Higher taxes and spending cuts should help Britain "tackle the cost of living crisis and rebuild the economy," announced Treasury Secretary Jeremy Hunt in his autumn statement on Thursday. The threshold above which the top income tax rate of 45 percent becomes due will be reduced from £150,000 (€171,638) to £125,000.

The taxation of excess profits in the energy industry will be expanded, as will that of capital gains. Income tax thresholds will not be raised in the coming years and the exemptions for electric vehicles will no longer apply.

The package is expected to bring in around £55bn, half from cuts, half from higher taxes. The austerity efforts are necessary because of the clearly deteriorated economic situation.

The independent audit office Office for Budget Responsibility (OBR), which presented new forecasts in parallel with the announcements, assumes that the country's economy will shrink by 1.4 percent in the coming year. The last forecast in March had priced in 1.8 percent growth.

Hunt's detailed statement is the third major announcement of its kind in less than two months. It has been almost eight weeks since Kwasi Kwarteng, Chancellor of the Exchequer in the previous government, presented a comprehensive package intended to boost the country's flagging growth.

The central component was tax cuts, without any indication of how they were financed. The country was promptly punished on the financial markets. The pound's exchange rate slipped, government bond yields soared, public debt became more expensive. Three weeks later, Kwarteng was replaced by Jeremy Hunt, who canceled almost all of his predecessor's measures in a spectacular about-face.

With the fiscal strategy that has now been presented, Hunt is finally moving away from the plans of his predecessor, hoping to put his damaged reputation in order. "It's amazing that in just a few weeks we've moved from 'time for the biggest tax cuts in 50 years' to 'necessarily the time for the clearest fiscal tightening since 2010'," commented Torsten Bell, Head of Economic and Social Policy Resolution Foundation think tank.

The updated OBR estimate gives a clear picture of the state of the UK economy. The auditors do not expect the country to return to the economic output of the Covid pandemic until the end of 2024.

The recovery is thus taking three years longer than expected in March. The other G-7 countries have all already reached this level again. In other words, in two years the UK economy will be five percent smaller than expected six months ago.

Inflation remains high and will be 7.4 percent in the coming year. Debt in relation to economic output will be 97.6 percent in 2025/26. In March, the auditors had assumed 80.9 percent.

And the British are clearly feeling this in their wallets. Real disposable income will fall by two percent over the next two years. The sharpest drop yet recorded brings real incomes back to 2013 levels.

The energy suppliers in particular are used for financing. A special tax on high profits thanks to the current energy crisis has long been very controversial in the conservative party.

Now the "energy profit tax" introduced in the spring for oil and gas producers will be raised from 25 to 35 percent. Instead of four years, it is valid for six. In addition, a further levy of 45 percent on profits above a certain threshold will be imposed on power plant operators and other energy producers.

In the longer term, the country must not only become more efficient in terms of energy consumption, but also make itself even more independent of supplies from abroad, emphasized Hunt. The approval of the new Sizewell C nuclear power plant should contribute to this. The project on the Channel coast has been in the pipeline for a long time. State financing – for the first time for a nuclear power plant in over 30 years – is now intended to speed up implementation.

At the same time, an energy package for private households will be extended. In order to cushion the sharp rise in prices, an average household has been paying £2,500 a year since October, around £1,000 less than the market price, thanks to government support. From April, however, private individuals will have to dig deeper into their pockets, and then the price will increase to £3,000.

A comprehensive program for the insulation of real estate should have a supporting effect. In a European comparison, the British real estate portfolio is considered to be particularly poorly insulated. On the expenditure side, Hunt prescribes that the state finances will grow significantly more slowly than planned for the individual ministries. For most, it will remain a plus of one percent in real terms.

Exceptions are the national health service NHS and the education sector, whose budgets will be adjusted more generously. Nevertheless, saving measures should also be sought here. “We want Scandinavian quality with Singapore efficiency,” Hunt clarified.

"Given the economic environment of persistently high inflation and sluggish growth, the adjustments to fiscal targets are a step in the right direction," said Hailey Low, economist at the National Institute of Economic and Social Research.

However, it makes sense to push back the dates for achieving these goals as far as possible, "otherwise there is a risk of plunging the economy into an even deeper recession".

The markets received the measures with cautious confidence. Since the turbulence following the announcement of Kwarteng's fiscal plans, particular attention has been paid to the development of the currency and government bonds. The pound fell slightly after Hunt's announcements, the Gilt market for British government bonds was somewhat more stable.

