The EU member states are struggling to reform the European debt rules. With its proposal, the European Commission set the agenda. Three basic ideas characterize this serve. First, the member states are to negotiate the debt reduction targets individually with the Commission. So far there is a mixture of formula-based rules and flexibility.

Second, investments and reforms should be given more consideration. The more boldly a country reforms and invests, the more breathing room it should have when it comes to debt. Thirdly, the Member States should be given much more time. According to the Commission's ideas, a country could be given a period of four to seven years to steer the debt level on the prescribed downward path.

Some of these ideas go in the right direction. It makes sense not to cling too tightly to fixed adjustment formulas and to ask more about the quality of government spending. The current "one-twentieth rule" also ultimately damages the credibility of the Stability Pact.

This rule states that the debt level should reduce its gap to the 60 percent limit of the Maastricht Treaty by one twentieth per year. Given the high levels of debt in Italy and Greece, this formula calls for such a high absolute decline in the debt ratio per year that this is hardly realistic.

Despite these right ideas, the Commission's proposal fails to address the Pact's key weaknesses and would actually exacerbate them. The basic problem in the current system is that there is no neutral referee. As a politically active body, the Commission itself is unsuitable for this. It decides politically whether a country will be treated harshly with the rules or not. If, for example, a pro-Europe government is threatened with being voted out, Brussels tends to be lenient when it comes to fiscal rules.

The same applies to countries that are particularly politically influential. The statement by the Commission President at the time, Jean-Claude Juncker, has become famous. The latter had succinctly explained the leniency of his authority towards Paris with the Stability Pact with the comment "Because it is France". This is symptomatic of the inability of a politically thinking institution to impartially monitor fiscal rules and enforce them with the goal of debt sustainability.

The correct conclusion from this experience should be to ensure more neutrality and to further restrict the Commission's room for maneuver, exactly the opposite of the Commission's proposal. Instead of the Commission, an independent body should play a stronger role.

An institution that is ideally suited for this already exists: the European Fiscal Board (EFA), consisting of five independent personalities, already accompanies the work of the Commission with first-class analyzes and reports. However, the influence of this instance has so far been limited to the power of good arguments, which the Commission can simply ignore.

The Commission's proposal therefore goes in exactly the wrong direction. The plan to let the Commission freely negotiate the debt reduction path per country would open up even more room for bargaining instead of credible fiscal supervision. The Commission would then no longer be just an arbitrator, but would even be able to determine the rules of the game in the future.

The Commission's ideas about the time horizon for debt repayment are also unconvincing. Setting a deadline of four to seven years is far too long in political reality. She invites you to paint a rosy picture of planned reforms today, only to continue incurring new debts in the present. The economic policy experience in Europe includes innumerable planned reforms that have failed to have their planned effects or could only be implemented partially or not at all.

Another misconception would be to think that debt-financed investments should be generally accepted. There are many investments that are enormously important, such as climate policy or defense, but which hardly help to increase a country's growth potential.

Such investments therefore do not improve debt sustainability and must therefore be covered by current income. Investment-related exceptions should therefore remain limited to a narrow group of investment types that demonstrably increase growth potential.

The bottom line is that the Commission's proposal cannot come as a surprise in terms of political economy. This reform would greatly expand the Commission's decision-making leeway; that is in its institutional self-interest. This reform blueprint would damage the credibility of the pact. Germany should separate the wheat from the chaff in the Commission's proposal. Details such as the one-twentieth rule should be negotiable and can easily be replaced with more realistic targets.

What is to be rejected is the Commission's great negotiating leeway, the arbitrariness of exceptions and the long deadlines. Politicians should always have to prove the success of their consolidation efforts directly; mere promises of consolidation are “cheap talk” and shouldn't count.

The federal government should also speak out in favor of expanding the mandate of the EFA. If one actually accepts more leeway in assessing the fiscal rules, then this can only be done with a neutral authority that does not already have the next political barter deal with Berlin, Paris or Rome in mind.

Prof. Dr. Friedrich Heinemann heads the Public Finance research department at the ZEW – Leibniz Center for European Economic Research and teaches at the University of Heidelberg.

"Everything on shares" is the daily stock exchange shot from the WELT business editorial team. Every morning from 5 a.m. with the financial journalists from WELT. For stock market experts and beginners. Subscribe to the podcast on Spotify, Apple Podcast, Amazon Music and Deezer. Or directly via RSS feed.

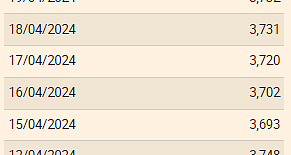

The Euribor today remains at 3.734%

The Euribor today remains at 3.734% Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations What is Akila, the mission in which the Charles de Gaulle is participating under NATO command?

What is Akila, the mission in which the Charles de Gaulle is participating under NATO command? What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic MEPs validate reform of EU budgetary rules

MEPs validate reform of EU budgetary rules “Public Transport Paris 2024”, the application for Olympic Games spectators, is available

“Public Transport Paris 2024”, the application for Olympic Games spectators, is available Spotify goes green in the first quarter and sees its number of paying subscribers increase

Spotify goes green in the first quarter and sees its number of paying subscribers increase Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund

Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer

Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame

Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame Three months before the Olympic Games, festivals and concert halls fear paying the price

Three months before the Olympic Games, festivals and concert halls fear paying the price With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics

With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Serie A: Bologna surprises AS Rome in the race for the C1

Serie A: Bologna surprises AS Rome in the race for the C1 Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues?

Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues? Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby

Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season

Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season