The Bank of England (BoE) is intervening in bond markets as part of a contingency plan to contain the crisis in the domestic government bond market. The monetary authorities warned of a "significant risk to the financial stability of Great Britain" in view of a fundamental revaluation on the financial market. Among other things, there is a risk of an “unjustified tightening of financing conditions and reduced access to credit for the real economy”.

To counteract this, central bankers announced on Wednesday that they would be buying long-dated government bonds. The program begins immediately and will run through October 14th. Purchases are made to whatever extent is necessary to achieve the stabilization goal. A program of bond sales should actually start next week as part of the so-called quantitative tightening.

The turbulence in the British bond market began last Friday with an announcement by the new government. In addition to extensive relief for households and companies through a guaranteed upper limit on energy costs, Finance Minister Kwasi Kwarteng has announced significant tax breaks.

He expects this to give him a growth spurt. The measure was not well received by the markets, especially since the package is to be financed exclusively from government debt and no analysis of the impact was presented. An additional bond issue worth £70 billion is planned for the current year alone. In addition, inflation would be fueled further.

"The Bank of England is stepping down from the sidelines with direct bond market intervention," commented Mohamed El-Erian, President of Queens' College Cambridge and advisor to Allianz. The announced step makes it clear what dilemma the central bank is facing. Actually, it has interest rate hikes and a winding-up of previous bond purchases on the program to get inflation under control. Instead, she feels compelled to act with an easing instrument.

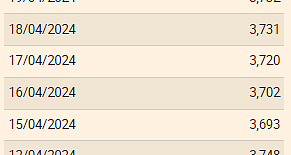

Yields on long-dated government bonds, known as gilts, have been rising for days as part of the turmoil. Bonds with ten-year maturities rose by around 1.5 percentage points in September and were now at 4.5 percent. They hadn't recorded such a significant leap in 50 years. Longer-dated gilts are now outperforming their equivalents in Italy and Greece, meaning the UK government is more expensive to finance than southern Europeans.

The BoE's measure quickly had an effect. 30-year Treasury yields fell from 5.1 percent to 4.3 percent within minutes of the announcement. This relaxation is important for pension funds and insurance companies, among others, which traditionally invest a large part of their assets in the bond market. According to reports in the British media, several providers have come under pressure. Because of the turmoil, they were forced to liquidate investments in order to make up the margin calls, their interest rate hedging strategy.

The day before, the International Monetary Fund (IMF) had criticized the British government's growth strategy. The multilateral organization said she was monitoring the situation closely and was in contact with the responsible authorities. "Given the high inflationary pressures in many countries, including the UK, we advise against large untargeted fiscal packages at this time," said the fund, which is considered lender of last resort. It is important that fiscal policy does not conflict with monetary policy. The IMF also criticized the fact that it was mainly the wealthy who would benefit from the tax cuts and that the step would likely further exacerbate inequality in the country.

US Treasury Secretary Janet Yellen also stressed that she was keeping a close eye on developments. It still looks like the problems are limited to Great Britain. The rating agency Moody's sees the danger that Kwarteng's measures will achieve the opposite of their goal. The significant fiscal stimulus, which is financed by debt, would inevitably lead to a tightening of monetary policy, which would depress the growth forecast in the medium term. The country's rating does not affect the agency's warning.

A significant problem in the country is that the volume of bonds the government intends to use to fund its measures "is far too much for demand," said Ray Dalio, founder of wealth manager Bridgewater Associates. As a result, investors would say goodbye to bonds and currency. “The UK government is acting like an emerging market government that is producing too much debt in a currency for which there is not much global demand.”

Whether the central bank's intervention will be enough to restore financial actors' confidence in the British government is questionable, says Susannah Streeter, an analyst at Hargreaves Lansdown. "The move the bank has taken, two days after it announced it would wait until November, smacks of panic." There is also frustration that the government is sticking to its position and unwilling to reverse course . "Instead, the Bank of England was forced into a policy U-turn."

"Everything on shares" is the daily stock exchange shot from the WELT business editorial team. Every morning from 7 a.m. with our financial journalists. For stock market experts and beginners. Subscribe to the podcast on Spotify, Apple Podcast, Amazon Music and Deezer. Or directly via RSS feed.

The Euribor today remains at 3.734%

The Euribor today remains at 3.734% Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations What is Akila, the mission in which the Charles de Gaulle is participating under NATO command?

What is Akila, the mission in which the Charles de Gaulle is participating under NATO command? What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic MEPs validate reform of EU budgetary rules

MEPs validate reform of EU budgetary rules “Public Transport Paris 2024”, the application for Olympic Games spectators, is available

“Public Transport Paris 2024”, the application for Olympic Games spectators, is available Spotify goes green in the first quarter and sees its number of paying subscribers increase

Spotify goes green in the first quarter and sees its number of paying subscribers increase Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund

Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer

Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame

Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame Three months before the Olympic Games, festivals and concert halls fear paying the price

Three months before the Olympic Games, festivals and concert halls fear paying the price With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics

With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Serie A: Bologna surprises AS Rome in the race for the C1

Serie A: Bologna surprises AS Rome in the race for the C1 Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues?

Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues? Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby

Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season

Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season