more and more Insured due to the high health insurance premiums in financial difficulties. But anyone who has debt in the health insurance, can't switch the checkout. A change to a cheaper Fund would relieve the Insured often, says Erika Ziltener, President of the umbrella Association of Swiss Patients (DVSP). So could be 100 francs per month Insured quickly once save.

The Patient of Zurich has now set up a Fund to pay off its debts to such Insured. The rash a married couple, the debts of the Fund and unpaid medical bills for a total amount of 10'000 CHF. In trouble, the Couple came, as in the case of the wife, an auto-immune disease broke out, and high treatment costs. Due to the stressful Situation, the man fell ill. Both had elected the maximum franchise of 2500 francs, to save on premiums, but do not have enough money to pay the cost of treatment.

help only for cash exchange

The Fund serves Patients from all over Switzerland, and will be built up with donations. Support is subject to the condition that the Insured, after settlement of the debts in an affordable cash register, the GP model and the standard deductible of CHF 300, choose. Because a common reason for the debt with a high deductible, Ziltener says. Insured on a Budget often chose a Franchise of 2500 francs, and had not placed sufficient money back to pay for any treatment costs.

Several cases from the German part of Switzerland were redirected Ziltener from debt advice agencies. Thanks to the first donations to some of the Insured could be helped. In a case that is Ziltener on the table, the amount of the debt, however, to a whopping 40'000 Swiss francs. Such a case is too much the Patient currently. The financial support of an advance payment, to be reimbursed by the person Concerned.

Ziltener hopes that you can some allow the Insured a cash exchange in the middle of this year. The Affected must cancel the current insurance until the end of March, which is just a rapid settlement of outstanding premiums and Cost sharing. A change in the middle of the year is allowed in the standard model with a minimal franchise of 300 francs. At the same time, Patients are advised when applications for the premium reduction. Often people in debt would have to first complete the tax return, because of a reduction in the Premium.

350 million of debt

Each year, the Insured will remain the health insurance funds more than 100 million Swiss francs of premiums and Cost sharing guilty. In the year 2017, from the the latest debt statistics are derived, were the outstanding payments of around 350 million Swiss francs. A part of this Insured turns because of their financial problems to debt advice agencies. Around 60 per cent of these clients have outstanding payments for the health insurance.

According to Mario Roncoroni of the debt advice service of Bern the debt, and the cash amount to the Insured person in a cut of almost 11'000 Swiss francs per. What is the share of outstanding costs account for investments, was not collected. But it is clear for Roncoroni, high franchise pose no additional debt risk.

(editing Tamedia)

Created: 15.03.2019, 22:08 PM

His body naturally produces alcohol, he is acquitted after a drunk driving conviction

His body naturally produces alcohol, he is acquitted after a drunk driving conviction Who is David Pecker, the first key witness in Donald Trump's trial?

Who is David Pecker, the first key witness in Donald Trump's trial? What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain?

What does the law on the expulsion of migrants to Rwanda adopted by the British Parliament contain? The shadow of Chinese espionage hangs over Westminster

The shadow of Chinese espionage hangs over Westminster Parvovirus alert, the “fifth disease” of children which has already caused the death of five babies in 2024

Parvovirus alert, the “fifth disease” of children which has already caused the death of five babies in 2024 Colorectal cancer: what to watch out for in those under 50

Colorectal cancer: what to watch out for in those under 50 H5N1 virus: traces detected in pasteurized milk in the United States

H5N1 virus: traces detected in pasteurized milk in the United States What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

