The term is cumbersome, but important. Because it's about money. A Lot Of Money. Specifically: Million. And it goes to a Good that is in Switzerland is becoming increasingly rare: plot of land. The term means more compensation, and this a tough fight is in the Canton of Zurich.

What is more compensation and more specifically, shows a simple example. On the edge of a medium-sized municipality of a disused factory. Land value: CHF 300 per square meter. An Investor would be constructed over the plot of land with multi-family homes. The municipality granted the Rezoning. And from one day to the other, the country is ten times more valuable.

The luck of the land owner is the municipality of a burden. You must be converted into a junction, a new bus station building, a new kindergarten class. All of this is expensive.

Here, the value of compensation comes into play. The municipality has provided the land owners with the Rezoning, a significant increase in value, without that this had anything to do. The municipality is expected to call a part of that value back, it could cover at least part of your costs.

Exactly the future is to be in the Canton of Zurich. So, the government proposes a new law. The question is, what is the extent of the value of compensation should have – and how much of it to the municipalities. As the Canton also they make claims.

"disaster"

to Volunteer, the government has not developed the value-added compensation act. For the past five years, the Federal government prescribes in Neueinzonungen a tax of at least 20 percent of the value, the cantons and the municipalities can, however, ask more. By the end of April of this year, all the cantons have enacted legislation that regulates the Details.

all done – except for Zug and Zurich. A year ago, the Zurich cantonal Council has referred its proposal to the cantonal Parliament, since then, the Commission for planning and building (KPB) breeds. In the next few weeks, you want to publish your Amendments.

It will probably be quite a lot, because with the proposal of the outgoing Baudirektors Markus Kägi (SVP) are the least of the groups satisfied. "A disaster," the draft says the SP-a member of the Parliament and KPB member of the Jonas Erni. Also for Lukas Bühlmann, Director of the spatial planning Association Espace Suisse, is not enough for the proposal: "We recommend to the cantons, the municipalities, the possibility of the minimum tax."

What is the thing in addition complicated, a cantonal popular initiative, which requires that municipalities be free to determine the rate of the tax. The Initiative comes in September in front of people, recently, the civil member of the Parliament majority, has recommended it for rejection.

Minimum

A comparison with the rules in other cantons shows that Would come through the government bill unchanged, would join Zurich below those of the cantons, the property owner at handled with care. Because it is based strictly on the Minimum. In Neueinzonungen the Canton would receive 20 percent of the added value that the municipality of nothing. A zone change would allow for a higher utilization, it could skim the municipalities 15 percent of value added, 5 per cent went to the Canton. Only in the design plans, the municipalities in the agreement are likely to require with the landowners.

a number of other cantons continue to go well. A pioneering role to play in Basel-city, where the value of compensation is already established since 1977 in the law. The value-added tax is 50 percent. In the section come together so between 6 and 7 million francs per year. The money flows into a Fund, from the green plants will be financed.

"In Basel-city, it is important to create a balance with playgrounds, Parks, green space and trees."

The scheme was broadly accepted, says Christiane then Berger. She is the Deputy head of the city nursery and the chair of the steering Committee to examine the use of the funds and a recommendation to the governing Council. "Basel-city is very densely populated", says Berger, "that is why it is extremely important to create a balance with playgrounds, Parks, green space and trees."

this not only benefits the Public, says Berger, but also the investors. Because you can achieve a higher rate of return, on the other, because you can build in a more attractive environment. The charges were measured by the construction cost is moderate, usually you will make between 2 and 4 percent of the total investment.

In the Grisons, the tax is at least 30 percent of the added value that the municipalities can increase the sentence but up to 50 percent. Also in Bern, the municipalities may request up to 50 per cent, in Solothurn up to 40.

Where the System works

the larger cities in the Canton of Zurich already collect taxes on the higher value. Is allowed but only in connection with the design plans, which allow significantly higher utilization. The System works well and is broadly accepted, say the municipalities.

One of the best-known examples is the Deal the city of Zurich, with the Zurich-insurance. The group was allowed to enlarge its headquarters to a Prime location on the shores of the lake, he was involved with 8.4 million Swiss francs in the redesign of the port promenade. Right next door is Swiss Re in return, agreed to a higher advantage to move the surface Parking to the existing car Park.

investors in Bülach, figures on a footbridge, and free Land for the road.

Less known, but no less extensive, the contract of the city of Bülach with the investors, the pull on brownfield sites in Bülach-Nord apartments for up to 2000 people. The investors participate in the construction of a foot-goer footbridge to the railway station, in addition, you need to make a part of the green area between the new residential block is accessible to the public, free of charge, Land for the Expansion of feeder roads to cede and 10 percent of the apartments at below market price offer.

