Anyone who is on Instagram, YouTube, Facebook or TikTok often comes across offers that sound tempting: from weight loss powder to lucrative investments. In our series, reporter Judith Henke takes a look at these products. What is behind it, how serious are you?

***

In the end he lost 9,000 euros, says Julian Müller. He has been trading on the stock exchange for several years, investing is a kind of hobby for him, said the student, who actually has a different name. At some point he wanted to try something new, not just stocks and ETFs. Purely by chance, he saw the post on Instagram by a financial influencer named “Dividendagobert”, it was about an artificial intelligence (AI) that is supposed to make currency bets for investors.

Julian Müller became curious - and in May last year he paid a test of 750 euros into the broker that is linked to the AI. "It was going well, so I kept adding to my investment."

Soon he was invested with 9000 euros. For months he brought in high profits, around 4,000 euros. "It was almost unbelievable how well it went." But the lucky streak broke and in December Müller was faced with a total loss. His profits, his initial investment - almost everything was gone.

Many customers who are currently venting their displeasure on the Trustpilot rating platform and on Instagram are like him. Some of them have even formed a kind of self-help group. I am in contact with around 20 victims, their losses add up to more than 35,000 euros. I suspect the number of unreported cases is much higher.

Most clients tell me how they first used trading AI to generate high returns - until they started losing money in November.

From there, they lost more and more money at an increasing rate until the AI pulled the emergency brake and closed the open trades. As a result, those affected suffered a loss of around 90 percent of their stake.

But what went wrong? To find out, I first look at the website of Velvet Autoinvest - the company behind the AI. "Your exclusive provider for automated investment - invest now just like the hedge funds and banks," it says there.

Anyone who relies on Velvet Autoinvest can invest their money just like an institutional investor who, due to their financial strength, has more options than a normal private investor - at least that's the promise.

Interested investors register with one of Velvet's partner brokers, where they deposit their money. Then the portfolio is linked to Velvet Autoinvest, which automatically closes trades for the investor. Velvet keeps 15 percent of the profits as a commission.

The investment decisions, according to the website, "are made by an automated AI algorithm." The investor can choose between three strategies that differ in the risk-reward ratio. The strategy with the highest risk and highest return is called “Velvet Ultra”.

According to the website, their annual performance is said to be a return of 162.18 percent. A tempting, almost unbelievable number. Most clients I spoke to have traded with Velvet Ultra. So I look at the strategy datasheet.

There I find a performance table that shows all monthly returns since January 2020 - however, there is no new data from May 2022. Also, in the fine print I find the following note: "The results displayed on this sheet are a combination of real results and hypothetical trading results."

But how are these hypothetical results calculated - and up to which month in the table are the returns not real? I can't find any information on this.

But maybe I can find out by finding out the founding date of the company behind Velvet Autoinvest. So I look at the imprint:

The seat of Velvet Software Technologies Ltd. is in Cyprus – a shadow financial center known for its lack of transparency and low taxes. A look at the commercial register there shows: The company was registered on February 23, 2021.

That surprises me, because the website also advertises that Velvet was founded in Stuttgart in 2018. What is correct now? I found a note on the “EU Startups” platform: Velvet Autoinvest used to be called Velvet FX and also had a different URL.

When I enter it, I'm redirected to Velvet's current website. But with the help of "Wayback Machine" - a kind of Internet time travel machine that allows me to look at old versions of the website - I look at how the Velvet FX site was structured. There I find a German company in the imprint: The Velvet GbR. But I can't find any further traces of her on the net.

Also a bit strange: the broker Velvet works with is based in Australia. Unlike brokers in the EU, there is no ban on additional payments in Australia. This means that the investor not only trades with the money invested, but in the worst case has to add money.

Because in short-term foreign exchange trading, which is the issue here, the investor usually only deposits collateral that is a fraction of the price. To illustrate, here's an example using stocks instead of currencies. But the principle is the same.

Suppose the price of a share is 100 euros. I bet that the price of the share will rise and deposit 10 euros as security. So my leverage is one in ten. If my bet is successful, everything is fine: I get my return and the ten euros I deposited as security back.

But what if the stock's price falls sharply -- say, 20 percent? For a share whose price is exactly 100 euros, that would be a loss of 20 euros. But my security is 10 euros. If there is now an obligation to make additional payments, that means I owe the broker ten euros.

EU brokers would automatically close such positions in advance, i.e. end all investments. The investor is therefore less in danger of destroying large parts of his savings - after all, he can only lose what he has deposited with the broker as security.

So why did the founders of Velvet Autoinvest choose an Australian broker as a cooperation partner? I send a long questionnaire to the company - and get a detailed answer.

