The construction crisis began just over a year ago. When many home builders gave up their plans for their own home due to high interest rates and prices, the number of permits for single and two-family houses fell. Now the construction crisis is hitting the whole breadth.

In January, only 21,000 new apartments were approved nationwide, the Federal Statistical Office reported on Friday. Compared to January 2022, this was a decrease of 26 percent. Last year, building permits fell to their lowest level since 2018. With the further decline, they are now falling to a value that was last seen in February 2015.

There is now a real freeze on construction for single and two-family houses: There were 25.5 percent fewer permits for single-family houses, and for two-family houses the minus is much higher at 48.4 percent.

This suggests that so-called threshold households, which calculate particularly tightly when buying their own home and cannot afford higher monthly installments from interest and principal, are abandoning their building projects. Such threshold households are more likely to opt for a new semi-detached house than for a detached house.

In the past year, the statisticians from Wiesbaden had also often pointed out a special effect: In the previous year, 2021, there had been a particularly large number of building permits for new one- and two-family houses, since there had been a pull-forward effect due to the child support allowance: many households would still have used the state subsidy want, which expired at the end of 2021.

This explanation can no longer be used, since the year-to-year comparison in the statistics falls entirely into a period without child benefit. The special effect has disappeared, and the statistical state of emergency has turned into a permanent construction slump.

Panic is growing in the construction and real estate industries, and economists are warning of a new wave of rental prices if the shortage in larger cities increases. Because there are also some indications: in multi-family houses, in which new rental apartments are typically built, there was a clear double-digit decline for the first time with minus 28.6 percent. By the end of 2022, there had only been a slight decrease in approvals in this category.

The general manager of the Central Association of the German Construction Industry (ZDB), Felix Pakleppa, warned of a "solid housing market crisis". In fact, data from the online portal Immowelt (like WELT belongs to Axel Springer) shows that rents have risen more sharply in recent months: In Bremen, Dresden, Hanover and Munich, for example, the asking rents for an average apartment rose by four percent from November to February .

For a period of three months, that's extraordinary. In Berlin, the jump in price was even 27 percent - although the experts are still puzzling over how such an extreme jump could have happened. In Munich, the rent index rose by 21 percent within two years.

"Housing construction is in a state of shock," says the ZDB. "We are seeing more and more the results of a rigorously slashed subsidy policy for new builds."

The Main Association of the German Construction Industry (HDB) also criticizes the lack of funding - and sees another danger, in addition to rising rents: "In the medium term, housing construction companies are finding themselves in an increasingly difficult situation," says HDB boss Tim Oliver.

"The goal should be to maintain capacity so that we can continue to meet urgent needs in the future." In other words, companies have just started hiring more people and training young people. But now a year-long construction lull turns out to be a mistake. According to HDB, the average order backlog will last until mid-2023.

When presenting the business figures for 2023, the CEO of the Vonovia housing group, Rolf Buch, also dealt with the construction slack. "We need an annual investment volume of 100 billion euros in new residential construction," he said. That is the magnitude that is necessary to cover the need, which has increased dramatically due to the persistently high number of refugees.

Unlike some industry colleagues in the real estate industry, however, Buch was skeptical as to whether higher government subsidies alone would help. "That's not enough," said the Dax board.

"Sensible subsidy programs and depreciation options that match the technical requirements are certainly needed." But there is currently a mix of several problem areas: "high interest rates, high construction costs, a lot of regulation and just insufficient funding".

The federal government has not yet recognized the problem, said Buch, but expressly excluded the building ministry: "In my view, it is to be welcomed that the federal building minister is working on simplifying building regulations and accelerating procedures."

Europe's largest housing group has put all new construction projects on hold for the time being. Only existing projects would still be processed and around 3,700 apartments would be completed this year.

"Everything on shares" is the daily stock exchange shot from the WELT business editorial team. Every morning from 5 a.m. with the financial journalists from WELT. For stock market experts and beginners. Subscribe to the podcast on Spotify, Apple Podcast, Amazon Music and Deezer. Or directly via RSS feed.

Rishi Sunak wants a tobacco-free UK

Rishi Sunak wants a tobacco-free UK In Africa, the number of millionaires will boom over the next ten years

In Africa, the number of millionaires will boom over the next ten years Iran's attack on Israel: these false, misleading images spreading on social networks

Iran's attack on Israel: these false, misleading images spreading on social networks Iran-Israel: David Cameron wants the G7 to impose “coordinated sanctions” on Iran

Iran-Israel: David Cameron wants the G7 to impose “coordinated sanctions” on Iran New generation mosquito nets prove much more effective against malaria

New generation mosquito nets prove much more effective against malaria Covid-19: everything you need to know about the new vaccination campaign which is starting

Covid-19: everything you need to know about the new vaccination campaign which is starting The best laptops of the moment boast artificial intelligence

The best laptops of the moment boast artificial intelligence Amazon invests 700 million in robotizing its warehouses in Europe

Amazon invests 700 million in robotizing its warehouses in Europe Solar panels: French manufacturer Systovi announces the cessation of its activities due to “Chinese dumping”

Solar panels: French manufacturer Systovi announces the cessation of its activities due to “Chinese dumping” Tesla: canceled in court, Musk's huge compensation plan will again be submitted to shareholders

Tesla: canceled in court, Musk's huge compensation plan will again be submitted to shareholders Two, three or a hundred euros: who are the most generous customers with tips?

Two, three or a hundred euros: who are the most generous customers with tips? Boeing safety examined in US Senate, after whistleblower's revelations

Boeing safety examined in US Senate, after whistleblower's revelations Immersion among the companions of the Liberation

Immersion among the companions of the Liberation Provence-Alpes-Côte d’Azur releases several hundred thousand euros for the promotion of the work of Marcel Pagnol

Provence-Alpes-Côte d’Azur releases several hundred thousand euros for the promotion of the work of Marcel Pagnol A palm of honor distinguishes Studios Ghibli for all of their work

A palm of honor distinguishes Studios Ghibli for all of their work Gaby, a new play by Pagnol adapted into a comic strip

Gaby, a new play by Pagnol adapted into a comic strip Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

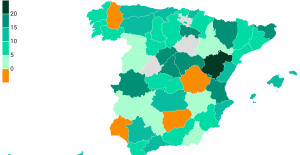

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy During the night of the economy, the right points out the budgetary flaws of the macronie

During the night of the economy, the right points out the budgetary flaws of the macronie Europeans: Glucksmann denounces “Emmanuel Macron’s failure” in the face of Bardella’s success

Europeans: Glucksmann denounces “Emmanuel Macron’s failure” in the face of Bardella’s success These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Union Bordeaux Bègles-Clermont: at what time and on which channel to follow the Top 14 clash?

Union Bordeaux Bègles-Clermont: at what time and on which channel to follow the Top 14 clash? Football: Ada Hegerberg extends at OL until 2027

Football: Ada Hegerberg extends at OL until 2027 Basketball: suspended for life from NBA for fixing his match

Basketball: suspended for life from NBA for fixing his match Paris 2024 Olympic Games: boxer Estelle Mossely wants to parade on the Seine as a flag bearer

Paris 2024 Olympic Games: boxer Estelle Mossely wants to parade on the Seine as a flag bearer