Sir John R. Hicks, Nobel laureate and high priest of economic theory, once said: "There is nothing more important than a balance sheet." After the collapse of the Silicon Valley Bank (SVB), the words ring very true again.

Neither SVB management nor government regulators kept tabs on the bank's balance sheet, and when they did, they didn't understand.

What is the US government's solution to the collapse of SVB? The Treasury Department, the Federal Reserve and the FDIC will fully protect deposits with the SVB and apparently every dog and cat with a bank account as well. And when it comes to the word "bail-out," Treasury Secretary Janet Yellen affirms, "We won't do it."

While Yellen is stretching the definition of "bailout" by doing so, she may end up with a point. This government bailout is not a bailout. He is a gift.

The Federal Reserve has just released a "Bank Term Funding Program" outlining how it intends to provide liquidity to American banks in the current turmoil. The Fed offers one-year advances to eligible borrowers in exchange for collateral such as US Treasuries and mortgage-backed securities.

The big trick, however, is that the Fed will value the collateral at face value. For example, if a bank holds $100 million in relevant securities trading 10 percent below face value, then the securities in the market will be $90 million. Under the Fed's new program, the bank can then get a $100 million advance on $90 million worth of securities.

The Silicon Valley Bank was closed due to impending payment difficulties. Worried about losses, many customers withdrew their money from their accounts. US President Joe Biden has now commented on this in a statement.

Source: WORLD

Essentially, the Fed has decided that hedging interest rate risk is no longer commercial banks' job. Why hedge interest rate risk when the Fed will cover your losses? The Fed has become Santa Claus for banks, and securities traded below par are the milk and the cookies.

With the blessing of Janet Yellen, FDIC chief Martin Gruenberg and Fed Chair Jerome Powell, banking is now a government-backed business. Andrew Ross Sorkin of The New York Times is right when he writes: "Once the government guarantees all deposits, the business of banks is hardly a business anymore."

Indeed, if the FDIC insures all deposits - even those over $250,000 - and the Fed bears the balance sheet losses of the banks, what work is there left for bankers? Very little.

But that's not the end of the story. Under such a government-backed regime, a massive amount of moral hazard is injected into the commercial banking system. Because banks get an incentive to take more risks because someone else, in this case the American taxpayer, foots the bill when something goes wrong.

And that's still not all. As night follows day, excessive interventionism always goes hand in hand with more regulation. And tougher rules for commercial banks will allow the shadow banking system to flourish.

That's exactly what happened after the 2007-08 financial crisis, when, following the passage of the Dodd-Frank legislation, the size of the shadow banking system grew by 75 percent in just seven years between 2010 and 2017. This is a threat to the stability of the financial system. And while stability isn't everything, everything is nothing without stability.

Having failed to anticipate the SVB collapse, the Treasury, Fed and FDIC put a bandaid on the wound. And only tear open new wounds.

Steve Hanke is an economics professor at Johns Hopkins University in Baltimore. Caleb Hofmann is Chief of Staff at the Institute for Applied Economics at Johns Hopkins University.

"Everything on shares" is the daily stock exchange shot from the WELT business editorial team. Every morning from 5 a.m. with the financial journalists from WELT. For stock market experts and beginners. Subscribe to the podcast on Spotify, Apple Podcast, Amazon Music and Deezer. Or directly via RSS feed.

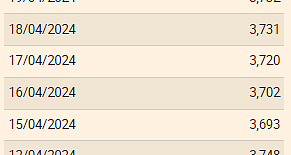

The Euribor today remains at 3.734%

The Euribor today remains at 3.734% Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations What is Akila, the mission in which the Charles de Gaulle is participating under NATO command?

What is Akila, the mission in which the Charles de Gaulle is participating under NATO command? What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic MEPs validate reform of EU budgetary rules

MEPs validate reform of EU budgetary rules “Public Transport Paris 2024”, the application for Olympic Games spectators, is available

“Public Transport Paris 2024”, the application for Olympic Games spectators, is available Spotify goes green in the first quarter and sees its number of paying subscribers increase

Spotify goes green in the first quarter and sees its number of paying subscribers increase Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund

Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer

Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame

Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame Three months before the Olympic Games, festivals and concert halls fear paying the price

Three months before the Olympic Games, festivals and concert halls fear paying the price With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics

With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Serie A: Bologna surprises AS Rome in the race for the C1

Serie A: Bologna surprises AS Rome in the race for the C1 Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues?

Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues? Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby

Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season

Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season