The voting citizens have rejected two years ago, the tax reform, USR III. Why should the people now on 19. May say Yes?

This Time, it seems to me difficult to find good reasons for a 'no'. The template solves at once two problems that need to be fixed after the rejection of the CTR III and the retirement 2020 urgently. It eliminates the special tax status for multinational enterprises, and it is an important step towards the financial stabilisation of the AHV .

But there Was still leads to considerable Tax losses.

In the USR III, the tax losses amounted to 2.5 billion Swiss francs, and now there are an estimated two billion. In addition, the template includes a social balance in favor of the AHV of two billion. Just those circles that have taken the Referendum, demanded always, the abolition of tax privileges for special status companies. Now a much more balanced template. It comes again to a no, the next template is not better.

The people can not decide freely, because the Parliament has linked the control unit with the AHV.

the goal was a template that is in the balance. The Federal Council suggested that with a modest increase in the family allowances other compensation that would have gone much less far than Parliament adopted two billion. We are now fully behind the Parliament solution.

you seem excited. You are the real father of this AHV-compromise?

no, not at all. But all know that the social security needs money and reform. In the course of the discussions in the Parliament over the control template, I was informed that it is a new idea had surfaced. It is a good solution, which brings an important step forward in two key areas, the OASI and corporate taxation,.

SP and trade unions will rejoice, with the help of additional financing for the OASI, the increase in the retirement age for women to 65 years is off the table. Agree?

two billion, cover only about half of the AHV financing shortfall by 2030. The Situation still remains uncomfortable. In 2017, the whole scheme took a billion less than they spent. The deficit will increase every year. The AHV Reform, the Federal Council will submit in August to Parliament. He has already said clearly in the consultation process are presented in detail, the increase in women's retirement age is part of the Reform.

Civil accuse you of the AHV Reform until after the 19. To delay may, so that the SP can claim in the voting campaign, the women's retirement age of 65 was off the table.

This is completely wrong. Everything is on the table. Whether we adopt the AHV Reform before or after the summer holidays, playing for the parliamentary consultation, no role. But I want to give my colleagues in the Federal Council the possibility, deepened to deal with it.

And the message of the Federal Council will be: The retirement age of 65 for women?

Yes, the Federal Council in its submission no Alternative to a retirement age of 65 for women.

A part of the social compensation for the reduction in corporate taxes, the employees pay with higher Wage premiums. Isn't this unfair?

It is a good business. 800 million francs will come from the Federal budget. 1.2 billion to Finance the employer and the employee each pay half. The workers pay 600 million in the year, but get two billion for the AHV.

For the young it is not a good business. You don't have to pay for a lifetime, but you know what you get once of the AHV.

on The contrary, is Scandalous from the point of view of youth, it would be to do nothing and to leave to the next Generation of the hole in the AHV. The long-term security of the AHV for the benefit of the young Generation.

the additional financing for the AHV is also located, so you will need to increase in the next Reform, the VAT is less strong?

Yes, because the facts are stubborn: We know exactly how many people will go in 10, 20 and 30 years in retirement. A big Reform is not easy and a reduction in the AHV- pensions not a majority. We can raise the retirement age a bit. Due to the demographic development, additional costs of around 1.5 to be incurred value added tax which is a percentage. Some people operate a bird-Strauss-politics, and don't want to hear. But it's the reality. If we now get 2 billion for the OASI, must be increased in the next Reform, the VAT rate is only 0.7 percentage points.

Back to the tax part. How can you defend a Reform, in which companies in high tax brackets come from?

What is the Alternative? We need this Reform, because a great injustice prevails. The companies with special status to be taxed low, the SMEs, however, with the normal set. Our partners in Europe, to find the unjust. No one in our country said today, we should retain the special status, and it was always clear that the abolition will cost something. As a result, companies will have to with a special status and more taxes to pay, while other companies, particularly SMEs, will benefit from a tax reduction. This is good for innovation, investment and jobs in Switzerland and thus also for the AHV.

it is again a no, the next template is not better. the Alain Berset , Federal councillor

you say, the tax template can bring more justice. But she brings enough of it?

to reject A significant step, because you want to make an even larger, it can mean that at the end nothing is achieved.

Switzerland remains one of the most tax-favorable countries in the world for multi national. It promotes tax dumping to the detriment of developing countries?

It has to do not only with taxation, that firms settle with us. Switzerland offers attractive conditions: such as a well-educated workforce, a functioning social partnership, political stability, an innovation-promoting collaboration between universities and business, as well as a good infrastructure. These factors are a lot of weights higher than the tax issue.

The control template does not prevent the differences in financial power between the rich and the poor cantons will continue to increase. It meets the concern?

This is a constant issue, it comes to the cohesion of Switzerland. The financial compensation is very important. With this vote, the template we are going to create after all, clearer rules of the game. The minimum rate of taxation of Dividends, for example, is set to the cantons is a limit, so that we can lead in the interest of the country tax competition fairer.

