The truce in the collapse of the euro and the bullish tone of Wall Street after the minutes of the Fed animate the markets. The Ibex, after chaining three falls, points to the rise in a new attempt to recover 8,000 points

The pessimism of investors in recent days has resulted in a general setback. The disbandment has reached equities, oil and the euro, and only debt has received a resurgence of purchases, with the consequent collapse in bond interest. Recession alerts are on the rise. If in previous weeks the maelstrom of rate hikes had aggravated fears of a slowdown in the economy, in recent days the alerts about a possible energy deficit in Europe have increased the risk of recession.

Traders have become especially sensitive to the energy issue. Any news about Russian gas shipments to Germany or even about gas price forecasts by firms could cause severe turmoil in the financial markets, as has happened during the previous two sessions, in the stock market and in the foreign exchange market. The euro has been the great casualty. The fear that the lack of energy supply will force rationing deepens the prospects of the downturn that the European economy could face. The community currency fell yesterday to a 20-year low of $1,016, just one step away from parity. Once the revalidation of the Fed's minutes has been passed, the community currency slows its falls and recovers at times the threshold of 1.02 dollars. The most relevant macro data of the week will be the official US employment report that will be released tomorrow. Until then, the mini-truce also reaches the British pound, reinforced above 1.19 dollars in the midst of another crisis in the Government of Boris Johnson.

The euro has succumbed this week to the risk of a gas deficit in Europe, but the commodity market has reacted in these same days with a collapse in the price of an alternative to gas such as oil. Medium-term recession fears have prevailed over short-term supply shortages. The barrel of Brent tries to stop its corrective today, deflated on the edge of the 100 dollar barrier. Below the triple digits is the West Texas-type barrel, a reference in the United States. Despite containing its falls today, it is trading at 98 dollars.

To the relief of most investors, the blow to oil prices has been accompanied by a resounding drop in interest on debt, reflecting lower inflationary pressures, but also a greater risk of recession and an even more defensive by the market. The required yield on the ten-year US bond consolidates below the 3% level after the Fed minutes, far from its recent high of 3.49%. In Europe, the fear of a recession has deflated the interest of the German bund to around 1.20%, and the ten-year Spanish bond to the verge of 1.30%.

The firmness of Wall Street after the minutes of the Fed and the increases in Asia favor advances in Europe. The Spanish stock market takes advantage of the situation to join the comeback. The Ibex, after chaining three consecutive falls, activates the rebound and recovers the barrier of 8,000 points.

The rest of the European stock markets, much firmer yesterday than the Ibex, respond with increases to the mini-truce that the markets hold today. The French Cac is closer to reconquering 6,000 points, and the pan-European Stoxx 600 index manages to extend its cushion above the 400-point barrier.

The brake on the dollar's rise opens the door to a timid rebound in gold, penalized in recent days despite its status as a haven asset. The precious metal is nearing $1,750 an ounce today. In the cryptocurrency market, the changes are again low, with bitcoin once again anchored at the $20,000 level.

His body naturally produces alcohol, he is acquitted after a drunk driving conviction

His body naturally produces alcohol, he is acquitted after a drunk driving conviction Who is David Pecker, the first key witness in Donald Trump's trial?

Who is David Pecker, the first key witness in Donald Trump's trial? What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain?

What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain? The shadow of Chinese espionage hangs over Westminster

The shadow of Chinese espionage hangs over Westminster Colorectal cancer: what to watch out for in those under 50

Colorectal cancer: what to watch out for in those under 50 H5N1 virus: traces detected in pasteurized milk in the United States

H5N1 virus: traces detected in pasteurized milk in the United States What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France The right deplores a “dismal agreement” on the end of careers at the SNCF

The right deplores a “dismal agreement” on the end of careers at the SNCF The United States pushes TikTok towards the exit

The United States pushes TikTok towards the exit Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille

Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille This is what your pay slip could look like tomorrow according to Bruno Le Maire

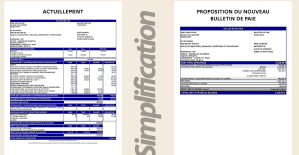

This is what your pay slip could look like tomorrow according to Bruno Le Maire Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week

Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival

The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival Strasbourg inaugurates a year of celebrations and debates as World Book Capital

Strasbourg inaugurates a year of celebrations and debates as World Book Capital Kendji Girac is “out of the woods” after his gunshot wound to the chest

Kendji Girac is “out of the woods” after his gunshot wound to the chest Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated

NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated Real Madrid: what position will Mbappé play? The answer is known

Real Madrid: what position will Mbappé play? The answer is known Cycling: Quintana will appear at the Giro

Cycling: Quintana will appear at the Giro Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card

Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card