2022 marked the end of a boom decade for equity investors. One of the most influential aspects was how runaway inflation put an end to "central bank stance", ie the idea that monetary policy would always step in to limit equity market losses.

The rise in real interest rates had a clear impact on growth stocks, given their long duration, but also weighed on the performance of European ESG-focused indices. Last year was only the third time in the last 12 years that the MSCI ESG Europe Leaders Index underperformed the broader European equity market.

The widespread view that rates will continue to rise for longer is making potential growth opportunities more scarce for equity investors. With the rate of return to beat now higher for companies, we believe that thoughtful, long-term assessment of the most attractive investment themes at stake will be more important than ever.

We define the lowest carbon intensity group as MSCI Europe companies with a carbon intensity score below the 20th percentile using -direct emissions -scope 1 and scope 2- per million dollars of revenue. Groups are rebalanced annually and carbon intensity scores are normalized by sector to capture best-in-class companies across sectors and avoid excluding companies with the largest share. The methodology is explained in the Appendix.

In the Graph, which covers the period 2011-2022, we can see that the most carbon-efficient companies (first quintile) register an average annual return of 8.1%, while the other baskets do not exceed 7%. Simply put, the most carbon efficient companies have tended to perform better since 2011, although past results are not indicative of future performance.

Relative to the European equity market, European low-carbon companies have outperformed average returns by 60 basis points (3.9% vs. 3.3%) per calendar year since 2011.

And in 2022? As we can see in Chart 2 (dark blue dots), it was the worst year for performance among companies in the top quintile, down 21.1% over 12 months.

Structurally, low-carbon companies tend to display some growth characteristics, as evidenced by three-year forward annual growth projections and the valuation premium to the market. Like growth, the basket of low carbon companies has suffered badly after 2021, when valuation levels and sales growth were considerably above average.

Consequently, a natural question arises: do low carbon companies show any substantial differentiation compared to growth values? Looking at the behavior of the basket against the benchmark MSCI Europe Growth Index, we see that the two strategies tend to diverge depending on the level of real rates.

The low carbon intensity category appears to be discount rate neutral. In fact, the average annual return of the basket does not vary according to the German real rate regime -which we use as a proxy for Europe as a whole-, while it does for the growth sector.

At times when real rates are higher and growth is suffering, the low carbon basket appears to be a potentially good alternative to growth.

Thus, regardless of real rates, the basket's underperformance relative to growth in 2022 is mainly explained by its overweight in the transport sector (-25.6% year-on-year in 2022). On the one hand, the slowdown in world demand has led to a reduction in bottlenecks -a drop in transport rates- and, on the other, the rise in the prices of raw materials has caused an increase in the prices of inputs that have severely penalized margins. It is important to note that these elements seem transitory, as they are the result of exogenous events, first a pandemic (COVID-19) and then geopolitical (war in Ukraine).

More generally, the best companies in terms of carbon emissions are not overly correlated with the ESG index or the broader European equity market. We have seen that they are slightly correlated with growth stocks, but it seems to us that this correlation occurs at the right time: when both are rising. Therefore, the most carbon-efficient companies appear to offer an opportunity for diversification, in our view.

Given that we expect headwinds for global equity markets to persist, would a low carbon strategy be relevant going forward? While the Fed is likely to have peaked in its tightening, while the ECB is probably about 50 basis points away, the market has been quite impatient in pricing in rate cuts, in our opinion. opinion, given the stubbornness of inflation. Consequently, we expect some volatility around interest rates going forward. Since the results of low-carbon companies are not sensitive to the level of interest rates, they should provide good protection for investors.

Second, from an economic growth standpoint, while the path to bringing inflation back into its target range will be bumpy, our economists forecast below-potential growth in Europe and the US next year, with a slight recession for the latter. Since stock markets trade based on forward-looking expectations, they tend to rally before economic growth bottoms out. Growth and cyclical stocks benefit the most in a business cycle recovery environment, so this may be a tailwind for a low-carbon investment strategy.

Finally, at a more abstract but structural level, the environmental challenge is a matter of the first order, and the role of financial agents is increasingly essential in the transition towards a greener economy. Directing capital towards energy efficient companies is vital to the success of this transition and is gaining increasing political and regulatory support.

The results of our analysis appear to support the attractiveness of low carbon, as the group of low carbon companies has averaged a mean alpha of 0.5% since 2011 (Chart 4). We also note that, in addition to being the only group with positive mean alpha across the pool, it has consistently held in positive territory, reflecting a potential quality element in the stock-picking nature of the low-cap strategy. carbon.

*Equity investment strategist of the Macro Research team of AXA IM

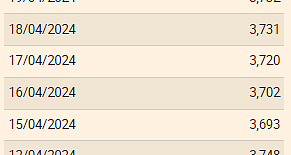

The Euribor today remains at 3.734%

The Euribor today remains at 3.734% Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations What is Akila, the mission in which the Charles de Gaulle is participating under NATO command?

What is Akila, the mission in which the Charles de Gaulle is participating under NATO command? What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic MEPs validate reform of EU budgetary rules

MEPs validate reform of EU budgetary rules “Public Transport Paris 2024”, the application for Olympic Games spectators, is available

“Public Transport Paris 2024”, the application for Olympic Games spectators, is available Spotify goes green in the first quarter and sees its number of paying subscribers increase

Spotify goes green in the first quarter and sees its number of paying subscribers increase Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund

Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer

Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame

Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame Three months before the Olympic Games, festivals and concert halls fear paying the price

Three months before the Olympic Games, festivals and concert halls fear paying the price With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics

With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Serie A: Bologna surprises AS Rome in the race for the C1

Serie A: Bologna surprises AS Rome in the race for the C1 Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues?

Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues? Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby

Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season

Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season