"We have damaged our reputation internationally," Bank of England (BoE) Governor Andrew Bailey admitted before Parliament's Finance Committee. And the head of the British central bank fears: "It will take longer to repair this reputation than it takes to calm the bond market."

After months in which Brexit was hardly discussed in the country, the economic consequences of leaving the European Union are once again coming into focus. "The UK economy as a whole has been permanently damaged by Brexit," said Michael Saunders, who sat on the BoE's monetary policy committee until the summer, earlier in the week.

"If we hadn't had Brexit, we probably wouldn't be talking about an austerity budget now," he said. Neither tax increases nor spending cuts would have been necessary if Brexit had not reduced economic potential.

BoE Governor Bailey confirmed that Brexit is showing an economic impact, including weak productivity developments in the country. The effect also plays a role in the slow recovery from the pandemic.

"Everything on shares" is the daily stock exchange shot from the WELT business editorial team. Every morning from 5 a.m. with the financial journalists from WELT. For stock market experts and beginners. Subscribe to the podcast on Spotify, Apple Podcast, Amazon Music and Deezer. Or directly via RSS feed.

Torrential rains in Dubai: “The event is so intense that we cannot find analogues in our databases”

Torrential rains in Dubai: “The event is so intense that we cannot find analogues in our databases” Rishi Sunak wants a tobacco-free UK

Rishi Sunak wants a tobacco-free UK In Africa, the number of millionaires will boom over the next ten years

In Africa, the number of millionaires will boom over the next ten years Iran's attack on Israel: these false, misleading images spreading on social networks

Iran's attack on Israel: these false, misleading images spreading on social networks New generation mosquito nets prove much more effective against malaria

New generation mosquito nets prove much more effective against malaria Covid-19: everything you need to know about the new vaccination campaign which is starting

Covid-19: everything you need to know about the new vaccination campaign which is starting The best laptops of the moment boast artificial intelligence

The best laptops of the moment boast artificial intelligence Amazon invests 700 million in robotizing its warehouses in Europe

Amazon invests 700 million in robotizing its warehouses in Europe Switch or signaling breakdown, operating incident or catenaries... Do you speak the language of RATP and SNCF?

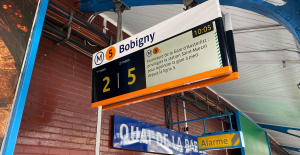

Switch or signaling breakdown, operating incident or catenaries... Do you speak the language of RATP and SNCF? Transport in Île-de-France: operators are pulling out all the stops on passenger information before the Olympics

Transport in Île-de-France: operators are pulling out all the stops on passenger information before the Olympics Radio audiences: France Inter remains firmly in the lead, Europe 1 continues its rise

Radio audiences: France Inter remains firmly in the lead, Europe 1 continues its rise Russian cyberattacks pose a global “threat”, Google warns

Russian cyberattacks pose a global “threat”, Google warns A new Lennon-McCartney duo, more than 50 years after the Beatles split

A new Lennon-McCartney duo, more than 50 years after the Beatles split The Curse vs Immaculée: two thrillers but only one plot

The Curse vs Immaculée: two thrillers but only one plot Mathieu Kassovitz adapts The Beast is Dead!, the comic book about the Second World War and the Occupation by Calvo

Mathieu Kassovitz adapts The Beast is Dead!, the comic book about the Second World War and the Occupation by Calvo Goldorak 'has never lived so much as now'

Goldorak 'has never lived so much as now' Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy During the night of the economy, the right points out the budgetary flaws of the macronie

During the night of the economy, the right points out the budgetary flaws of the macronie Europeans: Glucksmann denounces “Emmanuel Macron’s failure” in the face of Bardella’s success

Europeans: Glucksmann denounces “Emmanuel Macron’s failure” in the face of Bardella’s success These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Champions League: semi-final schedule revealed

Champions League: semi-final schedule revealed Serie A: AS Roma extends Daniele De Rossi

Serie A: AS Roma extends Daniele De Rossi Ligue 1: hard blow for Monaco with Golovin’s premature end to the season

Ligue 1: hard blow for Monaco with Golovin’s premature end to the season Paris 2024 Olympics: two French people deprived of the Olympic Games because of a calculation error by the international federation?

Paris 2024 Olympics: two French people deprived of the Olympic Games because of a calculation error by the international federation?