the end of the year will be charged. Who is employed in the home, someone should fill in these weeks with a form for the compensation Fund. In the case of the SVA Zurich, the entry deadline is at the end of January. No matter, whether cleaning woman, gardener, or other domestic workers – who use for a private hour, to the employer or to the employer. Thus, a number of other obligations are in addition to the payment of wages.

Who hires the staff, needs to settle as it is in every employer's ratio of AHV and IV and the employees against accidents insurance. Also the holiday entitlement is included in the salary. It sounds complicated, but thanks to a simplified procedure, the effort to cope with relatively easily.

the help by Online computer

Instead of monthly, must be accounted for in this method, the social insurance only once per year. In addition, five percent is deducted in taxes. Many employees appreciate it, if you can live without thanks to this withholding tax, a Declaration in the annual tax Declaration. In addition, the rate is comparatively low. This procedure is, however, only at low gross income of up to 21150 francs. It is higher, in addition to the occupational Pension scheme. For the compulsory accident insurance, there are many providers. In General, this costs 100 Swiss francs per year.

Some of the compensation funds provide you with Online calculators for additional assistance. For example, the SVA Zurich on your Internet site. It is known under the keyword "Online calculator" and "housekeeper". There, all the Numbers seconds according to wage and holiday claims quickly calculated. In addition, there is a form that can be used for the correct monthly payroll. Once completed, employers must enter in subsequent months, only the number of hours of work, and the Rest is calculated.

In one's own household hurt

Who does not pay the insurance of the house employees correctly, and in this sense, staff black employees, not only undermining the social protection of the employees – he's risking to get in trouble himself. This is the case, for example, if the compensation Fund will receive instructions and payments, together with five percent interest requires.

It also happens that a cleaner is injured while working in the own household, for example because she falls from a ladder. At the latest at the doctor the question after the mandatory accident insurance comes in.

special case Sackgeldjob

Lacking this, the employer must pay the treatment cost to pay, such as Jürg Thalmann of the furniture to be explained. In such cases, the replacement Fund takes on UVG cost of the healing. But at the same time, you will not only lose the employer after having assessed the individual case. In addition, this is obliged to accident insurance and to pay retroactive premiums.

In a different category of payroll so-called dead to fall-money jobs. An example of this is the hats service of the neighbor girl. Here there is no need for payroll. For 2015 a family for bag have to pay money jobs, no social contributions such as AHV and IV. And up to the age of 25 years and a merit of a year, 750 francs, as well as the accident insurance is not mandatory. For older Babysitter.

(editing Tamedia)

Created: 01.01.2019, 15:08 PM

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations What is Akila, the mission in which the Charles de Gaulle is participating under NATO command?

What is Akila, the mission in which the Charles de Gaulle is participating under NATO command? Lawyer, banker, teacher: who are the 12 members of the jury in Donald Trump's trial?

Lawyer, banker, teacher: who are the 12 members of the jury in Donald Trump's trial? What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic Orthodox bishop stabbed in Sydney: Elon Musk opposes Australian injunction to remove videos on X

Orthodox bishop stabbed in Sydney: Elon Musk opposes Australian injunction to remove videos on X One in three facial sunscreens does not protect enough, warns L'Ufc-Que Choisir

One in three facial sunscreens does not protect enough, warns L'Ufc-Que Choisir What will become of the 81 employees of Systovi, a French manufacturer of solar panels victim of “Chinese dumping”?

What will become of the 81 employees of Systovi, a French manufacturer of solar panels victim of “Chinese dumping”? “I could lose up to 5,000 euros per month”: influencers are alarmed by a possible ban on TikTok in the United States

“I could lose up to 5,000 euros per month”: influencers are alarmed by a possible ban on TikTok in the United States Dance, Audrey Hepburn’s secret dream

Dance, Audrey Hepburn’s secret dream The series adaptation of One Hundred Years of Solitude promises to be faithful to the novel by Gabriel Garcia Marquez

The series adaptation of One Hundred Years of Solitude promises to be faithful to the novel by Gabriel Garcia Marquez Racism in France: comedian Ahmed Sylla apologizes for “having minimized this problem”

Racism in France: comedian Ahmed Sylla apologizes for “having minimized this problem” Mohammad Rasoulof and Michel Hazanavicius in competition at the Cannes Film Festival

