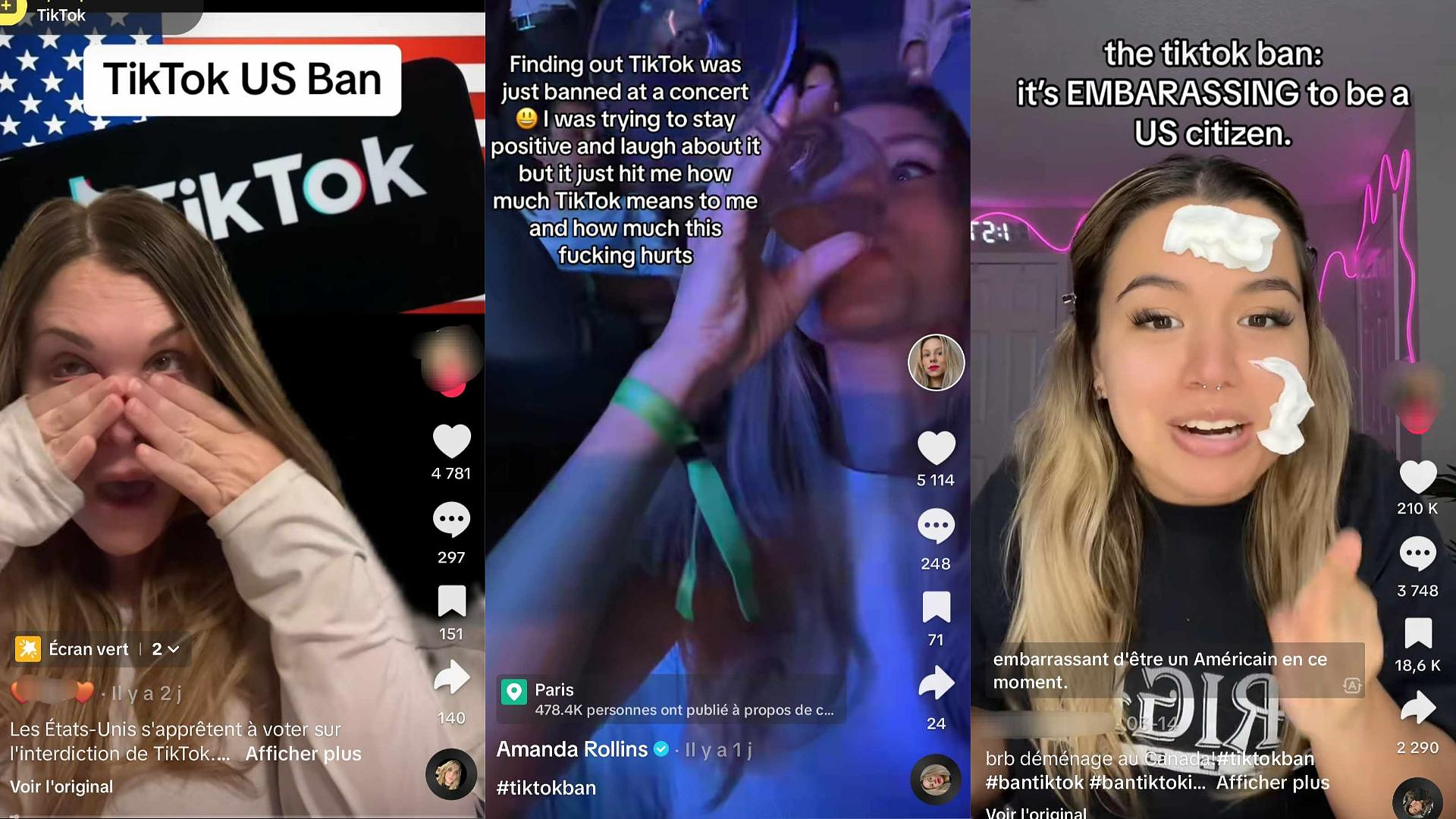

What will become of the 81 employees of Systovi, a French manufacturer of solar panels victim of “Chinese dumping”? “I could lose up to 5,000 euros per month”: influencers are alarmed by a possible ban on TikTok in the United States

“I could lose up to 5,000 euros per month”: influencers are alarmed by a possible ban on TikTok in the United States Dance, Audrey Hepburn’s secret dream

Dance, Audrey Hepburn’s secret dream The series adaptation of One Hundred Years of Solitude promises to be faithful to the novel by Gabriel Garcia Marquez

