The number of over-indebted private individuals in Germany is lower than ever before. The credit agency Creditreform reports 5.88 million cases in its current debtor atlas. The numbers have fallen for the fourth year in a row, this time by 4.4 percent or the equivalent of 274,000 people affected.

The over-indebtedness rate, i.e. the proportion of over-indebted people in relation to all adults in the country, falls to 8.48 percent and is also at an all-time low since records began in 2004.

Nevertheless, study author Patrik-Ludwig Hantzsch makes a worried face. "Unfortunately, the good numbers are deceptive," says the head of economic research at Creditreform. "We fear a trend reversal in the coming months."

Because Hantzsch sees a "threatening mixed situation" with the persistently high inflation and particularly high price jumps in energy and food, i.e. in exactly those areas that every household urgently needs. Added to this is mobility, which has also become much more expensive.

At the same time, the reserves saved during the Corona crisis have already been largely exhausted, as experts say. "Therefore, next year we will very likely measure increases in over-indebtedness figures again - and to a large extent," predicts Hantzsch, referring to calculations of the so-called Microm over-indebtedness typology, a new analysis model from Creditreform.

According to this, almost 20 percent of German households are currently at risk of not being able to pay the bills for utility services such as electricity, water, gas and heat immediately. This affects around 7.8 million households and consequently almost 16 million people, calculates Michael Goy-Yun, the managing director of Microm.

"The energy price shock is becoming too much of a financial burden for many." By way of comparison: before the start of the Ukraine war and the resulting jumps in energy prices, according to the Federal Statistical Office, 3.2 percent of households did not have enough money to heat their homes adequately . And according to Eurostat, 3.7 percent of households had arrears on utility bills.

Economic researcher Hanztsch also sees a surging wave. "The true burden of the energy crisis has not yet fully reached consumers," says the expert. “That is why the consequences of over-indebtedness have not yet been acutely felt. This will happen with a time lag in the coming months – and with a long-term effect.” Hantzsch sees low earners, who cannot put much aside even in normal times, at particular risk.

Creditreform is already seeing the first signs. The Corona period has so far been characterized by a reduction in over-indebtedness “at a drastic pace”, as the debtor atlas states. The reasons for this were the immense state support and aid programs with which politicians wanted to stabilize the economy and thus protect companies and consumers from the feared insolvency.

In addition, there are consumption options, for example on vacation, in gastronomy or in other leisure activities - and at the same time a fundamental cautious approach to spending among many consumers, which has led to a sharp increase in the savings rate and savings, which were often also used to reduce debt.

"Recently, however, this decline in over-indebted people has slowed noticeably," reports Hantzsch. And now comes the expected back payment shock for electricity and gas. "It can lead many consumers into lasting payment difficulties, sometimes even directly into over-indebtedness."

After all, Creditreform considers 600,000 new cases in the coming months to be “not unrealistic”. And there is a risk of energy poverty not only in the lower income groups. For the middle classes, too, the risk has increased significantly in view of the impact of the additional payment shock and the difficult to calculate duration of the inflationary tendencies.

According to the German Economic Institute (IW), the proportion of consumers in Germany who can save regularly has fallen from 70 percent in 2020 to just 50 percent now.

"Even the middle of society is coming under increasing pressure," says an IW report from September. "Precarious households are faced with existential questions, while in middle-class milieus the self-image of a secure future is faltering."

The federal government has announced explicit aid such as the electricity and gas price brake. However, Creditreform doubts whether the aid and support programs will be sufficient to limit the impact of energy price-related income losses.

And the IW also sees the need to make households aware of the importance of saving energy. "The general price level will remain high and possibly continue to rise," says the debtor atlas. "The signs remain stormy."

Especially since there are other risks of over-indebtedness. As a result, numerous banks and savings banks in Germany have started to raise interest rates for overdrafts and overdrafts significantly. Consumer advocates expect that many people will get into financial difficulties as a result.

At the same time, consumers have taken out more installment loans again as part of a Corona catch-up consumption: around seven million new installment loan agreements were concluded in 2021, which is five percent more than in the previous year and means the first increase after four years with declining numbers.

The younger target groups, who like to use so-called "buy now, pay later" offers, which are mainly offered by online retailers, were particularly active. The payments due will then be deferred and/or spread over several installments.

"It is obvious that these supposedly practical payment solutions for young people can quickly develop into an over-indebtedness trap," says Creditreform.

In principle, however, the issue of over-indebtedness tends to affect older generations. The average age of those affected is currently 46.45 years. Most cases affect men: in 2022 there were 3.59 million, compared to 2.3 million cases in women.

The proportion of women has been increasing for several years, as the debtor atlas shows. Another trend that has been going on for a long time is the poorer development of over-indebtedness among the older population groups.

Expert Hantzsch speaks of a double trend towards poverty in old age and over-indebtedness in old age. It can be observed that people of retirement age have to continue working, mostly in the context of atypical or marginal employment, in order to obtain the missing means to secure their livelihood.

As has been the case for many years, the reasons for slipping into acute financial difficulties are primarily six triggers, the so-called "Big Six", as it is called in the industry: unemployment, illness/addiction/accident, uneconomical household management, separation/divorce/death, one failed self-employment and long-term low income.

"Everything on shares" is the daily stock exchange shot from the WELT business editorial team. Every morning from 5 a.m. with the financial journalists from WELT. For stock market experts and beginners. Subscribe to the podcast on Spotify, Apple Podcast, Amazon Music and Deezer. Or directly via RSS feed.

His body naturally produces alcohol, he is acquitted after a drunk driving conviction

His body naturally produces alcohol, he is acquitted after a drunk driving conviction Who is David Pecker, the first key witness in Donald Trump's trial?

Who is David Pecker, the first key witness in Donald Trump's trial? What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain?

What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain? The shadow of Chinese espionage hangs over Westminster

The shadow of Chinese espionage hangs over Westminster Colorectal cancer: what to watch out for in those under 50

Colorectal cancer: what to watch out for in those under 50 H5N1 virus: traces detected in pasteurized milk in the United States

H5N1 virus: traces detected in pasteurized milk in the United States What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France The right deplores a “dismal agreement” on the end of careers at the SNCF

The right deplores a “dismal agreement” on the end of careers at the SNCF The United States pushes TikTok towards the exit

The United States pushes TikTok towards the exit Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille

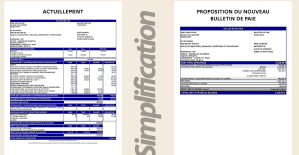

Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille This is what your pay slip could look like tomorrow according to Bruno Le Maire

This is what your pay slip could look like tomorrow according to Bruno Le Maire Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week

Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival

The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival Strasbourg inaugurates a year of celebrations and debates as World Book Capital

Strasbourg inaugurates a year of celebrations and debates as World Book Capital Kendji Girac is “out of the woods” after his gunshot wound to the chest

Kendji Girac is “out of the woods” after his gunshot wound to the chest Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated

NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated Real Madrid: what position will Mbappé play? The answer is known

Real Madrid: what position will Mbappé play? The answer is known Cycling: Quintana will appear at the Giro

Cycling: Quintana will appear at the Giro Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card

Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card