Accordingly, private investors have been able to use Velvet Autoinvest's offer since 2022. The main activity of the start-up is to "trade company capital on various financial markets".

As a “side branch”, they would now also allow retail investors to mimic some of their transactions. "To do this, the signals for our institutional accounts are broken down to a level that allows copying from very small investment amounts," says the company. Before that, the strategies were only available to large investors – Velvet does not say which they were.

So, through 2022, the returns reported on the Velvet Ultra strategy datasheet were probably just hypothetical -- at least that's my conclusion. According to the company, the data sheet is "still being prepared" anyway, and the focus at the moment is on improving trading strategies.

Since Velvet works with quite high leverage, it is unfortunately not possible for investors to follow Velvet signals with a European broker, the company also explains. Hence the broker from Australia, which is a little less strictly regulated - that makes sense to me.

The reason for the company headquarters in Cyprus is somewhat contradictory: Velvet is closer to some well-known forex brokers. In addition, Cyprus has a strong financial scene.

Velvet Autoinvest also emphasizes that the long-term performance is still "market-beating". But does that even make sense? Can a developer really write a trading algorithm that beats the market over the long run?

I asked Dirk Neuhaus, Professor of Information Systems in Financial Services at the University of Finance

AI technologies are able to effectively discover information that humans cannot or only with difficulty grasp and can analyze unstructured data. However, the methods implemented in AI software would not deliver any different results compared to conventional trading systems.

Peter Scholz, Professor of Business Administration at the Baden-Württemberg Cooperative State University in Mosbach, also has strong doubts that AI is already capable of beating the market in the long term. "AIs are incredibly good at recognizing patterns and details."

For example, they could help with medical diagnoses, for example by analyzing X-ray images. "But AIs are not yet that strong when it comes to forecasts," says Scholz.

But that's exactly what trading is all about: forecasting prices correctly. Market events are very unpredictable. "Strategies that an investor has used to generate good returns in the past can suddenly become useless."

So it is not enough to feed the AI with trading strategies and their chances of success from the past. Because if something unforeseeable happens on the market in the future, even the best algorithm will be useless. It is therefore important to also take risk management into account during development - so that the emergency brake is pulled in good time in the event of major losses.

This is exactly what the developers of Velvet Autoinvest forgot, in my opinion. Based on emails that a damaged customer forwarded to me, I can understand relatively exactly what happened.

Velvet Autoinvest sent the first email on November 30th. At this point, some open positions had been in the red for several days - in technical jargon this is called a drawdown.

Velvet explains to the concerned customers that the affected trades were opened using a so-called mean reversion strategy.

Here the algorithm would identify currency pairs with little tendency to trend up or down and easily trade against the current trend. The meaning behind it: In the event of a small price fluctuation contrary to the current trend, profits can be taken in this way.

In this case, however, the tactic backfired. On December 3rd, Velvet sends another mail. The currency pair is currently experiencing unusually high volatility – it is in a downward spiral. The algorithm, which was fed with data from the period from 2007 to 2022, has never experienced this in its entire history.

The next email followed three days later, on December 6th: "Unfortunately, the Emergency Stop Loss of our algorithm was triggered early this morning," it says. This means: All trades were closed - and thus the open losses were also realized.

The result: massive losses. The bottom line for those who have opted for the "Velvet Ultra" strategy is a minus of around 90 percent. After that, the company announced a winter break, also to improve the algorithm.

However, not all customers I spoke to received this email. Those affected are angry and feel betrayed, also because of the great performance data on the website.

Also, some clients find it absurd that during the currency pair's downtrend, the AI kept opening new positions like a grab on a falling knife. Some of them doubt that Velvet Autoinvest is really an AI.

The strategy, which opens up more and sometimes even larger positions in the event of a loss, is too under-complex - as if someone were to double their stake in roulette with every lost bet. Experts call this a martingale strategy.

When asked, Velvet Autoinvest replied that they could not take seriously the allegations that it was a simple trading bot or a simple martingale strategy.

"We do not claim that our system is perfect, but it is much more complex than the systems that are traditionally available to small investors," emphasizes the company. The heavy losses at the end of the year are a hard blow and they are now working hard to improve their risk management.

However, Velvet also emphasizes that many investors have still been positive on average since the beginning of 2022. In addition, they could have logged into their broker account at any time and closed unwanted positions.

That's true - but what about the customers who didn't receive an email? That, Velvet writes to me, is much to her regret. These customers would have provided incorrect or duplicate email addresses, or opted out of email communications in advance.

But not every customer wants to accept this justification: Julian Müller - the investor who lost 9,000 euros through Velvet - emphasizes that he did nothing of the sort.