The strongest opposition of the template comes from the Romandie. Is the tax rösti ditch is dangerous for the country?

Our diversity is our wealth. I see the very positive. The debate should be conducted in the Romandie something more intense than in the German part of Switzerland. I'm looking forward to it. For the opponent it is not easy to explain that you will be competing against a template, which eliminates a major tax inequity, and two billion Swiss francs for our most important social achievement, the AHV.

the consequences of The Reform are not entirely clear. You will have the control template as in the previous corporate tax reforms soon again correct, because the tax losses are higher than expected?

This control template is not compatible with previous reforms comparable. With the USTR II of 2008, I had dealt to me as a councillor. The opponents were able to show in the Outset that the Reform would cost very much. In the case of the tax-AHV-template, the estimates of the Federal Council are more accurate, and has learned from the past.

In the case of this vote, they represent a template, the fall, half in the jurisdiction of the financial departments. Do you want to go there in December?

But please, there is no discussion. As a member of the Federal Council, I am familiar with different topics. It is clear that I am working closely with President Ueli Maurer .

it Is an advantage that they both come from parties whose base is skeptical of this template?

We do not represent parties in the Federal Council, but we are familiar with people from different parties. This is certainly an advantage. At the beginning of quite a big question mark existed in all parties. In the case of the SP, a relatively complicated but interesting discussion developed. Also in other parties, the debates were not simply about the SVP. It is noteworthy that all parties show a great sense of responsibility, have voted in favour of the proposal in a positive light. (Editorial Tamedia)

Created: 07.04.2019, 21:54 PM

Torrential rains in Dubai: “The event is so intense that we cannot find analogues in our databases”

Torrential rains in Dubai: “The event is so intense that we cannot find analogues in our databases” Rishi Sunak wants a tobacco-free UK

Rishi Sunak wants a tobacco-free UK In Africa, the number of millionaires will boom over the next ten years

In Africa, the number of millionaires will boom over the next ten years Iran's attack on Israel: these false, misleading images spreading on social networks

Iran's attack on Israel: these false, misleading images spreading on social networks New generation mosquito nets prove much more effective against malaria

New generation mosquito nets prove much more effective against malaria Covid-19: everything you need to know about the new vaccination campaign which is starting

Covid-19: everything you need to know about the new vaccination campaign which is starting The best laptops of the moment boast artificial intelligence

The best laptops of the moment boast artificial intelligence Amazon invests 700 million in robotizing its warehouses in Europe

Amazon invests 700 million in robotizing its warehouses in Europe Switch or signaling breakdown, operating incident or catenaries... Do you speak the language of RATP and SNCF?

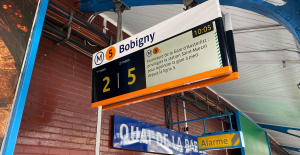

Switch or signaling breakdown, operating incident or catenaries... Do you speak the language of RATP and SNCF? Transport in Île-de-France: operators are pulling out all the stops on passenger information before the Olympics

Transport in Île-de-France: operators are pulling out all the stops on passenger information before the Olympics Radio audiences: France Inter remains firmly in the lead, Europe 1 continues its rise

Radio audiences: France Inter remains firmly in the lead, Europe 1 continues its rise Russian cyberattacks pose a global “threat”, Google warns

Russian cyberattacks pose a global “threat”, Google warns A new Lennon-McCartney duo, more than 50 years after the Beatles split

A new Lennon-McCartney duo, more than 50 years after the Beatles split The Curse vs Immaculée: two thrillers but only one plot

The Curse vs Immaculée: two thrillers but only one plot Mathieu Kassovitz adapts The Beast is Dead!, the comic book about the Second World War and the Occupation by Calvo

Mathieu Kassovitz adapts The Beast is Dead!, the comic book about the Second World War and the Occupation by Calvo Goldorak 'has never lived so much as now'

Goldorak 'has never lived so much as now' Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy During the night of the economy, the right points out the budgetary flaws of the macronie

During the night of the economy, the right points out the budgetary flaws of the macronie Europeans: Glucksmann denounces “Emmanuel Macron’s failure” in the face of Bardella’s success

Europeans: Glucksmann denounces “Emmanuel Macron’s failure” in the face of Bardella’s success These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Champions League: semi-final schedule revealed

Champions League: semi-final schedule revealed Serie A: AS Roma extends Daniele De Rossi

Serie A: AS Roma extends Daniele De Rossi Ligue 1: hard blow for Monaco with Golovin’s premature end to the season

Ligue 1: hard blow for Monaco with Golovin’s premature end to the season Paris 2024 Olympics: two French people deprived of the Olympic Games because of a calculation error by the international federation?

Paris 2024 Olympics: two French people deprived of the Olympic Games because of a calculation error by the international federation?