interest is to continue to wait for a turnaround in the Eurozone. By the end of the year, the ECB wants to maintain the zero interest rate. In addition, the commercial banks to get new loans to stimulate the economy.

As expected, the European monetary policy remains in crisis mode. While the American Central Bank, the Fed has increased its policy rate gradually, remains in the Eurozone for the foreseeable future is Zero. At least until the end of the year, the ECB will leave its key interest rate unchanged, as the Central Bank announced on Thursday.

Previously had signalled the guardian of the currency, only up to at least the end of the summer, the interest not to interfere. The key phrase to supply the commercial banks with money since March, 2016 at a record low of 0.0 percent.

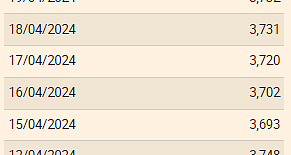

No Surprisein fact, the rate of inflation at 1.9 percent in the Target range of the Central bankers objective of price stability. Also, the economic indicators point to a significant cooling of the European economy. The large research institutes have revised downward their forecasts of long ago.

for More rate information the Euro in US dollars

the decision by the ECB to leave the interest rates untouched Under these conditions, not surprisingly. Economists also suggests that only with low interest rates, escalating public Finance debt in the EU and the Euro zone hold together.

New loans for the banksMore: to brace himself against the impending downturn in the Euro zone, is to inject the commercial banks with new money in the Form of discounted long-term loans TLTRO called. The Euro-guard set on Thursday a new edition of this loan.

Of the money shots are likely to benefit, especially the Italian banks, as they have always 240 billion in bad loans on their books and, therefore, the urgent need to refinance. The new money injection should be have a term of two years and from September 2019 issued.

for More course information to the Dax

Also of bonds in the portfoliothe first in A series of loans had decided the Central Bank in June 2014, a second in March 2016. Banks in Italy, Spain and France-to-grip handles reinforced.

The ECB wants to replace in addition to an interest in turn of for a longer period of time due to the end of bonds from its portfolio. The Euro-guard to remain a big player in the bond market. Your more than 2.6 trillion Euro engorged purchases of securities had set in December. The purchases were in the last few years your Central Instrument against a from their point of view to low Inflation.

lg

source: boerse.ard.de ECB sets bond purchases, 13.12.2018 US Central Bank raises key interest rate, 19.12.2018 Atlas |Germany |Frankfurt am Main New money from the ECB, Va-Q-Tec, to 2019, the ECB banks promises a fresh billion

The Euribor today remains at 3.734%

The Euribor today remains at 3.734% Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations What is Akila, the mission in which the Charles de Gaulle is participating under NATO command?

What is Akila, the mission in which the Charles de Gaulle is participating under NATO command? What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic MEPs validate reform of EU budgetary rules

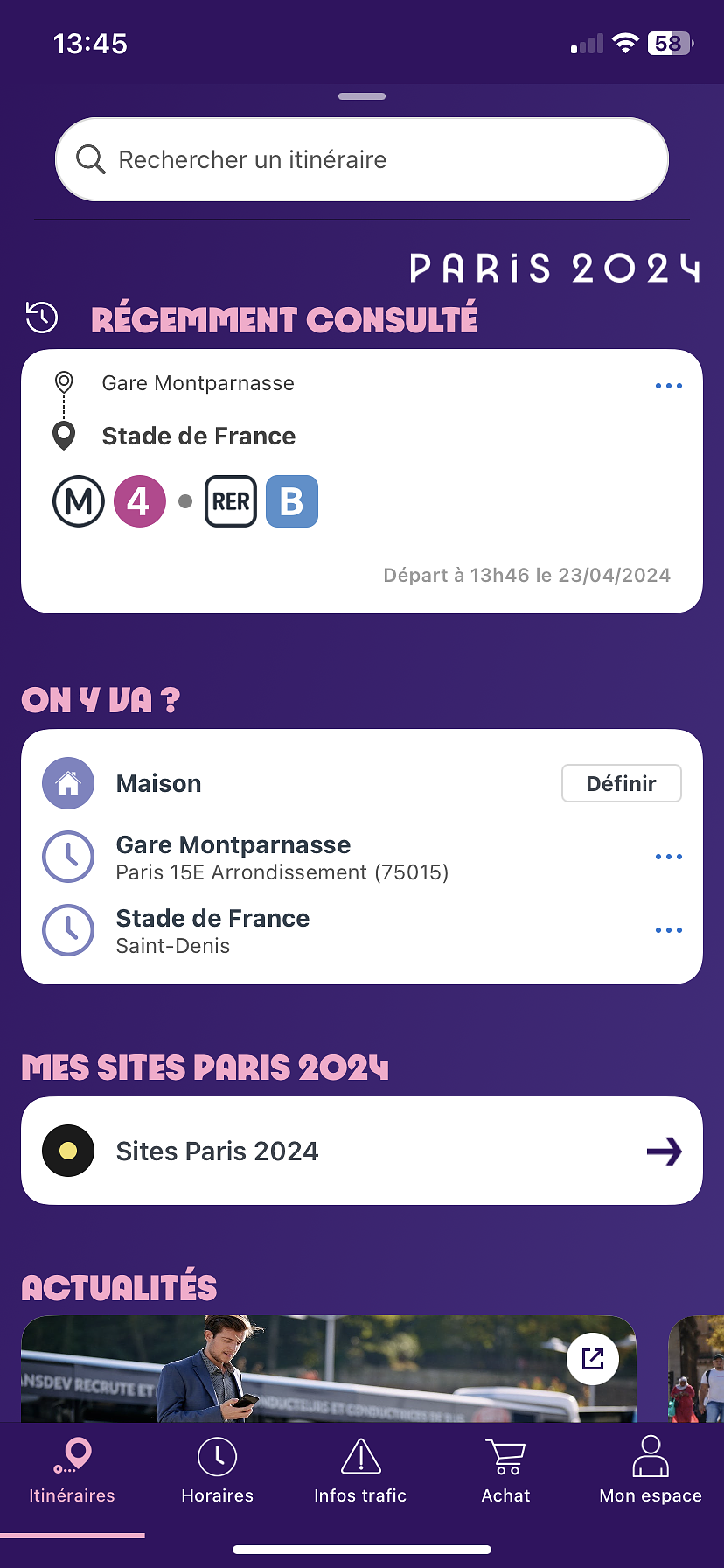

MEPs validate reform of EU budgetary rules “Public Transport Paris 2024”, the application for Olympic Games spectators, is available

“Public Transport Paris 2024”, the application for Olympic Games spectators, is available Spotify goes green in the first quarter and sees its number of paying subscribers increase

Spotify goes green in the first quarter and sees its number of paying subscribers increase Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund

Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer

Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame

Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame Three months before the Olympic Games, festivals and concert halls fear paying the price

Three months before the Olympic Games, festivals and concert halls fear paying the price With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics

With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Serie A: Bologna surprises AS Rome in the race for the C1

Serie A: Bologna surprises AS Rome in the race for the C1 Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues?

Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues? Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby

Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season

Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season