"The world is paying a very high price for Russian aggression in Ukraine," Organization for Economic Co-operation and Development Secretary-General Mathias Cormann told a news conference on Monday.

"Households and businesses are hurting," he continued, pointing out that "the burden of higher energy and gas prices as well as China's zero Covid policy imply lower growth and higher inflation. high and persistent".

The lack of calm on the ground in the eighth month of the Russian invasion of Ukraine, symbolized by the recent mobilization of reservists by Moscow, encourages the international organization based in Paris to be pessimistic.

In its quarterly report, entitled "paying the price of war", the OECD predicts that after a difficult year 2022, especially due to the inflationary outbreak, "global growth should continue to weaken in 2023".

The OECD expects global GDP to grow by 2.2% against 2.8% expected in June, although it maintained its forecast for 2022 at 3% after having reduced it sharply in recent months.

“Inflationary pressures are increasingly broad-based, with rising energy, transport and other costs impacting prices,” writes the OECD, which has revised down its 2023 forecast for the near future. all of the G20 countries with the exception of Turkey, Indonesia and the United Kingdom, whose economic activity will stagnate.

To show the extent of the shock of the war, the OECD has assessed the financial losses to be expected next year at 2.800 billion dollars compared to estimates prior to the arrival of tanks in Ukraine, "the size of the "French economy" measured in annual GDP, said the institution's acting chief economist, Alvaro Perreira.

It is logically the neighboring countries of kyiv and Moscow that will suffer the most significant costs: growth in the euro zone is undergoing the largest revision, to 0.3% against 1.6% expected in June. Inflation is expected there this year at 8.1% and 6.2% next year.

Agitated for months as a major risk, the recession is the scenario adopted by the OECD for Germany: the first European economy would see, according to the OECD, its GDP fall by 0.7% next year, a plunge of 2 .4 points compared to the previous forecast.

Its main neighbors escape it: growth of 0.4% is expected in Italy, 1.5% in Spain, and 0.6% in France, where the government is still counting on 1%.

The International Monetary Fund predicted in its latest global panorama 0.8% growth in Germany, 1% in France and 1.2% in the euro zone, but it could revise its figures downwards in October.

Among the other major regions, US growth is expected by the OECD at 0.5% against 1.2% expected in June, and Chinese growth at 4.7% against 4.9%.

- "Significant uncertainty" -

“Significant uncertainty surrounds these economic projections,” concedes the OECD, faced with the risk of energy shortages during the winter.

The dizzying rise in prices is already threatening the activity of a growing number of companies.

According to the OECD, greater gas shortages than expected could, through a cascading effect, reduce euro zone GDP by an additional 1.25 points next year, pushing many states into recession.

This scenario is all the more worrying as the central banks of developed and emerging countries are firmly committed to raising their interest rates to contain inflation, with the risk of undermining growth there too.

Rate hikes are "a key factor" in the slowdown at work, notes the OECD, which calls on central bankers to continue, however.

War, rate hikes, Covid-19, debt crisis... The OECD lists in its forecasts all the risks surrounding the economy. From there to lead to a plunge in global GDP? "The central scenario is not a global recession but the risks have increased in recent months," conceded Alvaro Pereira.

Targeted and temporary fiscal measures aimed at households and businesses are part of the solution to the emergency, the institution underlines, affirming that so far the measures taken against the rise in energy prices have been "poorly targeted ", because often benefiting too many households and businesses.

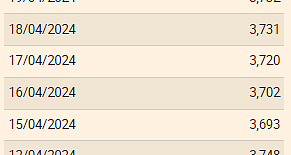

The Euribor today remains at 3.734%

The Euribor today remains at 3.734% Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations What is Akila, the mission in which the Charles de Gaulle is participating under NATO command?

What is Akila, the mission in which the Charles de Gaulle is participating under NATO command? What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic MEPs validate reform of EU budgetary rules

MEPs validate reform of EU budgetary rules “Public Transport Paris 2024”, the application for Olympic Games spectators, is available

“Public Transport Paris 2024”, the application for Olympic Games spectators, is available Spotify goes green in the first quarter and sees its number of paying subscribers increase

Spotify goes green in the first quarter and sees its number of paying subscribers increase Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund

Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer

Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame

Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame Three months before the Olympic Games, festivals and concert halls fear paying the price

Three months before the Olympic Games, festivals and concert halls fear paying the price With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics

With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Serie A: Bologna surprises AS Rome in the race for the C1

Serie A: Bologna surprises AS Rome in the race for the C1 Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues?

Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues? Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby

Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season

Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season