Velvet Autoinvest also argues that they have repeatedly pointed out the high risks associated with Forex trading and its strategies. In fact, I find a risk warning.

It states: “CFD and Forex trading may involve increased risk due to their leverage. When using these instruments, you have to consciously accept high risks and strong fluctuations in returns, prices, currencies and accounts.”

But if trading with Velvet Autoinvest is so risky, why have so many investors got involved in it? Very simple: Because many financial influencers have promoted it.

Most often, the damaged customers name the influencer Dividend Dagobert as a source, but the accounts Finanzenverständig, Investingenieur and Aktien4Future also advertised Velvet. Without them, many of the aggrieved customers might have refrained from investing their money.

But while the customers risked their own money, the capital that many of the influencers invested on a test basis was made available by the company: "If you were to participate in the cooperation, you would first of all get €750 available with which to open your personal account top up at Velvet AutoInvest. The money and any winnings Velvet makes for you are of course yours. In addition, you will also receive additional remuneration for the cooperation,” says an email that the financial influencer Techaktien forwarded to me, who himself decided not to advertise Velvet Autoinvest out of skepticism.

Why didn't the other influencers prick up their ears? Dividend dagobert answers my questions. He was made aware of Velvet by followers. "After a few requests I decided to test it."

He invested his own money, towards the end it was over 6,000 euros. “Of course there was an advertising bonus for one or the other if he came across Velvet through me. But I didn't push that," emphasizes the financial influencer. In addition, he repeatedly pointed out the immense risks associated with forex trading and recommended that his followers not invest large sums of money at once.

Financial understanding also answers my questions. "If I had known beforehand that many of Velvet's clients would lose money, I definitely would not have promoted the company," he writes. He has not heard of any subscribers who have registered with Velvet through their advertising links. In addition, he used his own capital and only received a payment of 1,100 euros afterwards.

Investingenieur, who also promoted Velvet, explains that he has emphasized to his followers that he sees Velvet as a possible addition to the risky part of a portfolio, which accounts for a maximum of five percent of the total for him. Now he wants to concentrate on his main focus on equities, dividends and ETFs. "What the process means for my role in cooperations, I will critically assess for myself."

Aktien4Future also intends to prioritize the approach of long-term investing in future cooperations. Even while he was testing the AI, he asked his followers to form their own opinion.

But what's next for Velvet Autoinvest? Time to take the offer off the market – especially since the Handelsblatt reported negatively about the company? Far from it: On Tuesday, Velvet sent another email to its customers. Trading would continue from January 6th. The risk management has been revised.

It doesn't matter whether it's lucrative investments, dental splints or coaching offers: anyone who uses social media is overwhelmed with product recommendations. What's behind it? How serious are you? You can find out in our podcast "Die Netz-Checkerin". Subscribe to Spotify, Apple Podcasts, Deezer, Amazon Music or directly via RSS feed.

His body naturally produces alcohol, he is acquitted after a drunk driving conviction

His body naturally produces alcohol, he is acquitted after a drunk driving conviction Who is David Pecker, the first key witness in Donald Trump's trial?

Who is David Pecker, the first key witness in Donald Trump's trial? What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain?

What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain? The shadow of Chinese espionage hangs over Westminster

The shadow of Chinese espionage hangs over Westminster Colorectal cancer: what to watch out for in those under 50

Colorectal cancer: what to watch out for in those under 50 H5N1 virus: traces detected in pasteurized milk in the United States

H5N1 virus: traces detected in pasteurized milk in the United States What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France The right deplores a “dismal agreement” on the end of careers at the SNCF

The right deplores a “dismal agreement” on the end of careers at the SNCF The United States pushes TikTok towards the exit

The United States pushes TikTok towards the exit Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille

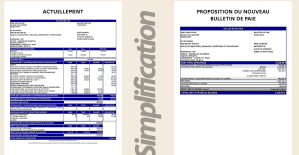

Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille This is what your pay slip could look like tomorrow according to Bruno Le Maire

This is what your pay slip could look like tomorrow according to Bruno Le Maire Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week

Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival

The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival Strasbourg inaugurates a year of celebrations and debates as World Book Capital

Strasbourg inaugurates a year of celebrations and debates as World Book Capital Kendji Girac is “out of the woods” after his gunshot wound to the chest

Kendji Girac is “out of the woods” after his gunshot wound to the chest Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated

NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated Real Madrid: what position will Mbappé play? The answer is known

Real Madrid: what position will Mbappé play? The answer is known Cycling: Quintana will appear at the Giro

Cycling: Quintana will appear at the Giro Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card

Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card