The financial crisis Observatory of the ETH Zurich has set itself the target of speculative bubbles in time to see. Worldwide, approximately 600 institutions use the analyses of the University, including banks, pension funds and sovereign wealth funds.

Today, the ETH Zurich has, in cooperation with the Spin-off of Simag, a current of water the message released, according to a small formation of bubbles between the different analyzed asset classes is observed. "Only for the S&P 500 VIX Futures we see a strong positive bubble activity. This means that the market could be more prone to abrupt volatility shocks," says Economics Professor Didier Sornette. He is the Director of the Observatory.

The VIX Futures allow investors to speculate on violent changes in the stock prices of the 500 largest listed US companies - however, regardless of the direction and level of the share price.

consequences for Switzerland

it is Noteworthy, however, that the ETH looks due to the world economic situation forced, in a new report on the economic risks of Contagion to take. The College stresses above all the importance of China to the world: China's economic growth fell due to internal problems, but also due to the slowdown of world trade on a 30-year Low.

as of weakness of a such a large market, a significant export-oriented public economies, such as Germany under pressure.

From Germany could spread the infection easily to many Eastern European countries. However, even Switzerland, would feel the consequences, because Germany is the main consumer of Swiss export products.

Finally, the question of the role of the Central banks to the language in the report: the money will be invested from new business loans less in the real economy rather than for the buy-back of own shares or for the purchase of financial assets related. This will continue so long as interest rates remained low or negative.

Dietmar Peetz from the ETH Spin-off Simag warns in this context that the Central banks are forcing through its interest rate policy, more and more institutional investors, illiquidity risks: "That the illiquidity premiums are so low, is a typical phenomenon in the late phase of the credit cycle'."

What to bring next year?

With the coming months holding the ETH Zurich: in 2021 could be a year in which the avoidance of the most dangerous financial bubbles is a difference between success and failure make it could. Many stock indexes are at or near historic highs. But the markets wrestle with their upward momentum.

Created: 12.11.2019, 19:16 PM

His body naturally produces alcohol, he is acquitted after a drunk driving conviction

His body naturally produces alcohol, he is acquitted after a drunk driving conviction Who is David Pecker, the first key witness in Donald Trump's trial?

Who is David Pecker, the first key witness in Donald Trump's trial? What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain?

What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain? The shadow of Chinese espionage hangs over Westminster

The shadow of Chinese espionage hangs over Westminster Colorectal cancer: what to watch out for in those under 50

Colorectal cancer: what to watch out for in those under 50 H5N1 virus: traces detected in pasteurized milk in the United States

H5N1 virus: traces detected in pasteurized milk in the United States What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France The right deplores a “dismal agreement” on the end of careers at the SNCF

The right deplores a “dismal agreement” on the end of careers at the SNCF The United States pushes TikTok towards the exit

The United States pushes TikTok towards the exit Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille

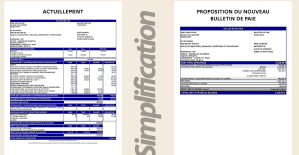

Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille This is what your pay slip could look like tomorrow according to Bruno Le Maire

This is what your pay slip could look like tomorrow according to Bruno Le Maire Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week

Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival

The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival Strasbourg inaugurates a year of celebrations and debates as World Book Capital

Strasbourg inaugurates a year of celebrations and debates as World Book Capital Kendji Girac is “out of the woods” after his gunshot wound to the chest

Kendji Girac is “out of the woods” after his gunshot wound to the chest Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated

NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated Real Madrid: what position will Mbappé play? The answer is known

Real Madrid: what position will Mbappé play? The answer is known Cycling: Quintana will appear at the Giro

Cycling: Quintana will appear at the Giro Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card

Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card