The series adaptation of One Hundred Years of Solitude promises to be faithful to the novel by Gabriel Garcia Marquez Racism in France: comedian Ahmed Sylla apologizes for “having minimized this problem”

Racism in France: comedian Ahmed Sylla apologizes for “having minimized this problem” Mohammad Rasoulof and Michel Hazanavicius in competition at the Cannes Film Festival

Mohammad Rasoulof and Michel Hazanavicius in competition at the Cannes Film Festival Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

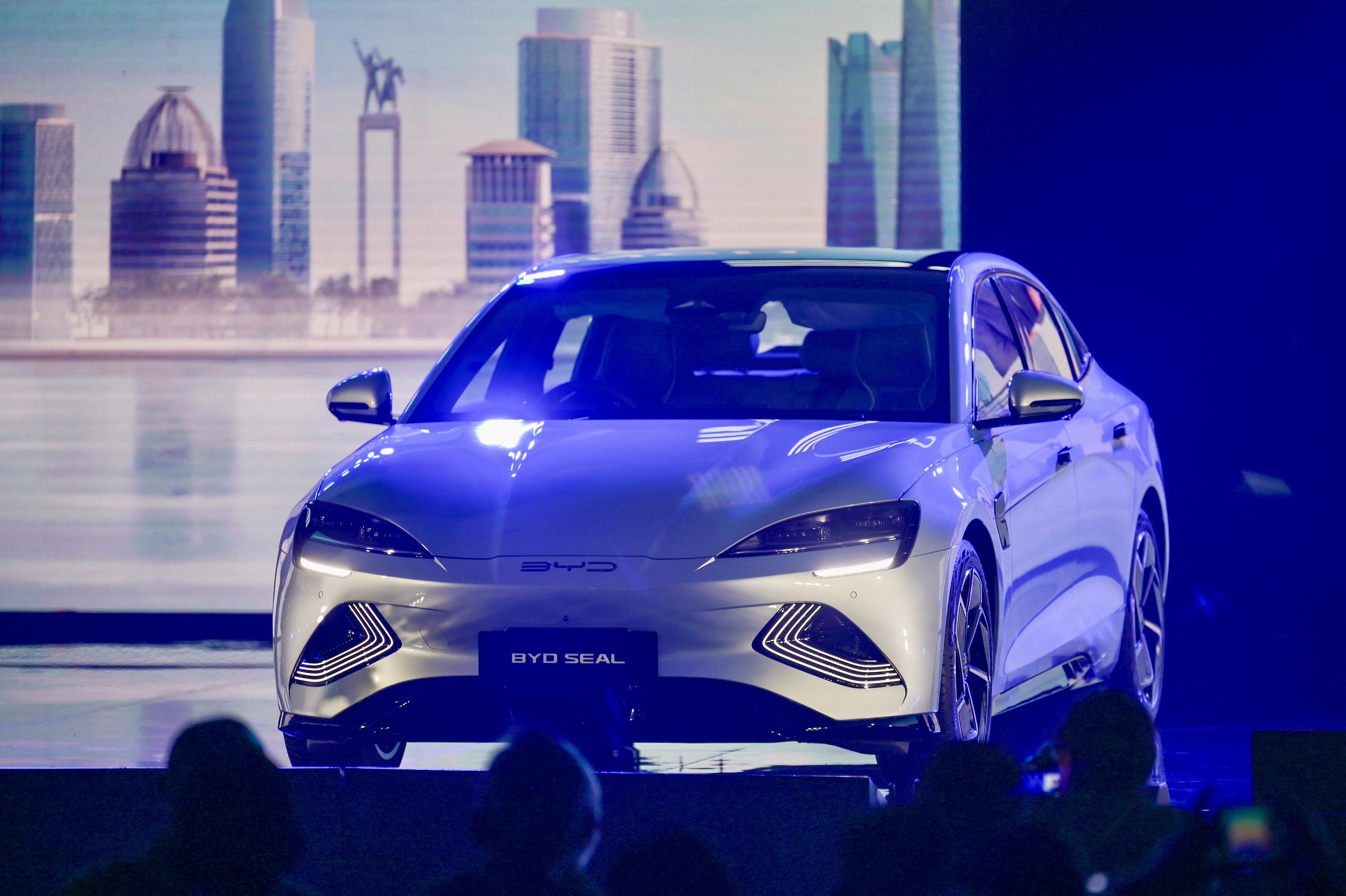

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Serie A: Bologna surprises AS Rome in the race for the C1

Serie A: Bologna surprises AS Rome in the race for the C1 Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues?

Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues? Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby

Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season

Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season