In view of a price slump and great uncertainty about Crédit Suisse, the Swiss National Bank (SNB) wants to make liquidity available to the financial institution if necessary. The central bank announced this on Wednesday evening together with the Swiss financial market supervisory authority Finma. There is currently no evidence of a direct risk of contagion for Swiss institutions due to the problems of US banks, it said.

Credit Suisse, which is struggling with a deep crisis of confidence, says it only makes use of the option described hours after the commitment. As the news agencies Reuters and AFP report, the money house wants to raise up to 50 billion Swiss francs (equivalent to 54 billion dollars) from the Swiss National Bank. With the move, Credit Suisse is the first global systemically important bank since the financial crisis to receive a customized lifeline.

The bank also asked to reassure bank customers. It is a "very well capitalized bank," emphasized the head of Crédit Suisse Switzerland, André Helfenstein, in an interview with the Swiss broadcaster "Blick TV". Of course, one is not satisfied with the share price, said Helfenstein. However, this has nothing to do with the security of customer deposits. The price slump is due to the fact that the bank stocks are under pressure because of the problems of US regional banks.

The collapse of several regional US banks recently triggered uncertainty in the banking sector. This was particularly evident on Wednesday at Crédit Suisse, which was already ailing. The bank's shares fell in Zurich by more than 30 percent at times to a record low of 1.56 francs (1.59 euros) and closed at the end of trading with a decline of more than 24 percent.

In an interview with Bloomberg TV, the chairman of the Saudi National Bank, Ammar Abdul Wahed Al Khudairy, categorically ruled out additional support on request. The bank is a major shareholder in Crédit Suisse, which last year reported a loss of 7.3 billion Swiss francs and massive withdrawals from client assets of 123 billion.

The Swiss business of Crédit Suisse, which he manages, is well positioned and working well, said Helfenstein. The bank now wants to be close to the customers and also consistently continue the restructuring of the bank. Crédit Suisse is one of the 30 banks in the world that are classified as “too big to fail” because their failure would have a devastating impact on the global economy. In two years, the house will be a different bank than it is today, it will be more stable and concentrate on Switzerland and the wealth management business, said Helfenstein. However, because of the restructuring and the “challenging financial year 2022”, the big bank is in sight with a loss in the billions, said Helfenstein. "It's more restless around us."

The uncertainty also pushed other bank stocks into the red on Wednesday. The industry index Stoxx Europe 600 Banks fell by 6.9 percent. In Germany, Commerzbank shares slipped by 8.7 percent, Deutsche Bank papers lost 9.3 percent at the end of the Dax.

With regard to the uncertainty in the banking sector, Federal Finance Minister Christian Lindner emphasized the stability of the German credit system. "The federal government is in constant and intensive exchange with everyone involved," said the FDP chairman on Wednesday evening on the ARD program "Maischberger". “With the Bafin, we have an efficient financial supervisory authority, and we have the Bundesbank, which also has a tradition of stability policy. We can therefore say very clearly: the German credit system – private banks, savings banks, cooperative institutes – is stable. And we will continue to ensure that.”

France's Prime Minister Élisabeth Borne sees Switzerland's turn in the case of Crédit Suisse. “This issue falls within the remit of the Swiss authorities. They have to regulate it," said Borne on Wednesday in the Senate in Paris - even before the SNB promised help if necessary. The problems at Crédit Suisse have been known for a long time, the bank does not belong to the euro zone and is therefore not subject to European banking supervision.

France's Finance Minister Bruno Le Maire will contact his Swiss counterpart in the next few hours, said Borne. French banks such as Société Générale, BNP Paribas and Crédit Agricole are also affected by the downward trend in the banking sector.

As Finance Minister Le Maire said the day before, the French banks are not exposed to any risk from the collapse of the Silicon Valley Bank in the USA, said Borne. "As you can see, we are very cautious, but the situation is very different from what we experienced in 2008, since then numerous precautionary measures have been taken for all banks in the euro zone."

Sydney: Assyrian bishop stabbed, conservative TikToker outspoken on Islam

Sydney: Assyrian bishop stabbed, conservative TikToker outspoken on Islam Torrential rains in Dubai: “The event is so intense that we cannot find analogues in our databases”

Torrential rains in Dubai: “The event is so intense that we cannot find analogues in our databases” Rishi Sunak wants a tobacco-free UK

Rishi Sunak wants a tobacco-free UK In Africa, the number of millionaires will boom over the next ten years

In Africa, the number of millionaires will boom over the next ten years WHO concerned about spread of H5N1 avian flu to new species, including humans

WHO concerned about spread of H5N1 avian flu to new species, including humans New generation mosquito nets prove much more effective against malaria

New generation mosquito nets prove much more effective against malaria Covid-19: everything you need to know about the new vaccination campaign which is starting

Covid-19: everything you need to know about the new vaccination campaign which is starting The best laptops of the moment boast artificial intelligence

The best laptops of the moment boast artificial intelligence Bitcoin halving: what will the planned reduction in emissions from the queen of cryptos change?

