The companies in northern Germany are looking to the coming year with great concern - at least that is clear from the assessments of association representatives, who gave an outlook for 2023 on Wednesday, combined with clear demands on politicians. Without action, the energy crisis and inflation would leave their mark.

“The high energy prices and the weakening economic prospects will present the economy in Hamburg and Schleswig-Holstein with major challenges. Against this background, investment activity is declining considerably, both nationally and internationally. This harbors the risk that our economy will continue to lose ground in global competition," said Philipp Murmann, President of the Association of Business Associations in Hamburg and Schleswig-Holstein (UV Nord). The energy crisis is the main trigger for inflation, recession and loss of prosperity. It is now the task of the federal government to create economic prospects and confidence in this tense situation by securing the energy supply at competitive prices. Murmann: "We will only be able to prevent de-industrialization in Hamburg and Schleswig-Holstein if we take swift action."

Matthias Boxberger, Chairman of the Board of Directors of the Hamburg Industry Association (IVH), also emphasized how much the overall situation would put Hamburg's industrial companies under "mighty pressure". He therefore also turned to the state government: "In order to support the economic opportunities in Hamburg, the Senate must declare a moratorium on all taxes, fees and charges for the industrial location of Hamburg for the next two years as soon as possible. The historic energy price shock must not just be sat out, supportive intervention must be taken now.” Otherwise, the danger of de-industrialization would be accepted and even promoted.

Both heads of the association also received support from academia at an event hosted by the Deutsche Bundesbank in the Hotel Atlantic. Stefan Kooths, Director of the Research Center for Business Cycles and Growth at the Kiel Institute for the World Economy (IfW), said: "The German economy is drifting in difficult waters. The post-pandemic recovery phase was abruptly interrupted by the energy crisis resulting from the war in Ukraine. Economic output continued to trend upwards into the third quarter; However, this is due to catch-up effects that should not hide the fragile economic situation.” With the energy crisis, the location conditions in Germany suffered again – and significantly so. But Kooths also looked at longer lines of development: “The deterioration that has been creeping in for years is also leaving its mark more and more clearly. Even if a new energy policy strategy on the part of the federal government is now a priority, the other location factors should not be forgotten. Otherwise, a reluctance to invest as a result of increased uncertainty will turn into an investment sclerosis as a result of setting the wrong course.”

However, there is also a northern German industry that can hardly run with strength: Germany's shipping companies are still almost all fully utilized despite the corona pandemic and the Ukraine war. The upturn has reached even the smallest ship owners, in 93 percent of German ocean-going shipping companies all ships are fully utilized, according to the 14th shipowner study, for PwC Germany from May 12 to June 13, 106 decision-makers in German ocean-going shipping companies called by telephone had questioned. The future is also characterized by confidence: Three out of four shipowners are expecting growth.

"Unemployed container ships have become an absolute rarity," said André Wortmann, head of the Maritime Competence Center at PwC Germany. The reasons are catch-up effects in the trade backlog caused by the pandemic and the structural changes in the industry since the financial crisis of 2009. "Today, the problem is no longer overcapacity with a lack of demand, but on the contrary a lack of transport capacities with a sharp increase in demand," said Wortmann's deputy Burkhard Sommer.

74 percent of those surveyed expect growth in the next twelve months - after only 33 percent in the first Corona year 2020. However, only almost two thirds of the shipowners still assume that the global volume of cargo will increase in the next five years. Last year it was 75 percent. According to the shipowners, the end of the road seems to have been reached even with the recent massive increase in charter rates. 62 percent expected stagnation, albeit at a high level.

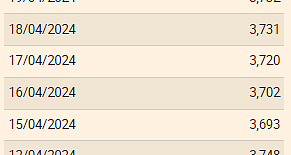

The Euribor today remains at 3.734%

The Euribor today remains at 3.734% Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations What is Akila, the mission in which the Charles de Gaulle is participating under NATO command?

