Marcel Brandt* not renounced the legacy of his deceased Cousins, since he was not sure if at the end only debt remain. He suggested the heritage, as lawyers say, and believed that the case was settled for him. The district court of Winterthur announced, however, that for the Erbausschlagung a fee of 150 CHF will be charged. "Cash expenditures" for Research – paid civil status documents, the court searched for other legal heirs. The costs amount to just under CHF 300. At Brandt's request, the court informed him that because of the "enormous burden" for a much higher fee could be imposed. In addition, the amount of the invoice could not rise, if other rash-paid members of the amount.

The district court of Winterthur, confirms the fees and disbursements, collects it, if someone renounce a legacy. Also in the cantonal data sheet for Erbausschlagung they are listed. The erbausschlag people would only be charged for those research costs that you are concerned, assured the district court. The joint and several liability of all the rash ends of the heirs, according to the court of the law. And if there is at the same time, members who accept the inheritance, they are passed after all, the proportion of cash expenses, when you apply for a certificate of inheritance, access to the assets of the testator. Finally, the district court of Winterthur, refers to the fact that the costs and ease of family conditions, a little lower level than in the present example, handle a more complex case.

Difficult to understand

parents and brother of the deceased life not more. However, out of a total of thirteen Cousins, three have accepted the inheritance. All the children of the Cousins have to beat the heritage. Brandt can't understand that it costs for the family tree research.

anyone Who is opposed to an heir should not take the settlement of the estate.

in fact, it is in other cantons, the usual practice is that rash heirs have to pay little to nothing. In the cantons of Basel-land and Basel-city families, the inheritance will be imposed, no cost. The competent inheritance offices to confirm. In the Canton of Bern, only a fee of 30 francs, as Simone Mülchi explained by the Association of Berne notaries. That members will receive an invoice for several Hundred francs, surprised even the experts: "Who renounce an inheritance, has to do according to my feeling, nothing more to do with the estate and should also have no such a high cost for Research," said Oliver Reinhardt, Secretary-General of the Swiss notary Association.

Who accepts a legacy, it must also stand for any debts of the deceased. Of the municipality of residence, Brandt received the information that the Cousin, according to the decreed tax return on assets of slightly more than 60'000 Swiss francs. Nevertheless, he decided against the legacy. Because he was unsure of whether other claims exist which are not taken into account in the tax return. In addition, it was unclear what remains after the deduction of court fees, costs for Apartment evictions and outstanding Rent left.

inventory creates clarity

In the Inheritance system from one Canton to big differences. But it is a Switzerland-wide valid regulation, which helps members to obtain prior to the adoption of a heritage of clarity on the financial circumstances of the deceased. You can request a so-called inheritance inventory, or a public inventory. The public inventory of creditors be called by publication, to Lodge claims. In accordance with the law, members have knowledge of the death three months reflection period to decide whether to disclaim the inheritance. To pass the three months unused, the heritage as a adopted. "The advantage of both the inheritance inventory as well as the public inventory is that this period only begins to run with the announcement of the inventory," says Simone Mülchi. The members have to decide first, if you are familiar with the financial circumstances. When it comes to public inventory, the heirs also have the opportunity to make the statement that they are "subject to public inventory," which means that you accept, in principle, only those debts that were included in the inventory. The disadvantage of this variant is that the inventory costs are incurred. The effort depends on the individual financial situation of the deceased. Depending on the Canton, it is possible that the family must pay an advance on Costs of several Thousand Swiss francs.

In some cantons members can decide on a more transparent Basis for a heritage, even without the need to pay for a public inventory. For example, in Basel-land, the Inheritance created a simplified inventory and this of the heirs. With the notification, the heirs would be required to decide within three months whether or not they wanted to accept or refuse an inheritance, said Daniel Stoll, President of the basel-Landschaft's notary Association.

interference to avoid

The municipality of residence of the deceased asked Marcel Brandt, whether he would organize the distribution of the estate and the apartment rooms. He refused. What may seem to be tough to appear-hearted, from a legal point of view: after all, who shall perform such duties, runs the risk that the legacy non-exclusive locations, such as notary Simone Mülchi explained.

The Prime example of this is when a pair takes the settlement of the estate to the Hand, such as termination and eviction from the apartment, or even some discount objects. This is considered "interference" in the estate, and thus as an acceptance of the heritage. Therefore, Mülchi members, which were a heritage of exclusive advises to refrain from such tasks and authorities not to put pressure on you, if ask them to take responsibility. Beat all the heirs, the costs to the detriment of the public, to the extent that they can not be from the estate funded.

* the Name has been changed

(editing Tamedia)

Created: 13.01.2019, 18:27 PM

A British man generates more than 1,000 child pornography images with AI... and is banned from using them

A British man generates more than 1,000 child pornography images with AI... and is banned from using them Iran-Israel: the West's policy of “appeasement” towards Tehran has failed, says the Shah's son

Iran-Israel: the West's policy of “appeasement” towards Tehran has failed, says the Shah's son In 2023, civilians “systematically massacred” in conflicts

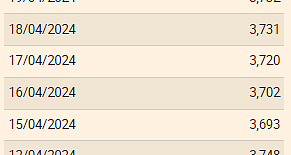

In 2023, civilians “systematically massacred” in conflicts The Euribor today remains at 3.734%

The Euribor today remains at 3.734% What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic Collection of booklet A stalls in March

Collection of booklet A stalls in March Kering expects a 40 to 45% drop in operating profit in the first half

Kering expects a 40 to 45% drop in operating profit in the first half Smartphones, televisions, household appliances… MEPs adopt a “right to repair”

Smartphones, televisions, household appliances… MEPs adopt a “right to repair” Fintechs increasingly focused on business services

Fintechs increasingly focused on business services The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival

The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival Strasbourg inaugurates a year of celebrations and debates as World Book Capital

Strasbourg inaugurates a year of celebrations and debates as World Book Capital Kendji Girac is “out of the woods” after his gunshot wound to the chest

Kendji Girac is “out of the woods” after his gunshot wound to the chest The Court of Auditors scrutinizes the management and projects of the Center Pompidou

The Court of Auditors scrutinizes the management and projects of the Center Pompidou Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Football: VAFC supporters are ironic after their descent into National

Football: VAFC supporters are ironic after their descent into National Tennis: Carlos Alcaraz should play in Madrid

Tennis: Carlos Alcaraz should play in Madrid Football: victim of discomfort in the middle of a match in mid-April, Evan Ndicka will resume training with AS Roma

Football: victim of discomfort in the middle of a match in mid-April, Evan Ndicka will resume training with AS Roma Ligue 1: PSG almost champion, OM, shock for the C1… 5 reasons to follow an exciting evening

Ligue 1: PSG almost champion, OM, shock for the C1… 5 reasons to follow an exciting evening