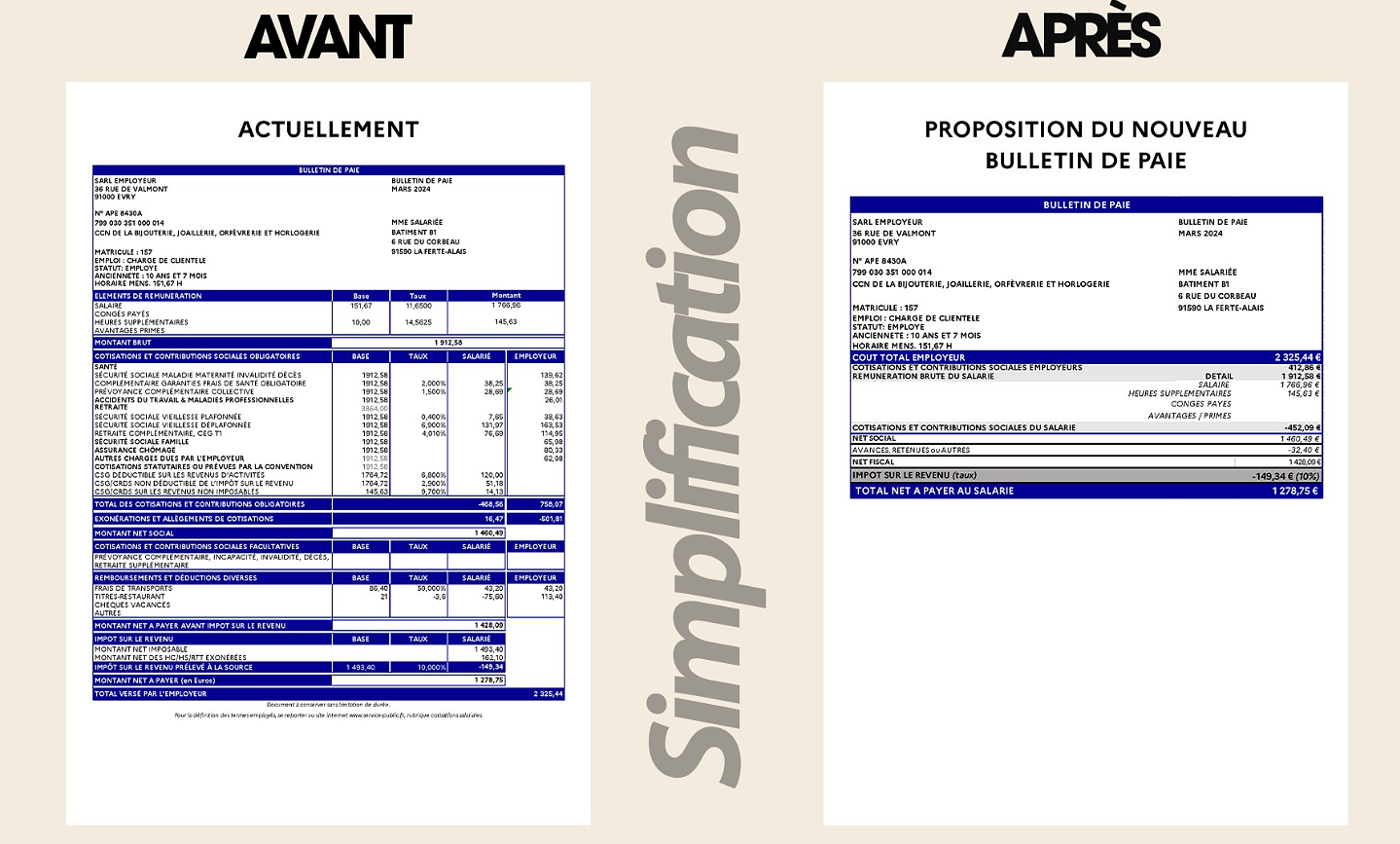

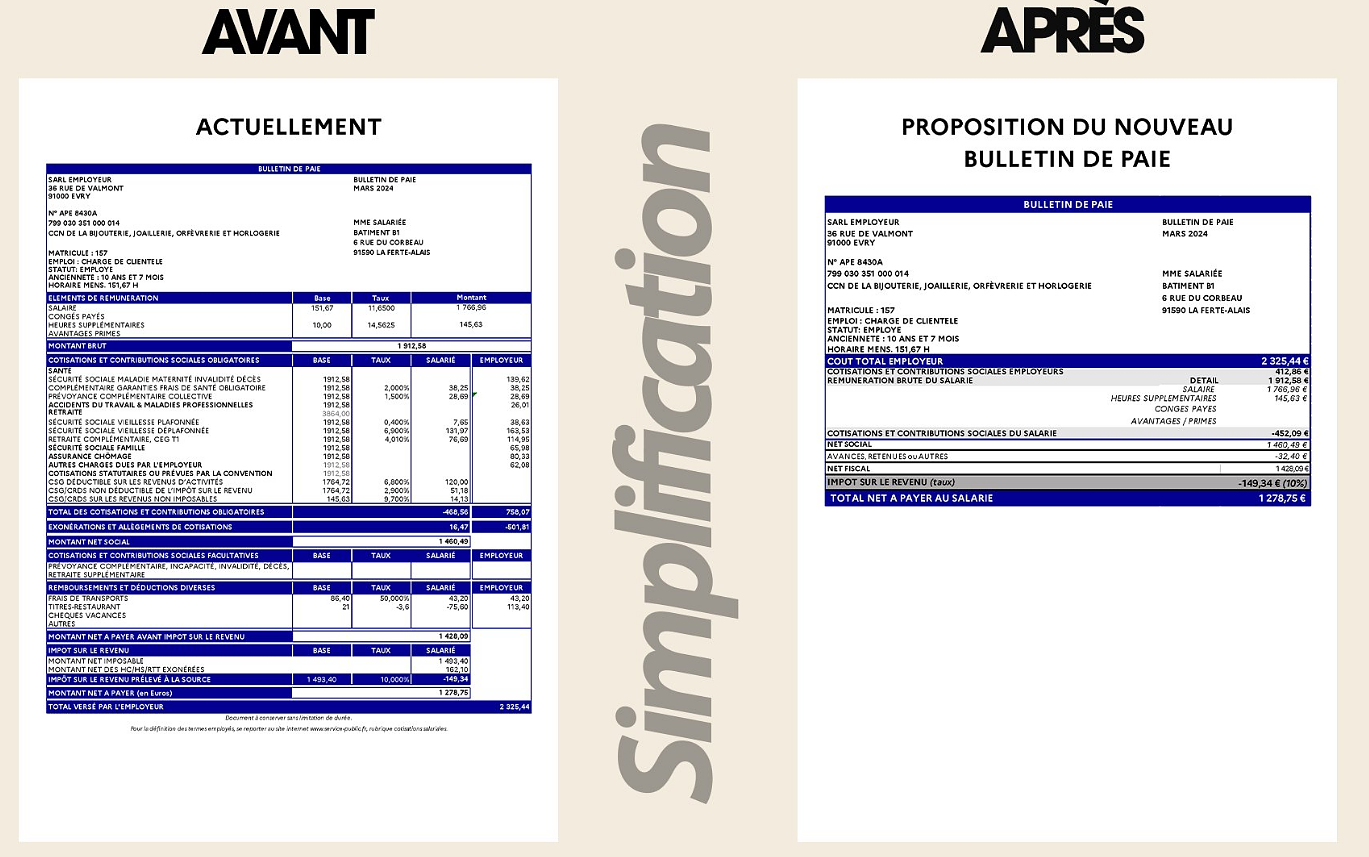

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) “I’m interested in knowing where the money that the State takes from me goes”: Bruno Le Maire’s strange pay slip sparks controversy

“I’m interested in knowing where the money that the State takes from me goes”: Bruno Le Maire’s strange pay slip sparks controversy Despite the lifting of the controllers' strike, massive flight cancellations planned for Thursday, April 25

Despite the lifting of the controllers' strike, massive flight cancellations planned for Thursday, April 25 The right deplores a “dismal agreement” on the end of careers at the SNCF

The right deplores a “dismal agreement” on the end of careers at the SNCF The United States pushes TikTok towards the exit

The United States pushes TikTok towards the exit Saturday is independent bookstore celebration

Saturday is independent bookstore celebration In Paris as in Marseille, the Flames ceremony opens to fans of rap and hip-hop

In Paris as in Marseille, the Flames ceremony opens to fans of rap and hip-hop Sale of the century for a mysterious painting by Klimt, in Austria

Sale of the century for a mysterious painting by Klimt, in Austria Philippe Laudenbach, actor with more than a hundred supporting roles, died at 88

Philippe Laudenbach, actor with more than a hundred supporting roles, died at 88 Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

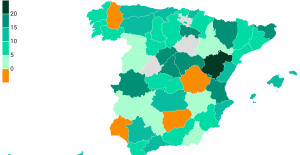

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Sale of Biogaran: The Republicans write to Emmanuel Macron

Sale of Biogaran: The Republicans write to Emmanuel Macron Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Montpellier-Nantes: at what time and on which channel to watch the Ligue 1 match?

Montpellier-Nantes: at what time and on which channel to watch the Ligue 1 match? Ligue 1: Luis Enrique leaves many PSG players to rest in Lorient

Ligue 1: Luis Enrique leaves many PSG players to rest in Lorient Football: Deschamps, Drogba, Desailly... Beautiful people with Emmanuel Macron to play with the Variétés

Football: Deschamps, Drogba, Desailly... Beautiful people with Emmanuel Macron to play with the Variétés Football: “the referee was bought”, Guy Roux’s anecdote about a European Cup match… with watches and rubies

Football: “the referee was bought”, Guy Roux’s anecdote about a European Cup match… with watches and rubies