Mohammad Rasoulof and Michel Hazanavicius in competition at the Cannes Film Festival Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

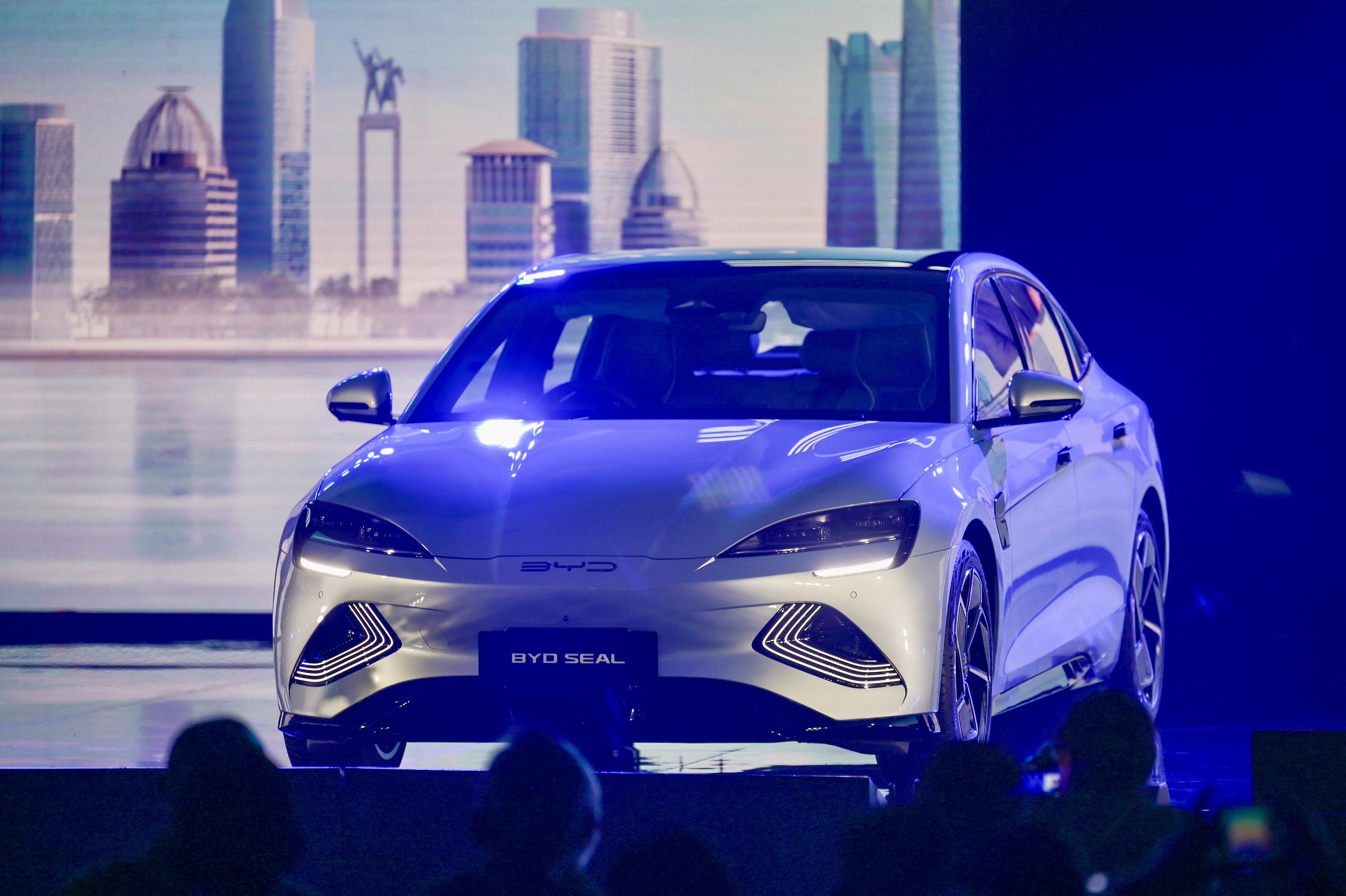

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Serie A: Bologna surprises AS Rome in the race for the C1

Serie A: Bologna surprises AS Rome in the race for the C1 Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues?

Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues? Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby

Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season

Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season