Significantly fewer new start-ups are emerging in Germany during the current crisis. On the other hand, the technological expertise of the founders is increasing: In the current year, more technology-based start-ups have been launched than in the entire previous year. This is shown by a study by the young Berlin tech investor Morphais.

According to this, 578 new start-ups were added in Germany in the third quarter of this year. That is almost a third less than in the same quarter of the previous year. The number of particularly technology-oriented start-ups in areas such as robots, biotechnology or artificial intelligence, known in scene jargon as deep-tech, rose to 209 in the nine months – two more than in the entire start-up boom year of 2021.

The study does not include all company foundations, but only start-ups. Start-ups are growth-oriented young companies that are usually financed with external venture capital and are therefore designed for a later sale or IPO. Craft businesses, for example, are not included.

Apparently, the crisis is causing start-up investors to choose young business models more carefully. Two areas in particular, which experienced an upswing in the past year, are falling behind in the case of the funds specializing in the first financing rounds. The authors of the study register significantly fewer new eCommerce companies. Because in times of inflation, their prospects decline.

Even more important from an investor's point of view: the stock exchange generally no longer believes that eCommerce models are capable of great growth. The prices of established companies such as Zalando and About You have fallen by two-thirds since the beginning of the year. This shows that online traders are increasingly no longer rated by stockbrokers as innovative growth companies, but as conventional retailers.

This makes new investments in this area less attractive for venture capital funds: After all, investors have to expect only a small return on a possible IPO or sale in a few years. A similar decline in the number of founders can be seen, for example, in food start-ups, which have been popular with investors in recent years with brands such as the YFood drink and Foodspring fitness bars, but have so far rarely fulfilled the high hopes for returns.

In the crisis, the financiers are therefore apparently thinking about technology-driven founders. This is borne out by the figures from the study, which is based on the Startup Detector database. Venture capitalists are investing their money primarily in the health, environment, software and crypto sectors. With the new focus, geographical weightings are also shifting: For the first time, just as many start-ups are emerging in Bavaria, i.e. primarily in the vicinity of the technology location Munich with its strong Technical University, as in Berlin. The capital is more of a location for eCommerce and software founders.

"The fact that the number of start-ups in the deep-tech sector continues to rise is a very positive sign for the industry and for Germany as a location for innovation," said Morphais founder Eva-Valérie Gfrerer. Such business models managed to get out of the start-up phase successfully much more often.

Instead of business models aimed at end customers, more and more founders are relying on services for companies. According to the current annual study by the start-up association, it is now over 71 percent. Software offers that give hope for regular subscription income are particularly popular.

The "Start-up Monitor" from the management consultancy EY had also shown for the first half of the year that the founders were collecting less money. The value of the financing rounds fell by 20 percent. However, the first half of 2022 was still the second strongest half of the year, because in the comparative year 2021 some particularly large rounds of financing had come about - for example for the Gorillas fast delivery service, which has meanwhile become quite ailing.

In any case, money for new founders is still available: Recently, important German early-stage investors such as Project A reported that they had filled new funds. A total of 30 billion euros are still invested in the funds of European venture capitalists. Therefore, what Silicon Valley banker Andrew Parker recently said to WELT still applies: “The start-up scene is not in crisis mode. 2021 was just an extraordinary year. A lot is normalizing now.”

"Everything on shares" is the daily stock exchange shot from the WELT business editorial team. Every morning from 5 a.m. with the financial journalists from WELT. For stock market experts and beginners. Subscribe to the podcast on Spotify, Apple Podcast, Amazon Music and Deezer. Or directly via RSS feed.

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations What is Akila, the mission in which the Charles de Gaulle is participating under NATO command?

What is Akila, the mission in which the Charles de Gaulle is participating under NATO command? Lawyer, banker, teacher: who are the 12 members of the jury in Donald Trump's trial?

Lawyer, banker, teacher: who are the 12 members of the jury in Donald Trump's trial? What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic Orthodox bishop stabbed in Sydney: Elon Musk opposes Australian injunction to remove videos on X

Orthodox bishop stabbed in Sydney: Elon Musk opposes Australian injunction to remove videos on X One in three facial sunscreens does not protect enough, warns L'Ufc-Que Choisir

One in three facial sunscreens does not protect enough, warns L'Ufc-Que Choisir What will become of the 81 employees of Systovi, a French manufacturer of solar panels victim of “Chinese dumping”?

