The Federal court of justice confirms this: customers determine not alone how long you want to save - banks have something to say about that.

By Wolfgang Janisch, Karlsruhe Wolfgang JanischOn the question of what profession he wanted to take, Wolfgang Janisch during his law studies, a standard answer: criminal defense attorney. Really seriously that was meant, and today he is glad it came to nothing, although he keeps the Job for one of the most important in the rule of law. So instead journalism: After various stations in regional Newspapers (Mainzer Rhein-Zeitung, Südwest Presse), and the FAZ, as well as a legal Promotion, with a one-year study stay in the USA, he went, in 1997, as a justice, a political correspondent for the German press Agency to Karlsruhe. Jura from the other side, as an observer of the Federal constitutional court and the Federal court of justice. Since 2010, reports and comments for the SZ. In the meantime, he also writes about the European courts; the location - Karlsruhe, Germany - has remained the same.

E-MailThe advertising flyer of the Kreissparkasse Stendal, in Saxony-Anhalt had made great promises: High interest rates, rising premiums, short-term access to the funds - and as a Bonus, on top of it: "you will determine alone, how long you want to save." It was a product with the name "S-save Premiums flexible", whose appeal was that it for the customer, the more lucrative it was, the longer he remained. The premiums started in the first year at Zero, climbed to 25 percent in the tenth year and reached the highest level in the fifteenth year, 50 percent of the annually deposited savings contribution. Before the Federal court of justice (BGH) had a fight now, customers with such contracts from the years 1996 and 2004, with the savings Bank. They had held on to in these times of low interest rates of course as long as possible in the indefinite duration contracts. However, the BGH has now decided: The customers determine not alone how long you want to save - the savings Bank has the right of termination.

Jürgen Ellenberger, Chairman of the Bank Senate sought, first, to make the good news for savers in the center. The crux of the Treaty was that no term was agreed upon, at least not explicitly. So the Supreme court had to interpret the content of the contract. The result: The savings Bank must let their customers so long as the contract hold out until the last reward level is reached - in this case, 15 years. That was initially quite controversial, and probably the reason why the Supreme court has the Revision explicitly allowed. This rule is now generally, and "beyond the case", as Ellenberger said. The termination right, the agreed to the savings Bank in their terms and conditions, is excluded up to the highest premium. Because of the incentive of the premium savings just lay in the gradual increase of the Profits, which is why the savings Bank of the don't prematurely could escape.

The less good news for savers: as soon As the award summit is reached, it is allowed to get off the savings Bank, in any case, if you can cite a proper reason. Sufficient a "change in the interest rate environment", such a persistent phase of low interest rates, which had not factored in the savings Bank, at the time, according to the BGH. In other words: That your savings contract, would be particularly attractive benefits the client, because the savings Bank can not get off with three months ' notice from the contract if he is attractive to you.

advertising, you should not give so much, so the Supreme court

That was, of course, quite surprising: two years ago, the Supreme court had allowed the building societies to the exit from your Altverträgen. Also, at the time, was concerned with the high interest rates, contracts to get rid of the goods you become in the face of permanently low interest rates. The Federal court of justice gave his approval: If, after the allocation to maturity of ten years had elapsed, a termination is allowed.

In both cases, the BGH clearly in mind, to distribute the risks of changes in the market environment on both sides, and to grant the savers are not an eternity warranty. In the case of the Saxony-Anhalt savings Bank, a promotional brochure was added but still, on the basis of the savers were able to make hope for a longer lasting business relationship. Not only because the savers should explicitly decide how long you will save. The customer, a sample was also been presented, which is not extended to 15 years, but on 25. "This is for the savers an interesting component, which led him to conclude the contract," said Norbert Tretter, a lawyer of the customer in the negotiation.

The Supreme court is of the opinion that one should not give up on advertising so much. The 25-years-to-table is "only a sample calculation, with no binding statement about the actual term of the contract is connected". Lawyer Matthias Siegmann had already reminded the hearing that the case-law of the Senate to be more "cautious" when it comes to the liability of advertising statements of the banks. The court stated: Significantly, the contract, not the Flyer that was just an "advertising promotion of the performance." An "average saver" can be found on the Flyer accordingly, no claims.

His body naturally produces alcohol, he is acquitted after a drunk driving conviction

His body naturally produces alcohol, he is acquitted after a drunk driving conviction Who is David Pecker, the first key witness in Donald Trump's trial?

Who is David Pecker, the first key witness in Donald Trump's trial? What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain?

What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain? The shadow of Chinese espionage hangs over Westminster

The shadow of Chinese espionage hangs over Westminster Colorectal cancer: what to watch out for in those under 50

Colorectal cancer: what to watch out for in those under 50 H5N1 virus: traces detected in pasteurized milk in the United States

H5N1 virus: traces detected in pasteurized milk in the United States What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France The right deplores a “dismal agreement” on the end of careers at the SNCF

The right deplores a “dismal agreement” on the end of careers at the SNCF The United States pushes TikTok towards the exit

The United States pushes TikTok towards the exit Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille

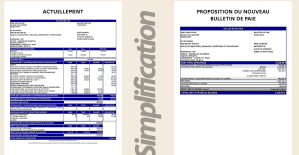

Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille This is what your pay slip could look like tomorrow according to Bruno Le Maire

This is what your pay slip could look like tomorrow according to Bruno Le Maire Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week

Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival

The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival Strasbourg inaugurates a year of celebrations and debates as World Book Capital

Strasbourg inaugurates a year of celebrations and debates as World Book Capital Kendji Girac is “out of the woods” after his gunshot wound to the chest

Kendji Girac is “out of the woods” after his gunshot wound to the chest Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated

NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated Real Madrid: what position will Mbappé play? The answer is known

Real Madrid: what position will Mbappé play? The answer is known Cycling: Quintana will appear at the Giro

Cycling: Quintana will appear at the Giro Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card

Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card