What is Akila, the mission in which the Charles de Gaulle is participating under NATO command? What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic MEPs validate reform of EU budgetary rules

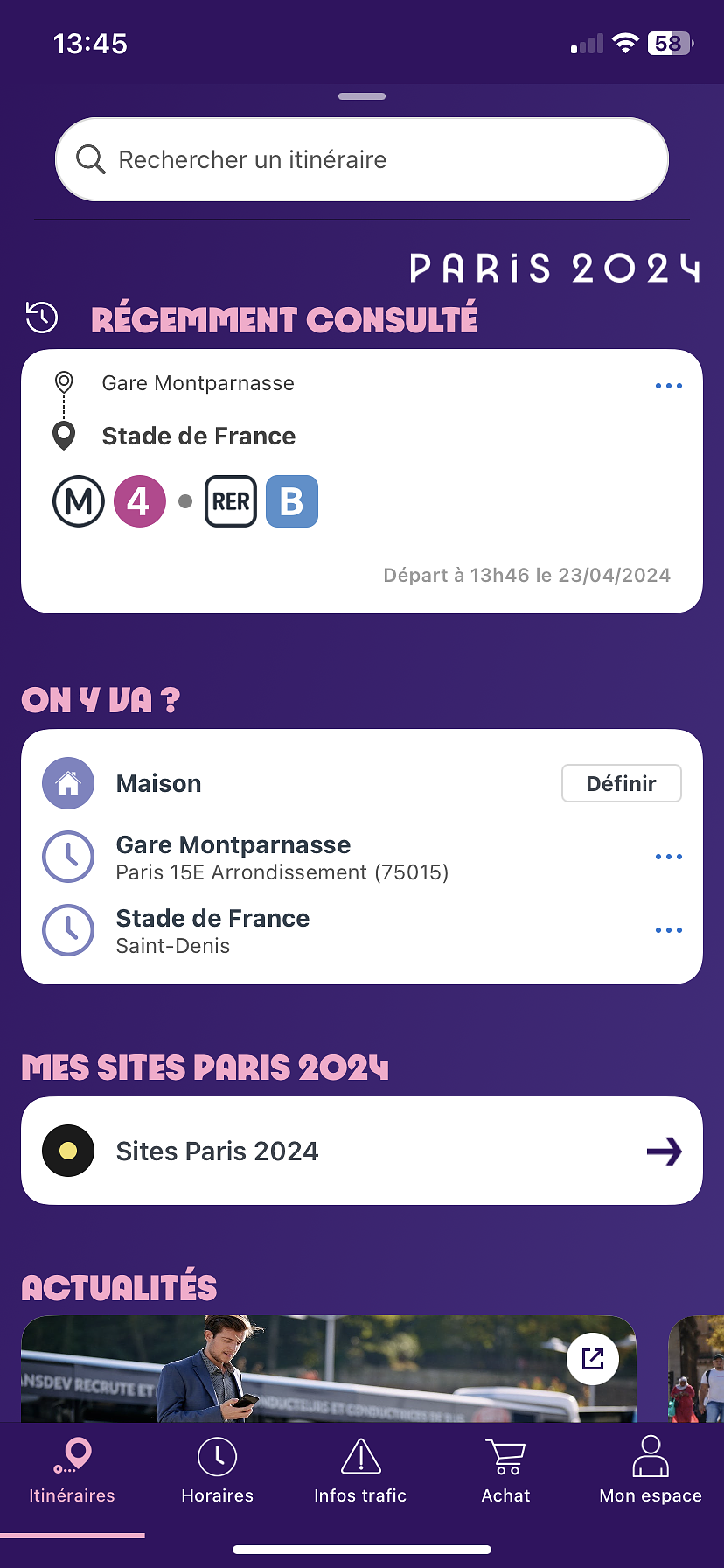

MEPs validate reform of EU budgetary rules “Public Transport Paris 2024”, the application for Olympic Games spectators, is available

“Public Transport Paris 2024”, the application for Olympic Games spectators, is available Spotify goes green in the first quarter and sees its number of paying subscribers increase

Spotify goes green in the first quarter and sees its number of paying subscribers increase Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund

Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer

Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame

Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame Three months before the Olympic Games, festivals and concert halls fear paying the price

Three months before the Olympic Games, festivals and concert halls fear paying the price With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics

With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Serie A: Bologna surprises AS Rome in the race for the C1

Serie A: Bologna surprises AS Rome in the race for the C1 Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues?

Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues? Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby

Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season

Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season