anyone Who has large sums of money on a Bank account, must today pay negative interest rates. But why do banks pay actually, Vice versa, their customers negative interest rates on mortgage ? The Federal court has released dealt with, and recently a judgment. It was not a mortgage but a large loan from a municipality, which stopped after the introduction of the negative interest on their Bank Transfers to the Bank and instead own an interest payment required. However, with the judgment's conclusions for a mortgage can be drawn.

The question of negative interest rates in the Libor-rate mortgages, which are guided periodically at the interest rate level of the market, and not, for example, in the case of fixed-rate mortgages in which the interest rate for a specific term is fixed. Actually, the Swiss franc Libor rates at which banks are to be guided are, for a long time in the Minus. But that does not mean that Mortgage borrowers can now recover in the case of banks with negative interest rates. The chances are after the Federal court judgment, on the contrary bad: "I see this little room," says Corinne Zellweger-Gutknecht, is Professor for financial markets law at the Kalaidos University of applied Sciences.

old contracts

the Legal in-game space, it is only when the Libor-mortgage has been completed after the start of the Phase with negative interest rates in early 2015, and the Bank requires still flat and without Reservation in respect of a Libor rate. Because in this way, the Bank took into account that the interest rate could fall below zero. This happened to me, without that, the Bank has adjusted the terms correctly, there is a realistic possibility, interest paid to reclaim.

such A recovery would have to be done under the legal concept of "unjust enrichment". This has the disadvantage of being time-barred rapidly – just one year after the customer learned of his claim. Customers could argue the best case for the past year, legally to mortgage interest rates. Due to the low interest rate levels it is not but, as a rule, rather deep in dispute totals, so that the process is worth the risk for most. Also Affected would have to prove that you have mistakenly paid too much. And finally, most of the banks have hedged their customers are already legally, so this is obviously no longer an Option, as Zellweger-explained Gutknecht.

In principle, the Federal court concludes that a reversal of the interest rate is a debt due to negative interest rates only possible, if this is provided for in a contract explicitly so, or if there are special indications to speak. It leaves open the question of whether the margin agreed between the Bank in addition to the Libor rate will be offset by the negative interest rate. The court considers that it is for "at least acceptable", that the margin will remain fully owed.

Unusual legal matters

In the present case, the language according to the Federal court, that the parties wanted the Libor rate, not below zero decrease. It is based on an Argument of the banks: The financing is done through savings accounts of customers. On these deposits, the financial institutions do not receive negative interest rates. However, this Argument can be relativized. On the one hand, banks require high level of customer deposits as well as negative interest rates. On the other hand, the banks refinance their mortgages in part on mortgage loans, which is also the case that negative interest rates. The Raiffeisen group confirms this, put into perspective but at the same time, mortgage loans were only a small part of the refinancing accounted for and that it is only in exceptional cases a negative interest rate give. However, these are arguments that can bring a prospective house owner, if he is negotiating with a Bank for a mortgage interest rate.

And finally, when negative interest rates are unusual legal issues. Thus, it is controversial whether or not a loan can be spoken. The Federal court says Yes – but this was an atypical loan. Some legal experts believe that a loan at negative interest rates to a "Deposit". That would be as if someone entered a value object such as a painting somewhere and a fee paid, and would also be legal for others to follow. (Editorial Tamedia)

Created: 01.07.2019, 15:03 p.m.

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday

Germany: the trial of an AfD leader, accused of chanting a Nazi slogan, resumes this Tuesday New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations

New York: at Columbia University, the anti-Semitic drift of pro-Palestinian demonstrations What is Akila, the mission in which the Charles de Gaulle is participating under NATO command?

What is Akila, the mission in which the Charles de Gaulle is participating under NATO command? Lawyer, banker, teacher: who are the 12 members of the jury in Donald Trump's trial?