Overall, draws Bülach, according to the estimates of Construction Hanspeter Lienhard (SP), around 30 percent of the added value from: "to be precise, however." Nevertheless, the city by new buildings of high costs: the investment for roads and foot paths, footbridge, factory lines, and the like amount to 18.4 million – for a city with around 50 million Swiss francs of tax revenue in the year of a big chunk. And that's not all. Bülach has to create school-temporaries, the sports facilities are bursting at the seams.

Flexible solution demanded

For pre-stayers Lienhard is clear: "we are Likely to absorb 15 percent more value, we would, in the future, with the nose of the disc. Contracts, such as in Bülach-Nord would no longer be possible." Many of his colleagues see in the large municipalities are similar, as well SP, Green, GLP and AL in the cantonal Parliament. You are asking for a flexible solution, similar to the one in Grisons or Bern.

Lukas Bühlmann of the Espace Suisse thinks is ideal: "The municipalities must be able to adapt the added value tax to your needs. Small are sometimes glad if any one builds with them. The great must, however, be able to the cost of the cushion, which occur with each compression. There is the risk that the population rejects the much-needed compression." A study by the cantonal office for spatial development, comes to the same conclusion: Where green spaces, new footpaths, culture or day-care centres, large projects better.

year-long Blockade

is Completely different, the Zurich cantonal Council sees it. The Director of planning is linked to fears that investors would prefer to go to the country, if urban municipalities would collect higher value charges. The heat, the urban sprawl. SVP and FDP argued in the cantonal Parliament in a similar way: A differentiated rate would lead to an undesirable competition.

room planner Bühlmann has made other experiences: "Even in regions where the tax rates are very different, we could detect no tendency to Dodge in municipalities with low taxes." This looks Christiane then Berger from Basel: "the value-added tax inhibits the construction activity, cannot be observed." And, although the levy is equal to the cantonal border valley, in the Basel area, is at the Minimum.

The debate in the Zurich cantonal Parliament is likely to be exciting in any case. Tipping the scales might play the EVP and CVP, the push for a compromise, and the people's initiative, reject it. It is clear that time is of The essence. From the end of April, the municipalities may no new building land, more single zone, until the law is passed. "We need to create the compromise," says Jonas Erni. Otherwise, the long Blockade threatens a year.

(Tages-Anzeiger)

Created: 09.04.2019, 22:59 PM

His body naturally produces alcohol, he is acquitted after a drunk driving conviction

His body naturally produces alcohol, he is acquitted after a drunk driving conviction Who is David Pecker, the first key witness in Donald Trump's trial?

Who is David Pecker, the first key witness in Donald Trump's trial? What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain?

What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain? The shadow of Chinese espionage hangs over Westminster

The shadow of Chinese espionage hangs over Westminster Colorectal cancer: what to watch out for in those under 50

Colorectal cancer: what to watch out for in those under 50 H5N1 virus: traces detected in pasteurized milk in the United States

H5N1 virus: traces detected in pasteurized milk in the United States What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France The right deplores a “dismal agreement” on the end of careers at the SNCF

The right deplores a “dismal agreement” on the end of careers at the SNCF The United States pushes TikTok towards the exit

The United States pushes TikTok towards the exit Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille

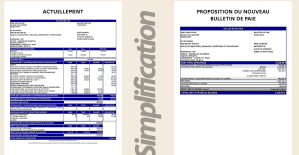

Air traffic controllers strike: 75% of flights canceled at Orly on Thursday, 65% at Roissy and Marseille This is what your pay slip could look like tomorrow according to Bruno Le Maire

This is what your pay slip could look like tomorrow according to Bruno Le Maire Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week

Sky Dome 2123, Challengers, Back to Black... Films to watch or avoid this week The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival

The standoff between the organizers of Vieilles Charrues and the elected officials of Carhaix threatens the festival Strasbourg inaugurates a year of celebrations and debates as World Book Capital

Strasbourg inaugurates a year of celebrations and debates as World Book Capital Kendji Girac is “out of the woods” after his gunshot wound to the chest

Kendji Girac is “out of the woods” after his gunshot wound to the chest Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated

NBA: the Wolves escape against the Suns, Indiana unfolds and the Clippers defeated Real Madrid: what position will Mbappé play? The answer is known

Real Madrid: what position will Mbappé play? The answer is known Cycling: Quintana will appear at the Giro

Cycling: Quintana will appear at the Giro Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card

Premier League: “The team has given up”, notes Mauricio Pochettino after Arsenal’s card