The return to the Dax is perfect: Commerzbank is returning to the first German stock exchange league after almost exactly four and a half years. From February 27th, the money house will again be one of the 40 members of the German stock index. The index provider Stoxx, a subsidiary of Deutsche Börse, announced the decision expected by experts on Friday evening after Wall Street closed in Zug.

The early return of the Dax founding member was made possible by the withdrawal of the Linde industrial group from the Frankfurt Stock Exchange. The currently most valuable Dax group no longer meets one of the criteria and is removed from the Dax price list.

Commerzbank lost its place in the Dax in autumn 2018 due to its sharply reduced stock market value and has been listed in the MDax of medium-sized stocks since September 24, 2018. The then Commerzbank boss Martin Zielke had calmly commented on the descent of the Dax-Dinos - of all things in the year of the 30th anniversary of the leading German index: "In terms of the importance of the bank for the German economy, nothing will change at all."

However, the truth also includes: Belonging to the Dax is definitely a question of prestige. A place in the showcase of the German economy guarantees attention and attracts international investors. In addition, index funds (exchange traded funds/ETFs) that replicate the composition of the leading index have to be rebalanced depending on the Dax list, which usually has an impact on the share prices of certain titles.

The acting Commerzbank boss Manfred Knof made no secret of the fact that the return to the Dax would be good news for his company when the balance sheet was presented on Thursday: This would be "first and foremost an important signal to our customers," said the manager. He expects that being part of the Dax will “reinforce” Commerzbank’s position in corporate customer business.

It is no coincidence that the current Commerzbank management banged its own drum before the stock exchange's current decision: at the end of January, a good two weeks before the balance sheet was presented, the partially nationalized money house announced that it was ready to return to the Dax. In 2022, the bank made a profit of almost 3.4 billion euros before interest, taxes, depreciation and amortization (Ebitda). This means that the requirement introduced by the stock exchange in the meantime, that Dax members must have been profitable at least on the basis of the Ebitda in the previous two financial years, is fulfilled. The bottom line is that Commerzbank made the highest profit since 2007 last year with a good 1.4 billion euros.

For the money house, the return to the Dax is also a confirmation of the restructuring of the group: CEO Knof, who took office at the beginning of 2021, had tightened the austerity course. The bank cut thousands of jobs and significantly reduced its comparatively dense branch network in Germany with around 1,000 locations before the corona pandemic.

The joke of the story: In autumn 2018, the payment service provider Wirecard took the place of Commerzbank among the then 30 companies in the first German stock exchange league. For the once highly acclaimed company, it was over in the summer of 2020: After a balance sheet scandal involving air bookings worth billions, Wirecard collapsed, and a trial is currently underway in Munich on suspicion of commercial gang fraud. Among others in the dock: the former Wirecard boss Markus Braun.

Ultimately, however, the Wirecard scandal did have one good thing: The Dax was not only expanded from 30 to 40 companies, but also received new rules - including those that only profitable companies were included in the first German stock exchange league.

"Everything on shares" is the daily stock exchange shot from the WELT business editorial team. Every morning from 7 a.m. with our financial journalists. For stock market experts and beginners. Subscribe to the podcast on Spotify, Apple Podcast, Amazon Music and Deezer. Or directly via RSS feed.

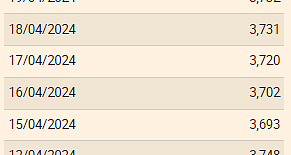

The Euribor today remains at 3.734%

The Euribor today remains at 3.734% Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations What is Akila, the mission in which the Charles de Gaulle is participating under NATO command?

