The "Inflation Reduction Act" (IRA) is currently keeping Europe's governments in suspense. The IRA is a large-scale program by the Americans that is intended to contribute to climate protection (the inflation in the title is just marketing, much of the content should have been approved in a program in December 2021).

Greenhouse gases should be reduced. Renewable energies in particular are to be promoted, including the production of wind turbines. This is to be done through measures such as tax credits and subsidies. $369 billion is earmarked for this by 2031.

The US economy is to be protected primarily. But the United States is an open economy. They trade with many countries around the world, including Germany. The IRA will therefore also affect US trading partners.

It is feared that this will put imports from Europe at a disadvantage and that European companies could migrate to the United States. A key question, therefore, is how European governments should govern the IRA.

With equally large subsidy programs? Here restraint is appropriate. First, it is doubtful that the IRA will turn the United States into a paradise for investment. Secondly, one would have to find out in Europe when and how subsidies are justified.

The IRA also entails tax increases that make the USA less attractive as an investment location. A tax on share buybacks will be introduced and more resources will be allocated to combat tax avoidance and tax evasion.

Probably the most significant tax increase is the introduction of a minimum tax of 15 percent for large companies. Not only American companies are affected. Rather, the tax increase also affects global companies with subsidiaries in the United States.

How many global companies (also from Germany) will be affected by the tax increase cannot yet be precisely quantified. Subsidies can be justified if they internalize so-called external effects.

If less of a good is produced on the market than would be efficient, then it makes sense from the point of view of welfare theory for the state to intervene in the market with a subsidy and thus ensure that more of the good is produced.

Within the framework of the IRA, such external effects arise mainly through the promotion of environmentally friendly energies, for example through research and development or new production plants with cutting-edge technologies. However, governments must succeed in promoting industries with subsidies in which their country actually has comparative advantages.

If the United States can produce wind turbines more efficiently than other countries, for example, their subsidy strategy would work. However, if money is simply pumped into an industry where companies in other countries could produce or develop more efficiently without these subsidies, then the companies will only stay as long as the subsidies exist.

In the production of wind turbines, it is particularly questionable whether the United States has a comparative advantage. If governments in Europe now want to subsidize industries themselves, they should be able to promote industries that can produce more efficiently here than elsewhere.

There is also a risk that governments will bolster each other in such a way that there will be a bidding competition for subsidies.

The practical implementation of subsidies in Europe would not be easy either. First of all, the state aid law would have to be relaxed. However, the national requirements for being able to provide subsidies are different in the countries of Europe.

Germany, for example, would have more options than other countries due to its somewhat more favorable public budget situation. That is why there are often calls for an EU funding pot to be created from which subsidies in financially weaker countries should be financed. There is talk of financing this pot through new debt.

The EU could take on new debts, which the member states could secure with guarantees according to their share of the EU gross national income. But that's not a good idea. Rather, it is important to consider using funds from the existing Next Generation EU (NGEU) fund – the borrowing of which was described as unique at the time. The countries in need are already getting the funds from the NGEU.

Niklas Potrafke is Professor of Economics at the LMU Munich and heads the ifo Center for Public Finance and Political Economy.

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations What is Akila, the mission in which the Charles de Gaulle is participating under NATO command?

What is Akila, the mission in which the Charles de Gaulle is participating under NATO command? Lawyer, banker, teacher: who are the 12 members of the jury in Donald Trump's trial?

Lawyer, banker, teacher: who are the 12 members of the jury in Donald Trump's trial? After 13 years of mission and seven successive leaders, the UN at an impasse in Libya

After 13 years of mission and seven successive leaders, the UN at an impasse in Libya What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic Orthodox bishop stabbed in Sydney: Elon Musk opposes Australian injunction to remove videos on X

Orthodox bishop stabbed in Sydney: Elon Musk opposes Australian injunction to remove videos on X One in three facial sunscreens does not protect enough, warns L'Ufc-Que Choisir

One in three facial sunscreens does not protect enough, warns L'Ufc-Que Choisir What will become of the 81 employees of Systovi, a French manufacturer of solar panels victim of “Chinese dumping”?

What will become of the 81 employees of Systovi, a French manufacturer of solar panels victim of “Chinese dumping”? “I could lose up to 5,000 euros per month”: influencers are alarmed by a possible ban on TikTok in the United States

“I could lose up to 5,000 euros per month”: influencers are alarmed by a possible ban on TikTok in the United States Dance, Audrey Hepburn’s secret dream

Dance, Audrey Hepburn’s secret dream The series adaptation of One Hundred Years of Solitude promises to be faithful to the novel by Gabriel Garcia Marquez

The series adaptation of One Hundred Years of Solitude promises to be faithful to the novel by Gabriel Garcia Marquez Racism in France: comedian Ahmed Sylla apologizes for “having minimized this problem”