What will become of the 81 employees of Systovi, a French manufacturer of solar panels victim of “Chinese dumping”? “I could lose up to 5,000 euros per month”: influencers are alarmed by a possible ban on TikTok in the United States

“I could lose up to 5,000 euros per month”: influencers are alarmed by a possible ban on TikTok in the United States Dance, Audrey Hepburn’s secret dream

Dance, Audrey Hepburn’s secret dream The series adaptation of One Hundred Years of Solitude promises to be faithful to the novel by Gabriel Garcia Marquez

The series adaptation of One Hundred Years of Solitude promises to be faithful to the novel by Gabriel Garcia Marquez Racism in France: comedian Ahmed Sylla apologizes for “having minimized this problem”

Racism in France: comedian Ahmed Sylla apologizes for “having minimized this problem” Mohammad Rasoulof and Michel Hazanavicius in competition at the Cannes Film Festival

Mohammad Rasoulof and Michel Hazanavicius in competition at the Cannes Film Festival Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

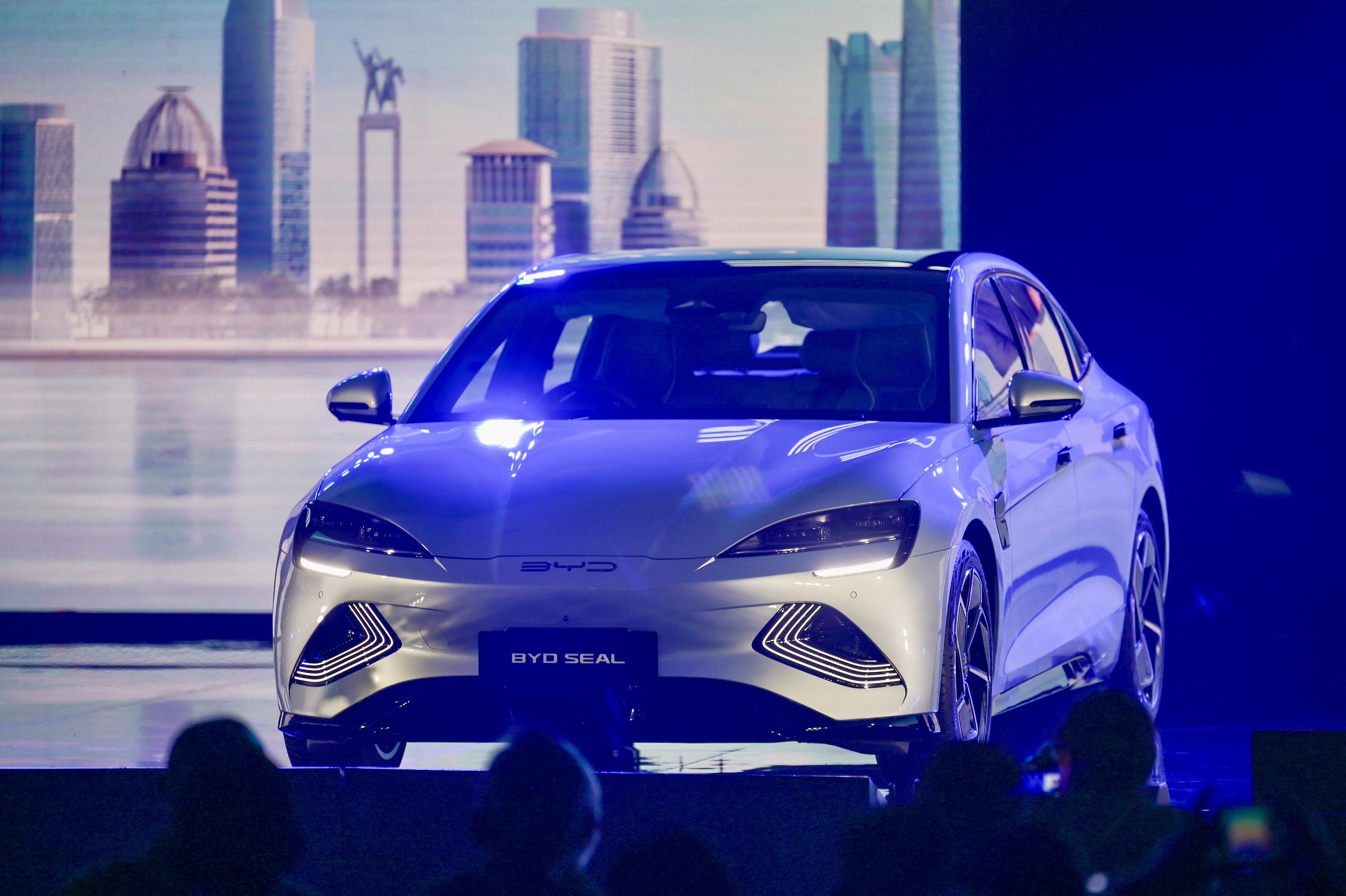

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Serie A: Bologna surprises AS Rome in the race for the C1

Serie A: Bologna surprises AS Rome in the race for the C1 Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues?

Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues? Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby

Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season

Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season