The expenses of the social long-term care insurance (SPV) introduced in 1995 have more than doubled in the past ten years. The massive expansion of benefits in particular contributed to this. In view of the impending dramatic aging of the population, this development will accelerate in the coming decades.

The proportion of people in need of care in the total population, which is less than five percent today, will increase to 6.4 percent by 2040 and to 7.6 percent by 2050. At the same time, the proportion of people of working age who can provide care services is shrinking.

The judgment of the Federal Labor Court in 2021 on the remuneration of foreign caregivers will mean that home care will also become much more expensive. The contribution rate to the SPV will increase by a further 1.5 to 2 percentage points by 2040, even if the catalog of benefits remains constant - and this will be during a period in which the contribution rates to statutory pension and health insurance will also rise sharply.

That is why the total contribution to social security threatens to rise from today's 40 percent to over 50 percent of gross wages. The ability to finance German social security as a whole is in jeopardy.

In this already difficult situation, the traffic light government is planning two additional service expansions according to the coalition agreement: On the one hand, the personal contributions of those in need of care to inpatient care are to be “limited and made plannable”.

On the other hand, the coalition wants to consider supplementing the SPV with “voluntary, equally financed full insurance” that “comprehensively covers the assumption of all care costs.” A commission of experts is to “submit proposals that are generation-fair.”

The personal contribution to inpatient care has indeed risen sharply recently and is currently around 2,200 euros a month on average across Germany, although there are strong regional differences. In Saxony, the average is around 1,600 euros, in Baden-Württemberg it is over 2,600 euros.

A limitation to the national average would not only increase the total expenditure of the SPV, but also mean a massive reallocation of contribution funds. At the expense of the insured in the poorer federal states, especially in the east of the republic, and in favor of the residents of the richest federal states.

The further expansion of the pay-as-you-go SPV would be even more worrying. Because it would lead to a significant intensification of the redistribution from the younger and unborn to the older generations. Among the elderly, it would primarily favor the wealthy. Because those who are unable to meet their own share of the care costs are already entitled to “help with care” from the social welfare office of the municipality. Back in 2003, Green Party politician Katrin Göring-Eckardt rightly called long-term care insurance “inheritance protection insurance”.

The division of care costs between the community of insured persons and the person concerned, who can bring in their own savings, private supplementary insurance or home care by relatives, has proven its worth over the last quarter of a century. There is no reason to cancel them in a situation where the aging of the population is rapidly increasing.

In contrast to pension insurance, it is not too late for sweeping reforms of care financing for more intergenerational justice. The lion's share of long-term care is required by people of very old age, usually 15 to 20 years after retirement.

Therefore, it is still possible that the large cohort of “baby boomers” (i.e. those born in the 1960s) could self-finance a larger part of their own care costs by accumulating sufficient capital. This can be done in two ways: public and private. The scientific advisory board at the Federal Ministry of Economics and Climate Protection recently demonstrated this in its report "Sustainable financing of care services".

On the one hand, the existing long-term care fund, which the social long-term care insurance fund fills with 1.2 billion euros each year from contributions, can be significantly increased. To do this, the contribution to the SPV would have to be increased accordingly, but the increase to be expected after 2030 could be flattened noticeably. It is crucial that the fund must be effectively protected against premature withdrawal of the funds by politicians, so that no election gifts can be financed from them.

On the other hand, the legislature could make it compulsory for all citizens of working age to take out private supplementary long-term care insurance, which covers a significant percentage of their own contribution to inpatient care, and subsidize the premiums of low earners by up to 100 percent. Such insurance products have been established on the market for a long time, and the premiums depend on the age of entry. Up until the age of 65, they still seem affordable to most people.

These private insurance contracts can also be concluded collectively, as is already the case in the chemical industry. There, 400,000 employees have taken out daily care allowance insurance, financed by the employer, in the amount of EUR 1,000 per month for inpatient care as part of the collective agreement. The family members can also purchase the same product for a affordable monthly premium.