Lawyer, banker, teacher: who are the 12 members of the jury in Donald Trump's trial? What High Blood Pressure Does to Your Body (And Why It Should Be Treated)

What High Blood Pressure Does to Your Body (And Why It Should Be Treated) Vaccination in France has progressed in 2023, rejoices Public Health France

Vaccination in France has progressed in 2023, rejoices Public Health France Food additives suspected of promoting cardiovascular diseases

Food additives suspected of promoting cardiovascular diseases “Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic

“Even morphine doesn’t work”: Léane, 17, victim of the adverse effects of an antibiotic Orthodox bishop stabbed in Sydney: Elon Musk opposes Australian injunction to remove videos on X

Orthodox bishop stabbed in Sydney: Elon Musk opposes Australian injunction to remove videos on X One in three facial sunscreens does not protect enough, warns L'Ufc-Que Choisir

One in three facial sunscreens does not protect enough, warns L'Ufc-Que Choisir What will become of the 81 employees of Systovi, a French manufacturer of solar panels victim of “Chinese dumping”?

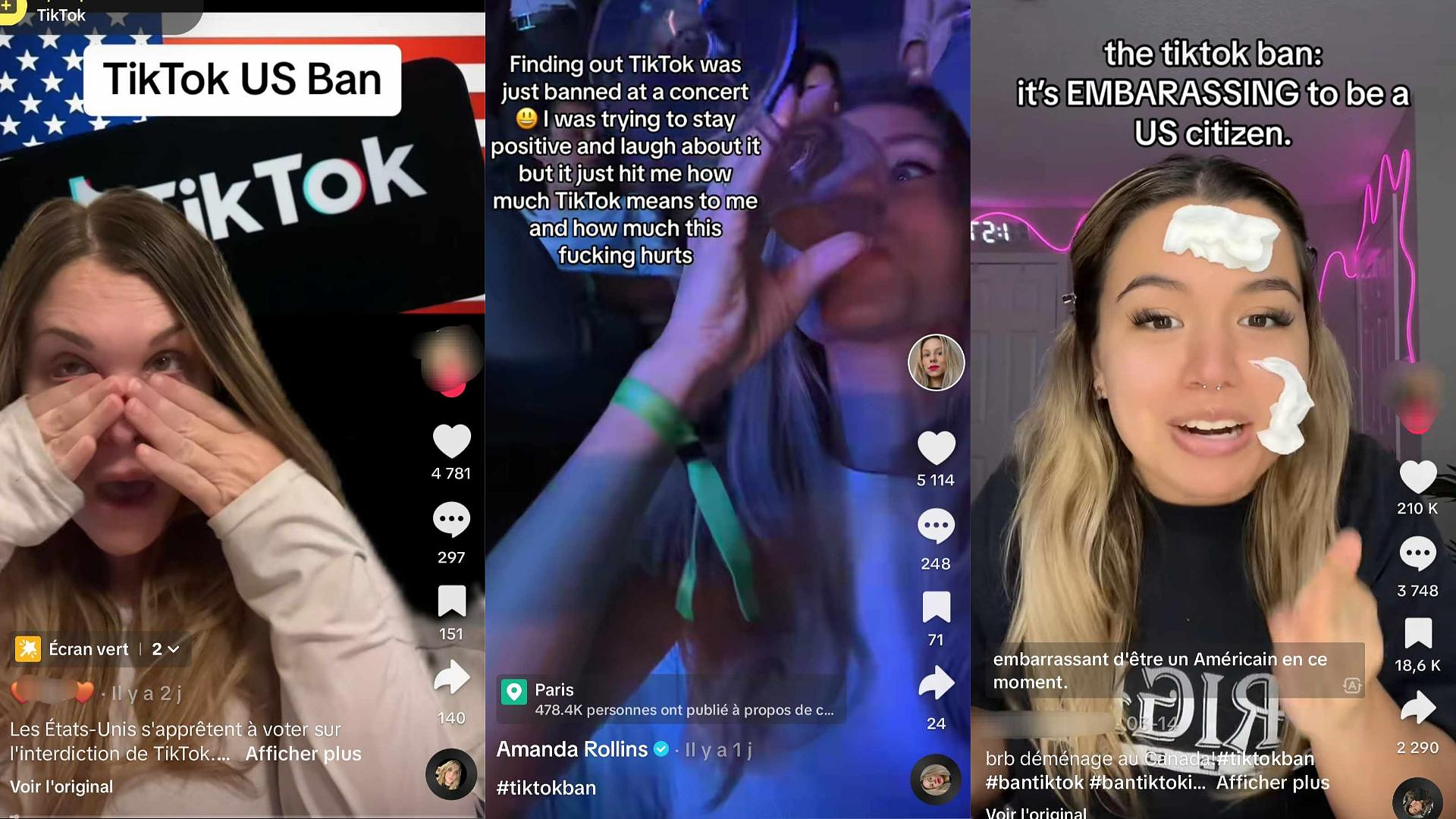

What will become of the 81 employees of Systovi, a French manufacturer of solar panels victim of “Chinese dumping”? “I could lose up to 5,000 euros per month”: influencers are alarmed by a possible ban on TikTok in the United States

“I could lose up to 5,000 euros per month”: influencers are alarmed by a possible ban on TikTok in the United States Dance, Audrey Hepburn’s secret dream

Dance, Audrey Hepburn’s secret dream The series adaptation of One Hundred Years of Solitude promises to be faithful to the novel by Gabriel Garcia Marquez

The series adaptation of One Hundred Years of Solitude promises to be faithful to the novel by Gabriel Garcia Marquez Racism in France: comedian Ahmed Sylla apologizes for “having minimized this problem”

Racism in France: comedian Ahmed Sylla apologizes for “having minimized this problem” Mohammad Rasoulof and Michel Hazanavicius in competition at the Cannes Film Festival

Mohammad Rasoulof and Michel Hazanavicius in competition at the Cannes Film Festival Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV

Skoda Kodiaq 2024: a 'beast' plug-in hybrid SUV Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price"

