The undisputed number one Wall Street, Goldman Sachs is no more. But still she is one of the most prestigious and the most powerful banks in the world. The beginnings 150 years ago were very modest.

exactly 150 years Ago, hired Marcus Goldman, near Wall Street in Manhattan, a simple one-roomed office and called his company M. Goldman & Company. Thus he laid the Foundation for one of today's most powerful and most respected banks in the world.

Because Bank loans were scarce and expensive, bot Goldman tobacco and diamond traders an Alternative: He bought you the debt certificates to their customers, and sold them then with profit to banks. He was one of the pioneers in the business of securities, which were later called Commercial Papers.

business was going splendidlyThe gains may initially be small, but business was splendid. In the mid 80-ies of the 19. Century had Goldman already over $ 100,000 in equity. In 1882, was the son of Samuel Sachs-in-law to be in the shops occurred. Three years later, Goldman's son, Henry, joined the company, got the sound fuller name "M. Goldman & Sachs".

A meteoric rise for the first in 1848 in the United States immigrant Marcus Goldman. He was born in 1821, as Mark Goldmann, in the lower Franconian village of Trapp city as the oldest of five siblings. His father was a so-called "Handelsjud", the moved as a dealer in livestock on the villages. Early the son left the poor conditions, moved first to Frankfurt and then to America. There, he earned his living initially as a textile salesman in New Jersey, and Philadelphia, before he moved to the American civil war at the Urging of his wife to New York.

the $ 500,000 capitalA fortunate decision that brought you to See Goldman and prosperity. When the company was invited in 1896, the New York stock exchange to join, it was ascended for the most successful sellers of securities, and had more than $ 500,000 capital. Goldman itself had withdrawn two years earlier,in 1894, from active business. He died in the summer of 1904.

First share placementat the beginning of the 20th century. Century, Goldman Sachs ventured something New: the placement of shares on the stock exchange. A first Emission, succeeded in 1906 in the order of the company General Cigar. The transaction had a volume of 4.5 million dollars. In the process, Goldman also decided for a Premiere.

Instead of on the basis of the property, plant and equipment the value of the IPO-seeking company was according to its yield force is measured. With the emissions appear Goldman loss a new, huge source of money, they soon made the number one in this division. Even more: The Goldman Sachs introduced evaluation method was the Standard in the entire financial sector.

Sidney Weinberg is "Mr. Wall Street"The success of Goldman in the first half of the 20th century. Century is determined substantially by the legendary leadership of figures such as Gustave Levy and Sidney J. Weinberg. The latter was increased in the house usually agents with a weekly salary of three dollars to the chief Executive officer (CEO) and led the Bank for almost 40 years, from 1930 until 1969. The vineyard, of the press, "Mr. Wall Street", directed the Bank through the great Depression of the 30s and the turmoil of the Second world war. Later, he made it back to the first address of the American financial industry.

another turning point took place in 1999. This year, the partners decided in an historic vote to bring Goldman Sachs to the stock exchange, to equip the house with more capital and a more efficient structure. On 4. In may 1999, the shares were admitted under the Ticker Symbol "GS" for trading on the New York stock exchange.

To close thethe peculiarities of Goldman Sachs is in the vicinity of the policy. Already Henry Goldman advised the American President Woodrow Wilson in the creation of the Federal Reserve Bank. In the 1990s, the Co-head of Goldman, Robert Rubin, US Treasury Secretary.

in 2006, followed by Hank Paulson, a long time Chairman of the Board of the Bank, the reputation of George W. Bush to the Ministry of Finance. Also at the key points of the financial authorities of former Goldman employees.

"Government Sachs"The Connections are so tight that Goldman in the United States received the nickname of "Government Sachs". It has also changed after the election of Donald Trump is nothing, but Steven Mnuchin, the current Minister of Finance, a former Partner of Goldman Sachs. Even Mario Draghi, the President of the European Central Bank, is a former employee of Goldman Sachs.

In its long history the Bank was also at the centre of scandals. So Goldman Sachs was convicted of deception in the last financial crisis, to a penalty of $ 550 million. In addition, the Bank helped to instruments with complicated financial, to disguise the true extent of the Greek debt crisis. Really you don't have to hurt all these entanglements. You still earned billions and is still one of the most important pillars of the financial industry in the world.

source: boerse.ard.de Dax speculation on the merger crawls forward boost shares of Ford are not doing enough

His body naturally produces alcohol, he is acquitted after a drunk driving conviction

His body naturally produces alcohol, he is acquitted after a drunk driving conviction Who is David Pecker, the first key witness in Donald Trump's trial?

Who is David Pecker, the first key witness in Donald Trump's trial? What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain?

What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain? The shadow of Chinese espionage hangs over Westminster

The shadow of Chinese espionage hangs over Westminster Colorectal cancer: what to watch out for in those under 50

Colorectal cancer: what to watch out for in those under 50 H5N1 virus: traces detected in pasteurized milk in the United States

H5N1 virus: traces detected in pasteurized milk in the United States What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France The right deplores a “dismal agreement” on the end of careers at the SNCF

The right deplores a “dismal agreement” on the end of careers at the SNCF The United States pushes TikTok towards the exit

The United States pushes TikTok towards the exit Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille

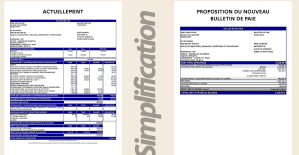

Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille This is what your pay slip could look like tomorrow according to Bruno Le Maire

This is what your pay slip could look like tomorrow according to Bruno Le Maire Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week

Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival

The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival Strasbourg inaugurates a year of celebrations and debates as World Book Capital

Strasbourg inaugurates a year of celebrations and debates as World Book Capital Kendji Girac is “out of the woods” after his gunshot wound to the chest

Kendji Girac is “out of the woods” after his gunshot wound to the chest Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated

NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated Real Madrid: what position will Mbappé play? The answer is known

Real Madrid: what position will Mbappé play? The answer is known Cycling: Quintana will appear at the Giro

Cycling: Quintana will appear at the Giro Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card

Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card