The Consulate General of Switzerland in New York delivered this summer, twice Post on the Caribbean Bermuda Islands. The recipients were three Trusts in the tax haven of your seat. Two official orders and a 110-page indictment were handed out in German and English. The sender of the Post: regional court Oberland in Thun. This is from a publication in the Bernese official journal of 16. October shows.

The three Trusts named Bermuda, Grosvenor and Omega are the defendants 6, 7 and 8 in a civil procedure, which provides the upper countries, the judge is currently one at the same time complex as explosive task: you have to be the judge in the probate case, one of the richest families in the world – the descendants of the German dynasty of Entrepreneurs angel horn. The sensitivity of this method has a lot to do with the reputation of the family. The angels horns are, in particular, in Germany known to be a notorious tax-optimizer – with the hillside, to go to the limits of legality.

At the 13. October of 2016, died at the age of 90 years, the head of the family, Curt Glover Engelhorn. He was the longtime Patron of the German pharmaceutical company Boehringer Mannheim, which he sold in 1997 for $ 11 billion to Roche. Angel horn left behind at his death a wife, three Ex-wives, four daughters from two marriages, a son from an affair, a step-son, as well as a fortune of 3.5 billion Swiss francs – the most recent estimate of the Swiss business magazine "balance was".

zu Sayn Always in the best of company: the Curt Engelhorn with the Princess Wittgenstein, 2013-a Party in Munich. Photo: Imago

The Chalet is located on the Oberbort

How high is this asset but in fact, in addition to wild rumors and speculation for years. Angel's horn had Packed the money in a so-nested financial construct, to outcrops that already during his lifetime, tens of tax investigators in the teeth of it. After years of suspicion of the German authorities in 2013 started a process. They threw Parts of the family, to have up to 450 million euros in tax evasion.

Two of the at the time still living in Germany angel horn-daughters were arrested and went to jail. The lawyers of the family and the German authorities agreed, but shortly after the arrest, on a Payment of 145 million euros was negotiated but only half of the truth, how soon should turn out.

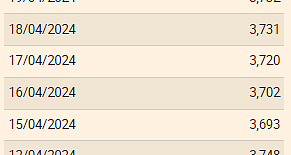

From 2010 to 2011, the taxable assets of the couple increased, at a stroke, from 20 to 406 million Swiss francs.

in 2017, made a worldwide research network including the Tamedia Newspapers – the Paradise Papers public. The Datenleak contained confidential documents from the law firm of Appleby, with headquarters in Bermuda. As the documents show, is the asset

the situation of the Engelhorn family, a lot more complex than previously assumed. In addition to the 44 Trusts, over which the German authorities knew at the time notice had appeared in 38 more of these Trusts. In the case of a Trust to transfer his assets to a Trustee who manages the money for the benefit of one or more beneficiaries.

Four processes on the Run

Here are the Berner justice comes into play. The top countries judges the opportunity to look deeper into this angel horn – ash thicket of Trusts, foundations and shell companies than ever before-and all thanks to a luxury Chalet at Gstaad Oberbort. There, the official residence of the widow of Curt Engelhorn, which is being sued by one of the daughters of the first marriage is. Because the probate case to a civil procedure, the documents relating to the case until the day of the public hearing under lock and key.

On request, the regional court confirmed Oberland, only that there are currently three proceedings in this case were on the Run – in addition to the main procedure two more lawsuits. A fourth point of contention, a Supervisory complaint against the Curt Engelhorn used executor – landed in 2017, the government's top at a district Simmental-Saanen. Since this complaint has already been drawn up before the Federal court, are some of the Details of the probate case known.

As the judgment shows, was Curt Engelhorn in his 2014 certified as a true Testament of his wife as sole heir. The five children he had resigned during his lifetime – in accordance with the German news magazine "Spiegel" with the legacies of around 450 million Euro per child. In his Testament he had provided for his direct descendants, therefore, only a small Erbevon 20 million dollars.

The US-residing daughter from his first marriage was not happy. 45 days after the death of her father she called from the executor with the administration of the estates of relevant information – from a plot summary to a copy of the marriage contract of the deceased from the year 2011. Since then, the probate case is raging.

thanks to the family feud could get information to the Public, which to date have remained under lock and key – also with regard to the tax situation of the angel's horn in the Canton of Bern. The Alt-SP, national Council member Margret Kiener Nellen tried already in 2012, insight into the control to obtain data.

After the family under the aid of the municipality of Saanen and Berne tax administration was for many years cross, decided by the Federal court in 2017, the tax data from the angel's horn, and other prominent choice-Gstaadern to the public must be accessible. The tax identification cards of the couple from 2009 to 2011, prior to this newspaper therefore.

From 20 to 406 million

What is striking: While the angel's horn in the Canton of Bern reported no taxable income, this changed in March 2010. In the following year, you are taxed, a taxable income of CHF 3.3 million. So you were at the latest as of this date, no more than a lump sum-taxed in the Canton of Bern reported.

Also, the taxable assets of the couple increased from 2010 to 2011, suddenly of CHF 20 million to 406 million Swiss francs. What's up with this sudden growth in assets, exactly, could show the court the procedure now. And also, whether the municipality of Saanen and the Bernese tax authorities have taxed the very wealthy family over all the years correctly.

Created: 02.11.2019, 19:11 PM

The Euribor today remains at 3.734%

The Euribor today remains at 3.734% Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations What is Akila, the mission in which the Charles de Gaulle is participating under NATO command?

What is Akila, the mission in which the Charles de Gaulle is participating under NATO command? What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic MEPs validate reform of EU budgetary rules

MEPs validate reform of EU budgetary rules “Public Transport Paris 2024”, the application for Olympic Games spectators, is available

“Public Transport Paris 2024”, the application for Olympic Games spectators, is available Spotify goes green in the first quarter and sees its number of paying subscribers increase

Spotify goes green in the first quarter and sees its number of paying subscribers increase Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund

Xavier Niel finalizes the sale of his shares in the Le Monde group to an independent fund Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer

Owner of Blondie and Shakira catalogs in favor of $1.5 billion offer Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame

Cher et Ozzy Osbourne rejoignent le Rock and Roll Hall of Fame Three months before the Olympic Games, festivals and concert halls fear paying the price

Three months before the Olympic Games, festivals and concert halls fear paying the price With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics

With Brigitte Macron, Aya Nakamura sows new clues about her participation in the Olympics Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Serie A: Bologna surprises AS Rome in the race for the C1

Serie A: Bologna surprises AS Rome in the race for the C1 Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues?

Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues? Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby

Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season

Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season