Tesla launches a new Model Y with 600 km of autonomy at a "more accessible price" The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter

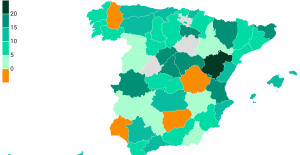

The 10 best-selling cars in March 2024 in Spain: sales fall due to Easter A private jet company buys more than 100 flying cars

A private jet company buys more than 100 flying cars This is how housing prices have changed in Spain in the last decade

This is how housing prices have changed in Spain in the last decade The home mortgage firm drops 10% in January and interest soars to 3.46%

The home mortgage firm drops 10% in January and interest soars to 3.46% The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella

The jewel of the Rocío de Nagüeles urbanization: a dream villa in Marbella Rental prices grow by 7.3% in February: where does it go up and where does it go down?

Rental prices grow by 7.3% in February: where does it go up and where does it go down? Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou

Europeans: “All those who claim that we don’t need Europe are liars”, criticizes Bayrou With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition

With the promise of a “real burst of authority”, Gabriel Attal provokes the ire of the opposition Europeans: the schedule of debates to follow between now and June 9

Europeans: the schedule of debates to follow between now and June 9 Europeans: “In France, there is a left and there is a right,” assures Bellamy

Europeans: “In France, there is a left and there is a right,” assures Bellamy These French cities that will boycott the World Cup in Qatar

These French cities that will boycott the World Cup in Qatar Serie A: Bologna surprises AS Rome in the race for the C1

Serie A: Bologna surprises AS Rome in the race for the C1 Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues?

Serie A: Marcus Thuram king of Italy, end of the debate for the position of number 9 with the Blues? Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby

Milan AC-Inter Milan: Thuram and Pavard impeccable, Hernandez helpless… The tops and flops of the derby Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season

Ligue 2: Auxerre leader, Bordeaux in crisis, play-offs... 5 questions about an exciting end of the season