If more sustainability and intergenerational equity is to be achieved, a debate about the future of social insurance must be held before the end of this legislative period. In long-term care insurance, it is particularly important that the benefits financed in the pay-as-you-go system are not expanded any further. Instead, the instruments of funded provision that already exist should be used more extensively.

Klaus Schmidt is chairman and Friedrich Breyer a member of the scientific advisory board at the Federal Ministry for Economic Affairs and Climate Protection

"Everything on shares" is the daily stock exchange shot from the WELT business editorial team. Every morning from 7 a.m. with our financial journalists. For stock market experts and beginners. Subscribe to the podcast on Spotify, Apple Podcast, Amazon Music and Deezer. Or directly via RSS feed.

Torrential rains in Dubai: “The event is so intense that we cannot find analogues in our databases”

Torrential rains in Dubai: “The event is so intense that we cannot find analogues in our databases” Rishi Sunak wants a tobacco-free UK

Rishi Sunak wants a tobacco-free UK In Africa, the number of millionaires will boom over the next ten years

In Africa, the number of millionaires will boom over the next ten years Iran's attack on Israel: these false, misleading images spreading on social networks

Iran's attack on Israel: these false, misleading images spreading on social networks New generation mosquito nets prove much more effective against malaria

New generation mosquito nets prove much more effective against malaria Covid-19: everything you need to know about the new vaccination campaign which is starting

Covid-19: everything you need to know about the new vaccination campaign which is starting The best laptops of the moment boast artificial intelligence

The best laptops of the moment boast artificial intelligence Amazon invests 700 million in robotizing its warehouses in Europe

Amazon invests 700 million in robotizing its warehouses in Europe Switch or signaling breakdown, operating incident or catenaries... Do you speak the language of RATP and SNCF?

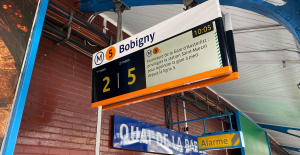

Switch or signaling breakdown, operating incident or catenaries... Do you speak the language of RATP and SNCF? Transport in Île-de-France: operators are pulling out all the stops on passenger information before the Olympics

Transport in Île-de-France: operators are pulling out all the stops on passenger information before the Olympics Radio audiences: France Inter remains firmly in the lead, Europe 1 continues its rise

Radio audiences: France Inter remains firmly in the lead, Europe 1 continues its rise Russian cyberattacks pose a global “threat”, Google warns

Russian cyberattacks pose a global “threat”, Google warns A new Lennon-McCartney duo, more than 50 years after the Beatles split

A new Lennon-McCartney duo, more than 50 years after the Beatles split The Curse vs Immaculée: two thrillers but only one plot

The Curse vs Immaculée: two thrillers but only one plot Mathieu Kassovitz adapts The Beast is Dead!, the comic book about the Second World War and the Occupation by Calvo

Mathieu Kassovitz adapts The Beast is Dead!, the comic book about the Second World War and the Occupation by Calvo Goldorak 'has never lived so much as now'

Goldorak 'has never lived so much as now' Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy During the night of the economy, the right points out the budgetary flaws of the macronie

During the night of the economy, the right points out the budgetary flaws of the macronie Europeans: Glucksmann denounces “Emmanuel Macron’s failure” in the face of Bardella’s success

Europeans: Glucksmann denounces “Emmanuel Macron’s failure” in the face of Bardella’s success These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Champions League: semi-final schedule revealed

Champions League: semi-final schedule revealed Serie A: AS Roma extends Daniele De Rossi

Serie A: AS Roma extends Daniele De Rossi Ligue 1: hard blow for Monaco with Golovin’s premature end to the season

Ligue 1: hard blow for Monaco with Golovin’s premature end to the season Paris 2024 Olympics: two French people deprived of the Olympic Games because of a calculation error by the international federation?

Paris 2024 Olympics: two French people deprived of the Olympic Games because of a calculation error by the international federation?