The sale of ABB's power line division of the Japanese Hitachi group gives the impression of a Notübung that at the end nobody is satisfied. Best buy CEO Ulrich spiesshofer and the Board of Directors President Peter Voser to time from unhappy shareholders. But that's not.

For the approximately 2800 employees in the power line division in Switzerland, the sale provides a very long period of uncertainty. Until the formal completion of the deal to the Japanese, one and a half years should pass. Until then, is likely to remain unclear whether and how much the new owner will make to the site, Switzerland savings.

Spiesshofer is once again optimistic, from his discussions with the Japanese, he gained the impression that Hitachi would be in Switzerland rather additional Jobs, he says.

But the Japanese themselves are, however, less euphoric: In the media release from Hitachi is the point, how many people in the new, merged current-division will be employed, only in a succinct way: "Still undetermined." What seems certain, however, that it will come in the Wake of the announced reorganization, ABB at the company's headquarters in Zurich-Oerlikon to cuts.

No response to the growth of doubt

not very convincing, also the communication in terms of sales, the current network appears to the division: In just two years, the ABB leadership had committed to the sale and this is justified with the dazzling prospects for the future of the business: the division would take "the opportunities of the energy transition and of the Fourth Industrial Revolution". Now the area is sold. And the sale proceeds will not be reinvested in the remaining business of ABB pure, but is to be distributed 100 percent to the shareholders.

This turnaround can be explained alone with the pressure from shareholders such as the investment company Cevian. The big shareholder urges for years to a stronger focus of FIG. However, to ignite instead of a course fireworks, turned the ABB share on the day of the long-awaited sale announcement even short of the loss zone. The hoped-for relief from the criticism by the saves of sale is likely to be the group's leadership so short-lived.

in order for investors to regain confidence in ABB, must Spiesshofer deliver the long-promised growth. To achieve the growth target of 3 to 6 per cent, managed to FIGURE in a period of global economic boom only selectively. It will be exciting to see how the target is now in a Phase of global cooling can be achieved. The sale of the tradition-rich business with high-voltage lines is not the answer to the growth of doubt, in FIG. (Editorial Tamedia)

Created: 17.12.2018, 15:12 PM

After 13 years of mission and seven successive leaders, the UN at an impasse in Libya

After 13 years of mission and seven successive leaders, the UN at an impasse in Libya Germany: search of AfD headquarters in Lower Saxony, amid accusations of embezzlement

Germany: search of AfD headquarters in Lower Saxony, amid accusations of embezzlement Faced with Iran, Israel plays appeasement and continues its shadow war

Faced with Iran, Israel plays appeasement and continues its shadow war Iran-Israel conflict: what we know about the events of the night after the explosions in Isfahan

Iran-Israel conflict: what we know about the events of the night after the explosions in Isfahan “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic Sánchez condemns Iran's attack on Israel and calls for "containment" to avoid an escalation

Sánchez condemns Iran's attack on Israel and calls for "containment" to avoid an escalation China's GDP grows 5.3% in the first quarter, more than expected

China's GDP grows 5.3% in the first quarter, more than expected Alert on the return of whooping cough, a dangerous respiratory infection for babies

Alert on the return of whooping cough, a dangerous respiratory infection for babies Vacation departures and returns: with the first crossovers, heavy traffic is expected this weekend

Vacation departures and returns: with the first crossovers, heavy traffic is expected this weekend “Têtu”, “Ideat”, “The Good Life”… The magazines of the I/O Media group resold to several buyers

“Têtu”, “Ideat”, “The Good Life”… The magazines of the I/O Media group resold to several buyers The A13 motorway closed in both directions for an “indefinite period” between Paris and Normandy

The A13 motorway closed in both directions for an “indefinite period” between Paris and Normandy The commitment to reduce taxes of 2 billion euros for households “will be kept”, assures Gabriel Attal

The commitment to reduce taxes of 2 billion euros for households “will be kept”, assures Gabriel Attal The exclusive Vespa that pays tribute to 140 years of Piaggio

The exclusive Vespa that pays tribute to 140 years of Piaggio Kingdom of the great maxi scooters: few and Kymco wants the crown of the Yamaha TMax

Kingdom of the great maxi scooters: few and Kymco wants the crown of the Yamaha TMax A complaint filed against Kanye West, accused of hitting an individual who had just attacked his wife

A complaint filed against Kanye West, accused of hitting an individual who had just attacked his wife In Béarn, a call for donations to renovate the house of Henri IV's mother

In Béarn, a call for donations to renovate the house of Henri IV's mother Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

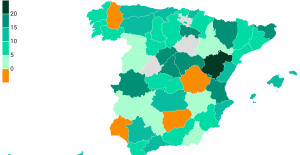

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy During the night of the economy, the right points out the budgetary flaws of the macronie

During the night of the economy, the right points out the budgetary flaws of the macronie These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Formula 1: Verstappen wins the sprint in China, Hamilton 2nd

Formula 1: Verstappen wins the sprint in China, Hamilton 2nd Rally: Neuville and Evans neck and neck after the first day in Croatia

Rally: Neuville and Evans neck and neck after the first day in Croatia Gymnastics: after Rio and Tokyo, Frenchman Samir Aït Saïd qualified for the Paris 2024 Olympics

Gymnastics: after Rio and Tokyo, Frenchman Samir Aït Saïd qualified for the Paris 2024 Olympics Top 14: in the fight for maintenance, Perpignan has the wind at its back

Top 14: in the fight for maintenance, Perpignan has the wind at its back