The value of tomorrow is produced in partnership with Zonebourse.com

Born in Florence in 1981 in the university fold, the group designs and markets laser devices used in medicine and industry. If you have any experience of industry dynamics, you probably think that the characteristics of these two markets are very different, and you are right. The medical branch is more profitable and less competitive than the industrial branch. However, the latter has benefited for several years from strong demand from the Chinese steel industry, which has boosted its growth. The industry generated 45.5% of the group's turnover last year, against 35% five years earlier, mainly thanks to laser tools for cutting materials, but also in the marking of products or more confidential, such as the restoration of monuments.

The medical division is mainly exposed to the cosmetic surgery market, ranging from hair removal to acne treatment, including all kinds of cosmetic applications. El.En. also has a non-invasive surgical range and supplements the division's revenues with a range of services dedicated to its products. It goes without saying that all this arsenal is perfectly in tune with the aesthetic aspirations of the time. This partly explains why the medical gross margin flirts with 45%, against 28% for the industry. It is therefore the nugget of the group, especially as the growth dynamic is accelerating after the air pocket linked to the coronavirus. In geographical terms, the Florentine is a very international player, which carries out approximately 80% of its activity outside the Italian borders. It also has production sites in Italy, Germany, China and Brazil, in addition to R

El.En. will roughly double its turnover between 2019 and 2024, to increase it from 401 to 796 million euros, according to the projections currently available. At the same time, its results should be multiplied by 2.5. This is a sign that profitability is on an upward slope, after an intense phase of R

The company also has the advantage of prudent management, which has allowed it to weather economic cycles without too much damage. Management did not interrupt the payment of the dividend during the health crisis, which offers a good illustration of its level of confidence. To top it off, El.En. has copious excess cash and managers who are also shareholders with almost half of the capital. In other words, the company has the resources necessary for its development and the experience required to use them wisely. The management also keeps a major card up its sleeve, the split followed by an IPO of its largest industrial segment, laser cutting. He very recently confirmed that this was a line of thought, in the event that a refocusing on more sophisticated activities appeared to him to be judicious. If the project were to materialize, the valuation that we mentioned earlier would have even more reasons to tend towards the medical sector than towards industry.

His body naturally produces alcohol, he is acquitted after a drunk driving conviction

His body naturally produces alcohol, he is acquitted after a drunk driving conviction Who is David Pecker, the first key witness in Donald Trump's trial?

Who is David Pecker, the first key witness in Donald Trump's trial? What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain?

What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain? The shadow of Chinese espionage hangs over Westminster

The shadow of Chinese espionage hangs over Westminster Colorectal cancer: what to watch out for in those under 50

Colorectal cancer: what to watch out for in those under 50 H5N1 virus: traces detected in pasteurized milk in the United States

H5N1 virus: traces detected in pasteurized milk in the United States What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France The right deplores a “dismal agreement” on the end of careers at the SNCF

The right deplores a “dismal agreement” on the end of careers at the SNCF The United States pushes TikTok towards the exit

The United States pushes TikTok towards the exit Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille

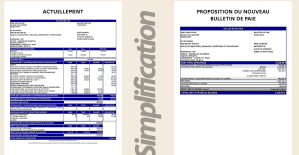

Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille This is what your pay slip could look like tomorrow according to Bruno Le Maire

This is what your pay slip could look like tomorrow according to Bruno Le Maire Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week

Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival

The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival Strasbourg inaugurates a year of celebrations and debates as World Book Capital

Strasbourg inaugurates a year of celebrations and debates as World Book Capital Kendji Girac is “out of the woods” after his gunshot wound to the chest

Kendji Girac is “out of the woods” after his gunshot wound to the chest Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated

NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated Real Madrid: what position will Mbappé play? The answer is known

Real Madrid: what position will Mbappé play? The answer is known Cycling: Quintana will appear at the Giro

Cycling: Quintana will appear at the Giro Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card

Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card