Racism in France: comedian Ahmed Sylla apologizes for “having minimized this problem” Mohammad Rasoulof and Michel Hazanavicius in competition at the Cannes Film Festival

Mohammad Rasoulof and Michel Hazanavicius in competition at the Cannes Film Festival Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

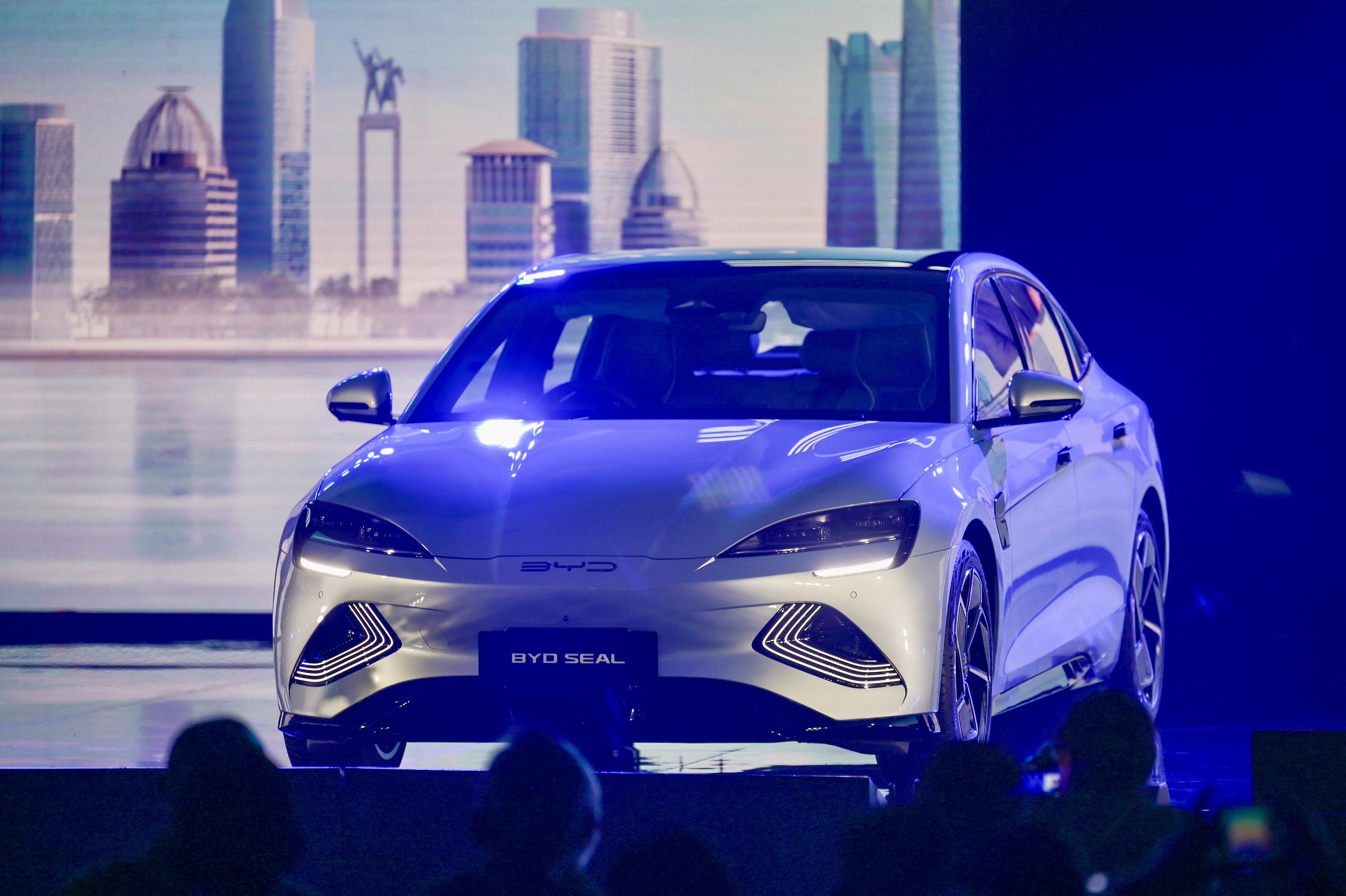

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Basketball (F): big winner of Asvel, Basket Landes will face Tarbes in the semi-final of the League

Basketball (F): big winner of Asvel, Basket Landes will face Tarbes in the semi-final of the League Football: Yazici (Lille) “in shock” after an attempted theft at his home

Football: Yazici (Lille) “in shock” after an attempted theft at his home Serie A: victorious over AC Milan, Inter crowned Italian champions for the 20th time

Serie A: victorious over AC Milan, Inter crowned Italian champions for the 20th time Serie A: “Winning a title in a derby has never happened,” relishes Martinez after Inter’s coronation

Serie A: “Winning a title in a derby has never happened,” relishes Martinez after Inter’s coronation