Bitcoin halving: what will the planned reduction in emissions from the queen of cryptos change? The Flink home shopping delivery platform will be liquidated in France

The Flink home shopping delivery platform will be liquidated in France Bercy threatens to veto the sale of Biogaran (Servier) to an Indian industrialist

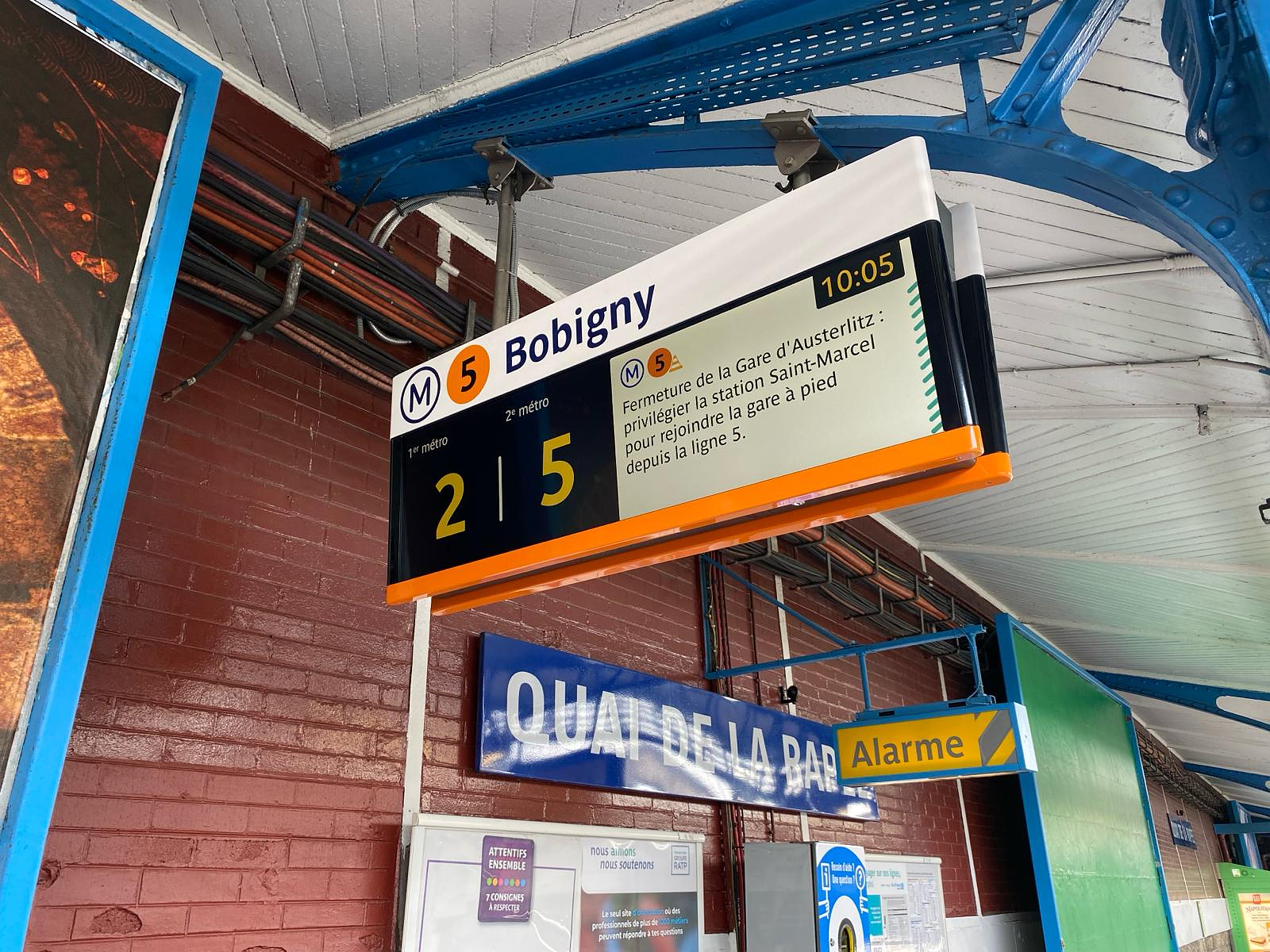

Bercy threatens to veto the sale of Biogaran (Servier) to an Indian industrialist Switch or signaling breakdown, operating incident or catenaries... Do you speak the language of RATP and SNCF?

Switch or signaling breakdown, operating incident or catenaries... Do you speak the language of RATP and SNCF? Who’s Who launches the first edition of its literary prize

Who’s Who launches the first edition of its literary prize Sylvain Amic appointed to the Musée d’Orsay to replace Christophe Leribault

Sylvain Amic appointed to the Musée d’Orsay to replace Christophe Leribault Jeremy Allen White to play Bruce Springsteen for biopic

Jeremy Allen White to play Bruce Springsteen for biopic In Los Angeles, Taylor Swift hides clues about her new album in a library on the street

In Los Angeles, Taylor Swift hides clues about her new album in a library on the street Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

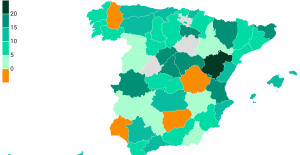

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy During the night of the economy, the right points out the budgetary flaws of the macronie

During the night of the economy, the right points out the budgetary flaws of the macronie These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Tour of the Alps: Simon Carr takes on the 4th stage of the Tour of the Alps, marked by a big scare

Tour of the Alps: Simon Carr takes on the 4th stage of the Tour of the Alps, marked by a big scare Cycling: in video, Chris Harper's big scare on the 4th stage of the Tour des Alpes

Cycling: in video, Chris Harper's big scare on the 4th stage of the Tour des Alpes Football: Mathieu Coutadeur will retire at the end of the season

Football: Mathieu Coutadeur will retire at the end of the season Athletics: young Tebogo says African sprinters will dominate the season

Athletics: young Tebogo says African sprinters will dominate the season