In fiscal year 2018 fell in the Helsana group and of the profit of 54 million francs to 218 million in the previous year. "An excellent underwriting result to a loss in the investments," said the company on Thursday.

In the previous year, had doubled the net profit, thanks to good investment results, more than from 98 million to 218 million francs.

combined ratio back in profit

The earned premiums increased in the past year to 6.50 billion Swiss francs of 6,39 billion, while the insurance declined services – 6,20 billion of 6.32 billion.

As the reasons for the lower benefits, called Helsana is the practical lack of inflation in the acute inpatient area, the second government's intervention in the Tariff for outpatient physician services, Tarmed, a more intense performance-cost management with new procedures for the control of the economy, as well as the re-recorded price check for pharmaceuticals.

The technical result achieved in 2018, however, 175 million Swiss francs after a loss of 10 million in the previous year. And the combined ratio (Combined Ratio) is 97.3 per cent to 100.2 per cent in 2017 and again in profit. From a value below the threshold of 100 percent of the money is earned.

In all three divisions of the Surplus: In the basic insurance, the combined ratio stood at 97.1 percent to 99.6 percent. In the area of supplementary insurance, he improved to 98.3% to 99.0%, and in the Accident business, the ratio was even 92.3 percent after 131,3%. The high Combined Ratio in the prior year was primarily due to a one-time effect.

Volatile financial markets

After the Boom in the financial markets, had filled the health insurer, 2017, the funds, the investment income 2018 negative. The global capital markets were characterised by a high volatility and is found in a deep red December a temporary low point, such as Helsana writes. This Trend was not able to escape.

the Performance of The financial market investments amounted in the end to -2,64% on assets of 6.2 billion Swiss francs. The investment loss thus reached 136 million Swiss francs. "So the plants were not able to contribute to many good to very good years, for once, to an improvement of the overall result," writes health insurance.

recommendation improves

With a view to the capitalization of Helsana looks, meanwhile, are still well positioned: All of the companies in the group überträfen the legal requirements in terms of solvency. The equity was further increased, and also the premium position in the basic insurance have improved again. The year had been added in the basic insurance 66'000 customers.

Moreover, had brought the goal closer, to be part of the customer's recommendation (measure Net Promoter Score, NPS) to the Top 3 in the industry. The most recent survey from December 2018, have shown that the residue at the third rank have more than halved. (fal/sda)

Created: 07.02.2019, 10:49 PM

Iran-Israel conflict: what we know about the events of the night after the explosions in Isfahan

Iran-Israel conflict: what we know about the events of the night after the explosions in Isfahan Sydney: Assyrian bishop stabbed, conservative TikToker outspoken on Islam

Sydney: Assyrian bishop stabbed, conservative TikToker outspoken on Islam Torrential rains in Dubai: “The event is so intense that we cannot find analogues in our databases”

Torrential rains in Dubai: “The event is so intense that we cannot find analogues in our databases” Rishi Sunak wants a tobacco-free UK

Rishi Sunak wants a tobacco-free UK Alert on the return of whooping cough, a dangerous respiratory infection for babies

Alert on the return of whooping cough, a dangerous respiratory infection for babies Can relaxation, sophrology and meditation help with insomnia?

Can relaxation, sophrology and meditation help with insomnia? WHO concerned about spread of H5N1 avian flu to new species, including humans

WHO concerned about spread of H5N1 avian flu to new species, including humans New generation mosquito nets prove much more effective against malaria

New generation mosquito nets prove much more effective against malaria The A13 motorway closed in both directions for an “indefinite period” between Paris and Normandy

The A13 motorway closed in both directions for an “indefinite period” between Paris and Normandy The commitment to reduce taxes of 2 billion euros for households “will be kept”, assures Gabriel Attal

The commitment to reduce taxes of 2 billion euros for households “will be kept”, assures Gabriel Attal Unemployment insurance: Gabriel Attal leans more towards a tightening of affiliation conditions

Unemployment insurance: Gabriel Attal leans more towards a tightening of affiliation conditions “Shrinkflation”: soon posters on shelves to alert consumers

“Shrinkflation”: soon posters on shelves to alert consumers The restored first part of Abel Gance's Napoléon presented at Cannes Classics

The restored first part of Abel Gance's Napoléon presented at Cannes Classics Sting and Deep Purple once again on the bill at the next Montreux Jazz Festival

Sting and Deep Purple once again on the bill at the next Montreux Jazz Festival Rachida Dati: one hundred days of Culture on the credo of anti-elitism

Rachida Dati: one hundred days of Culture on the credo of anti-elitism The unbearable wait for Marlène Schiappa’s next masterpiece

The unbearable wait for Marlène Schiappa’s next masterpiece Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

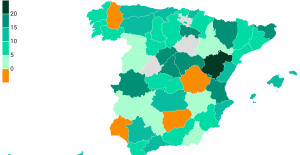

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy During the night of the economy, the right points out the budgetary flaws of the macronie

During the night of the economy, the right points out the budgetary flaws of the macronie These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Champions League: France out of the race for 5th qualifying place

Champions League: France out of the race for 5th qualifying place Ligue 1: at what time and on which channel to watch Nantes-Rennes?

Ligue 1: at what time and on which channel to watch Nantes-Rennes? Marseille-Benfica: 2.99 million viewers watching OM’s victory on M6

Marseille-Benfica: 2.99 million viewers watching OM’s victory on M6 Cycling: Cofidis continues its professional adventure until 2028

Cycling: Cofidis continues its professional adventure until 2028