The warning about declining iPhone sales put Apple's share price under strong pressure. The group must Smartphone is its dependence reduce - for example through Acquisitions. Candidate, there are enough.

ever since the warning from the beginning of January before declining sales - particularly in China - are increasing the voices of those who demand that Apple had to wide place: away from the increasingly saturated Smartphone market to go on to other things with which properly to earn money. While the growth story from Apple is not over yet - the turnover has increased in 2018 to 20 percent - but the Plus could shrink this year to a single-digit value.

Each company coming in to tell his story to the point where it newly had to invent, if it wants to continue to grow and survive, argue the critics. Apple need a replacement for the iPhone. A whole list of potential firms to appear regularly, could buy Apple.

In search of the "Wow-effect"group chief Executive Tim Cook has looked back long ago. "We see many, many companies, even large," he revealed in a recent interview with CNBC. "But we have not hit, because no candidate was, we could say, wow, that fits exactly to us. But I do not exclude that it will happen."

thanks to the huge cash reserves, Apple is able to get a suitable company to choose and the know-how and market position of short-hand to incorporate, as the last of 2014, with the headphone brand Beats. In fact, the Apple group has Cash reserves of 200 billion dollars. Who in 2019, then, is it?

"Asian twin"The Japanese game industry and Nintendo is about as "Asian twin" of Apple: Both companies are swimming in money, have loyal customers and attractive Ecosystems of Software and services. The renowned stock market magazine "Barron's" is, therefore, sure: Apple and Nintendo fit together perfectly. In doing so, Apple could learn from Microsoft's success. After all, this company has built up since its entry into the world of a profitable business around the XBox brand.

With Nintendo, the iPhone, and the group would now have the Chance to participate in the annual nine percent of the growing game market by buying the "best quality game manufacturer in the world" to a "reasonable price". For your orientation: Nintendo's market capitalization is currently around 38 billion euros.

And what about Salesforce?In the list of takeover candidates, the Name Tesla appears to be on a regular basis. Like Apple, the E-car maker beautiful, consumer-friendly and efficient products. It is also no secret that Tesla CEO Elon Musk wants to take the company from the stock exchange, to be able to it away from the Wall Street alone develop. It is also known that Apple itself is working on the development of electric and self-driving cars.

Further course information, to Apple

for More course information to Salesforce

surfaced about Nintendo

learn More price New in the list of possible takeover candidates in the cloud-software pioneer Salesforce. The Software is easy to use and is suitable for small and medium-sized customers. Although Apple enter as a hardware manufacturer with the purchase of a company like Salesforce are completely new - "off focus" as it is called in the USA - however, such a Takeover could be just the "Story" to investors and shareholders. Also Amazon, Google and Microsoft are in segments outside of its core activities.

Also iRobot would be out of the questionAdded to this, the professionals that Salesforce have tried to founder and CEO Marc Benioff already in 2015, to sell the group to Microsoft. At the time, Salesforce was rated the stock with 50 billion dollars, today the company is more than twice as much value. Also, it is unclear whether Benioff would be currently willing to sell at all. In any case, such a purchase would be very expensive.

Significantly cheaper the Takeover of iRobot, a manufacturer of robots, valued at 2.4 billion dollars, and to fit perfectly Apple would, as professionals would. The offer includes robots for Cleaning floors and swimming pools.

Difficult DNAThe advantage of such smaller companies is that they can be better in a big group to integrate, as Walt Disney, and Salesforce. In addition, many professionals think that larger Acquisitions fit in with the "corporate DNA" of Apple. The Apple culture is simply very own. Group founder Steve Jobs once said, "technology alone is enough to rejoice the hearts of the customers. You must also be associated with the arts and Humanities in line." to say

Difficult if these requirements are still valid today. What is certain is that Apple needs to solve from the dependence on the iPhone. The fastest way to this way would be a purchase. Since the Acquisition less than five years ago of the headphone manufacturer Beats Electronics for three billion dollars, the group has shied away from further acquisitions, but back.

source: boerse.ard.de Dax investors are exercising caution Ebay investor makes you happy expansion of business, Comdirect costs millions

After 13 years of mission and seven successive leaders, the UN at an impasse in Libya

After 13 years of mission and seven successive leaders, the UN at an impasse in Libya Germany: search of AfD headquarters in Lower Saxony, amid accusations of embezzlement

Germany: search of AfD headquarters in Lower Saxony, amid accusations of embezzlement Faced with Iran, Israel plays appeasement and continues its shadow war

Faced with Iran, Israel plays appeasement and continues its shadow war Iran-Israel conflict: what we know about the events of the night after the explosions in Isfahan

Iran-Israel conflict: what we know about the events of the night after the explosions in Isfahan Sánchez condemns Iran's attack on Israel and calls for "containment" to avoid an escalation

Sánchez condemns Iran's attack on Israel and calls for "containment" to avoid an escalation China's GDP grows 5.3% in the first quarter, more than expected

China's GDP grows 5.3% in the first quarter, more than expected Alert on the return of whooping cough, a dangerous respiratory infection for babies

Alert on the return of whooping cough, a dangerous respiratory infection for babies Can relaxation, sophrology and meditation help with insomnia?

Can relaxation, sophrology and meditation help with insomnia? Vacation departures and returns: with the first crossovers, heavy traffic is expected this weekend

Vacation departures and returns: with the first crossovers, heavy traffic is expected this weekend “Têtu”, “Ideat”, “The Good Life”… The magazines of the I/O Media group resold to several buyers

“Têtu”, “Ideat”, “The Good Life”… The magazines of the I/O Media group resold to several buyers The A13 motorway closed in both directions for an “indefinite period” between Paris and Normandy

The A13 motorway closed in both directions for an “indefinite period” between Paris and Normandy The commitment to reduce taxes of 2 billion euros for households “will be kept”, assures Gabriel Attal

The commitment to reduce taxes of 2 billion euros for households “will be kept”, assures Gabriel Attal The exclusive Vespa that pays tribute to 140 years of Piaggio

The exclusive Vespa that pays tribute to 140 years of Piaggio Kingdom of the great maxi scooters: few and Kymco wants the crown of the Yamaha TMax

Kingdom of the great maxi scooters: few and Kymco wants the crown of the Yamaha TMax A complaint filed against Kanye West, accused of hitting an individual who had just attacked his wife

A complaint filed against Kanye West, accused of hitting an individual who had just attacked his wife In Béarn, a call for donations to renovate the house of Henri IV's mother

In Béarn, a call for donations to renovate the house of Henri IV's mother Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

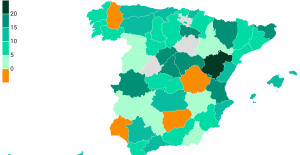

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy During the night of the economy, the right points out the budgetary flaws of the macronie

During the night of the economy, the right points out the budgetary flaws of the macronie These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Rally: Neuville and Evans neck and neck after the first day in Croatia

Rally: Neuville and Evans neck and neck after the first day in Croatia Gymnastics: after Rio and Tokyo, Frenchman Samir Aït Saïd qualified for the Paris 2024 Olympics

Gymnastics: after Rio and Tokyo, Frenchman Samir Aït Saïd qualified for the Paris 2024 Olympics Top 14: in the fight for maintenance, Perpignan has the wind at its back

Top 14: in the fight for maintenance, Perpignan has the wind at its back Top 14: Toulon-Toulouse, a necessarily special reunion for Melvyn Jaminet

Top 14: Toulon-Toulouse, a necessarily special reunion for Melvyn Jaminet