What is Akila, the mission in which the Charles de Gaulle is participating under NATO command? What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic MEPs validate reform of EU budgetary rules

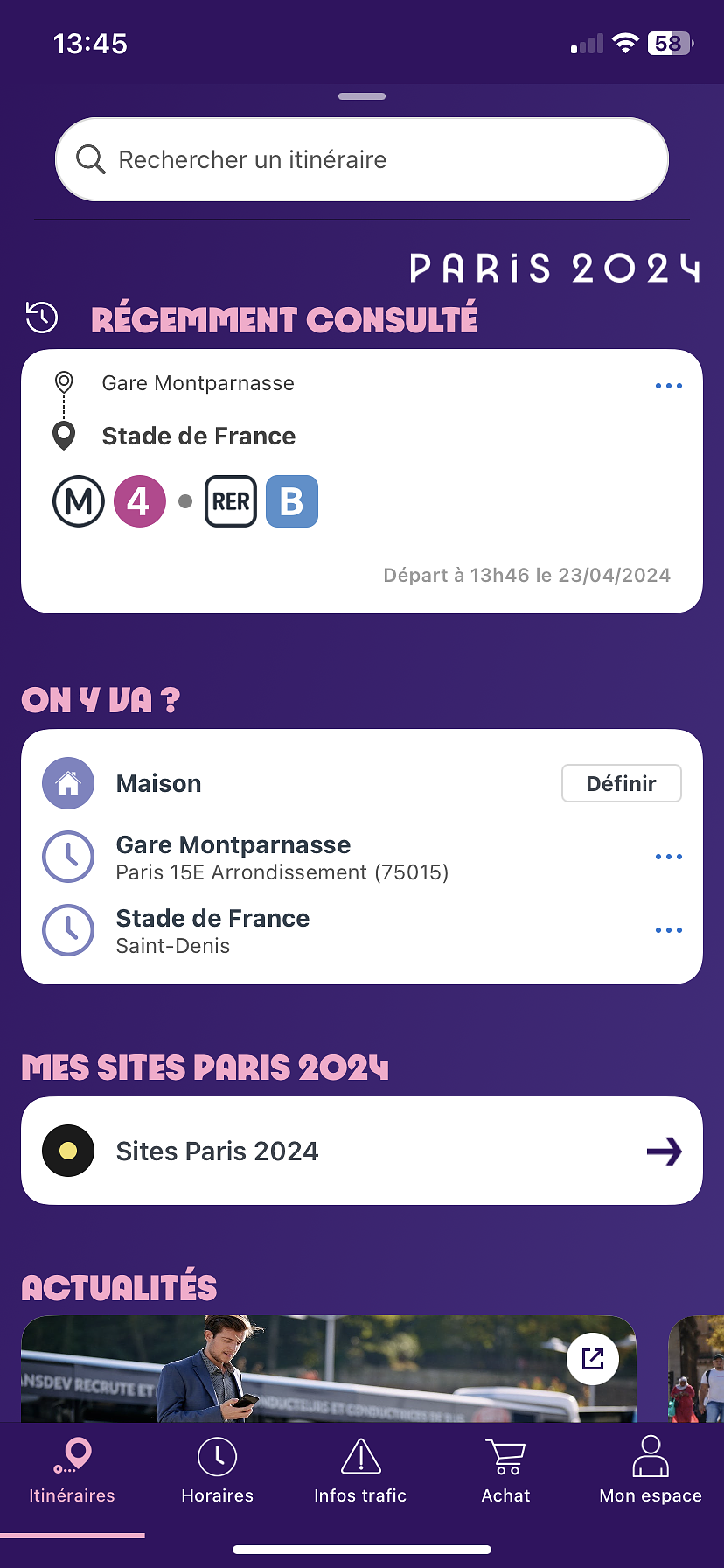

MEPs validate reform of EU budgetary rules “Public Transport Paris 2024”, the application for Olympic Games spectators, is available

“Public Transport Paris 2024”, the application for Olympic Games spectators, is available Spotify goes green in the first quarter and sees its number of paying subscribers increase

Spotify goes green in the first quarter and sees its number of paying subscribers increase Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund

Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer

Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame

Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame Three months before the Olympic Games, festivals and concert halls fear paying the price

Three months before the Olympic Games, festivals and concert halls fear paying the price With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics

With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Serie A: Bologna surprises AS Rome in the race for the C1

Serie A: Bologna surprises AS Rome in the race for the C1 Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues?

Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues? Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby

Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season

Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season