American economists have presented in the last years, numerous proposals for the Reform of the financial system that were considered in the critical Swiss Public as an attack on the cash. The International monetary Fund (IMF) in Washington has now submitted a working paper, and its contents, the attention could cement a position in this country even stronger. 31 pages with the title "Monetary Policy with Negative Interest rates: Decoupling Cash from Electronic Money" is the burning question, how to prevent savers in a economy crisis, their assets in the Bank in cash to withdraw.

The two authors propose to increase the price of the money, for example by a penalty interest rate of 3 percent. Simply put it means that anyone Who wants to withdraw 100 francs, receives at an ATM, only 97 francs in Cash. The longing is cash?

Every man has, of course, limit his own pain. But savers should consider holding Cash three times, when, due to a exorbitantly high penalty interest rate of 100 francs, for example, only 85 Swiss francs remained. "Our discussion shows that this System is technically possible, and no drastic changes in the mandates of Central banks would require", i.e. in the working paper.

Less room for manoeuvre in a recession

The debate highlights a major Problem of monetary policy. All the Western Central banks have kept their interest rate in the past few years to the lowest level in its history, and, although the economy is neatly grown. The Bank holds a European Central the key interest rate still at zero percent. The Problem: What can Central banks do when the next global recession, even if the policy rate is already so low?

One possibility would be to bring the people in any Form, their high Savings. This surge in demand could boost the economy. This is the purpose of the IMF working paper. Savers need to fear a devaluation of their assets, spend their money quickly. The introduction of high negative interest rates on account balance is not sufficient, however, because savers would withdraw their money under the mattress. It is only when the possession of cash would also be sanctioned, it could unfold the measure their full effect.

Both of the authors of the study used to be for the Swiss national Bank (SNB). This does not mean that we are designing at the SNB plans on how you could implement in Switzerland the devaluation of cash. On the other hand, the author throws a shaft of light on what the Central Bank Guild is thinking – "just in case". Again and again, the IMF continues its work papers as a test balloon in order to feel like certain topics academically and politically. In the case of the SNB, you do not want to comment on the matter. Even if no one says openly, it is nonetheless clear that the implementation of such plans with the national Bank nothing. With their new series of banknotes makes the contrary clear that they want to continue to back the cash.

"Huge communicative challenge"

"cash, a flight offers the possibility of negative interest rates," said Stefan Bielmeier, chief economist of DZ Bank. "The ongoing debate about a stronger push Back of cash in the economies is a consequence of the decreasing scope of action of the Central banks within the classical monetary policy," said Bielmeier.

the authors of The IMF working paper emphasize as an advantage that the measure of a cash devaluation is reversible at any time. A big disadvantage you have identified, however, because the introduction of the penalty rate on cash would be a "tremendous challenge in terms of communication". That's probably true. It sounds a bit of an understatement.

(editing Tamedia)

Created: 14.03.2019, 11:13 PM

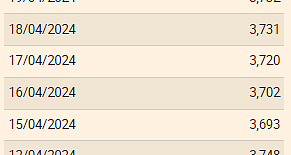

The Euribor today remains at 3.734%

The Euribor today remains at 3.734% Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations What is Akila, the mission in which the Charles de Gaulle is participating under NATO command?

What is Akila, the mission in which the Charles de Gaulle is participating under NATO command? What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic MEPs validate reform of EU budgetary rules

MEPs validate reform of EU budgetary rules “Public Transport Paris 2024”, the application for Olympic Games spectators, is available

“Public Transport Paris 2024”, the application for Olympic Games spectators, is available Spotify goes green in the first quarter and sees its number of paying subscribers increase

Spotify goes green in the first quarter and sees its number of paying subscribers increase Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund

Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer

Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame

Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame Three months before the Olympic Games, festivals and concert halls fear paying the price

Three months before the Olympic Games, festivals and concert halls fear paying the price With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics

With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Serie A: Bologna surprises AS Rome in the race for the C1

Serie A: Bologna surprises AS Rome in the race for the C1 Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues?

Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues? Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby

Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season

Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season